Blogger Ben’s work is already done. In his very first substantive post as a civilian he gave away all the secrets of the monetary temple. The Bernank actually refuted the case for modern central banking in one blog.

In fact, he did it in one paragraph. This one.

A similarly confused criticism often heard is that the Fed is somehow distorting financial markets and investment decisions by keeping interest rates “artificially low.” Contrary to what sometimes seems to be alleged, the Fed cannot somehow withdraw and leave interest rates to be determined by “the markets.” The Fed’s actions determine the money supply and thus short-term interest rates; it has no choice but to set the short-term interest rate somewhere.

Not true, Ben. Why not ask the author of the 1913 Federal Reserve Act and legendary financial statesman of the first third of the 20th century—–Carter Glass.

The then Chairman of the House Banking and Currency Committee did not refer to the new reserve system as a “banker’s bank” because he was old-fashioned or unschooled in finance. The term evoked the essence of the Fed’s original mission. Namely, to passively rediscount good commercial collateral (receivables and inventory loans) brought to its window by member banks—priced at a penalty spread floating above the market rate of interest.

Amazon Prime (One Year...

Check Amazon for Pricing.

Amazon Prime (One Year...

Check Amazon for Pricing.

Notwithstanding Bernanke’s spurious claim that the Fed has to “set the short-term rate somewhere”, the reserve system designed by Congressman Glass was authorized to do no such thing. It had no target for the Federal funds rate; no remit to engage in open market buying and selling of securities; and, indeed, no authority to own or discount government bonds and bills at all.

Instead, its job was to passively respond to the ebb and flow of trade and industry on main street as mediated through the commercial banking system. If business conditions were robust, interest rates would rise on the free market in order to balance the demand for working capital loans and long-term debt financing with the available supply of private savings.

In that environment, commercial banks wishing to expand their loan books beyond what could be supported by their deposits and reserves ( the latter generally amounted to between 9% and 15% of deposits), could “rediscount” their loans for cash at a penalty rate. Likewise, solvent banks holding good commercial collateral which faced unexpected or untimely deposit redemptions could borrow cash in the same manner in lieu of liquidating their loan books. The entire purpose of the original Fed’s rediscounting tool was to augment liquidity in the banking system at market determined rates of interest.

This modus operandi was the opposite of today’s monetary central planning model. Back then, the rediscount window at each of the twelve Reserve Banks had no remit except the humble business of examining collateral.

The green eyeshades who toiled in the Richmond, St. Louis and Dallas reserve banks thus did not know from the macros. That is, they were on the look-out for “slow” paper, not slow GDP growth or slow progress in lifting housing starts, retail sales and business inventories—–or even “slowflation” on the CPI less food and energy index. And that’s not only because most of such “incoming data” measures did yet exist—- or even because the Fed had no proactive tools to guide the macro-economy in any event.

In fact, the Fed was created on the earlier side of the Keynesian divide. When Woodrow Wilson signed the act on Christmas eve of 1913, the notion that the state must manage the business cycle and turbocharge capitalist prosperity did not exist.

And well it didn’t. During the prior 40 years, the US economy had grown at a 4% compound rate—the highest four-decade long growth rate before or since—- without any net change in the price level; and despite the lack of a central bank and the presence of periodic but short-lived financial panics largely caused by the civil war-era national banking act.

So in 1913 there was no conceit that a relative handful of policy makers at the White House, or serving on Congressional fiscal committees or at a central bank could improve upon the work of millions of producers, consumers, workers, savers, investors, entrepreneurs and even speculators. Society’s economic output, living standards and permanent wealth were a function of what the efforts of its people added up to after the fact—-not what the state exogenously and proactively targeted and pretended to deliver.

And most importantly, the cosmic economic error of the 20th century had not yet settled in. That is, the false belief that market capitalism has a suicidal impulse and chronically veers towards underperformance, breakdown and depressionary spirals absent the deft interventions and ministrations of the state and its central banking branch. Indeed, that is the utterly false lesson of the Great Depression——a Big Lie regarding which Bernanke himself is a principal propagandist (see below).

In short and contrary to Bernanke, the Fed’s actions under its original charter did not “determine the money supply and thus short-term interest rates”. It was exactly the opposite. Short-term interest rates (and the whole yield curve, too) were determined by supply and demand on the free market.

Likewise, the “money supply” was a product of the banking system, not the writ of the Federal Reserve. That is, the supply of checkable demand deposits and the “elastic” Federal Reserve notes enabled by the 1913 Act were essentially determined by private savers and augmented by lenders when their advances generated new checkable deposits. Indeed, even the rediscount loans issued by the “banker’s bank” did not represent new money; they only liquefied working capital savings or collateral which had already been created in the process of production and commerce.

It is therefore more than a bit rich that the Bernank even talks about the Fed’s supposedly indispensable role in creating the “money supply”. That’s because during his entire tenure at the Fed he paid no heed to it whatsoever.

He virtually never even uttered the word! His entire focus was on pegging interest rates low for long in order to promote incessant and monumental credit expansion. And the more the better on the theory that debt is the elixir of economic growth and prosperity.

But here’s the thing. There is absolutely no need for a central bank to create honest credit. The latter comes from savers who are willing to forgo current consumption (or reinvestment of business profits) at a price that rewards them for their thrift and deferral of the current use of their incomes.

What the Bernanke-style Fed does is foster the creation of dishonest credit. That is, mortgage loans, credit card loans, auto loans, and government bonds that bear subsidized below-market interest rates.

This form of dishonest credit arises when the central bank buys government bonds and bills with credits made out of thin air rather than funded from savings out of current income that must earn a market clearing price or rate of interest. Bad credit also arises when banks make auto loans funded by deposits that earn the Fed’s pegged money market rate of interest rather than the market clearing price. And dishonest credit is generated when brokers hypothecate collateral for repo or margin loans at short-term rates fixed by the writ of the central bank, not the law of supply and demand.

So rather than performing the necessary function of money creation, the modern Keynesian era central bank performs the unnecessary and harmful function of generating mis-priced credit—–or, for the want of a better term, fraudulent excess finance.

The latter, in turn, fosters a plethora of ills including penalties for savings and the crushing of thrift; cheap funds for speculation and carry trades in the financial markets which eventually transforms them into dangerous houses of leveraged gambling; and false, low prices on government debt which turn democratic politicians into agents of chronic fiscal profligacy and destructive free lunches for organized and financially advantaged lobby groups.

To be sure, all of these adverse consequences of cheap dishonest credit might be at least vaguely plausible if it could be shown the economic benefits and gains outweigh the disadvantages. But no such showing is possible, nor is it really even attempted any more by our Keynesian economic rulers.

They just postulate it. And after decades upon decades of repetition—ritual incantation, almost—-the attentive public does not question it; the Wall Street casino finds in convenient; and the politicians are tickled pink.

Aside from the special case of capitalism’s alleged depression- seeking tendency, just exactly how does dishonest credit cause more growth, prosperity and societal wealth and welfare than does honest credit reflecting market-priced bargains between savers and borrowers?

Surely, it can’t be that under a free market regime there would be too little savings to fund the growth of working capital and the long-term debt needed to finance the fixed production assets of growing businesses. Indeed, scratch a Keynesian during almost any phase of the last eighty years of economic history and you will hear the opposite. Namely, that economic output and growth is always being impaired by too much savings and too little demand—-by which they mean consumer spending.

Likewise, there is no empirical argument whatsoever that the massively higher leverage ratios to income that have prevailed since the early 1970’s have led to a step-wise and sustainable improvement in economic growth or in real median household incomes(as a proxy for gains in living standards). As a matter of fact, both measures have been heading south since the nation’s credit market debt to national income ratio came off its historical average of 150% in the late 1970’s—- and then kept climbing until it reached the 350% zone during the Greenspan-Bernanke-Yellen era of Keynesian central banking.

Needless to say, when it comes to a $17.8 trillion GDP two extra turns of debt against national income amount to a lot more than chump change. Total credit market debt outstanding today is $58 trillion and nearly 3.5X GDP; it would be $33 trillion lower or about $25 trillion under the ratio that prevailed during the 1950-1975 era shown in the graph.

Those forgotten times before the Greenspan ascent do not need to be gussied-up as a “golden era” to make the point. The numbers speak for themselves. Between 1954 and 1972 real GDP growth averaged about 4% per year. Since the turn of the century when the US economy became fully loaded with central bank enabled dishonest credit, the GDP trend growth rate has fallen to 1.7%; and it has averaged only 1.1% since the housing bubble peak in 2007.

The even more relevant numbers for real median family income also speak for themselves. Just as the national debt-to-income ratio was beginning its heady climb in the late 1980s, main street living standards peaked. And they remain below that peak 1989 level even today. That is, real living standards have fallen materially even as the balance sheet of the Federal reserve soared from $200 billion (1987) to $4.5 trillion today.

In short, the massive accretion of dishonest debt enabled by the Fed’s monumental balance sheet expansion and crushing financial repression in the last three decades has not improved the nation’s financial performance or well being. Not be a long-shot.

So there is no affirmative case that control of interest rates spurs a magic elixir called more debt and higher leverage ratios which, in turn, generate improved economic performance and greater societal welfare and wealth. Accordingly, the Keynesian central banking remit, perforce, rests on the default case of prevention of business cycle instability and warding off the alleged suicidal tendency of capitalism toward depressionary swoons.

Well, thanks to Bernanke himself we don’t have to deal with economic underperformance and business cycle instability. The blinding empirical reality is that since the arrival of Keynesian central banking under Greenspan and his successors we have had the Great Immoderation, not the nirvana of stable, endless growth and a recession-free world. Indeed, as could be readily demonstrated on another occasion, the notion that central banking can prevent business cycle instability has been refuted by the entire US experience since 1950.

All of the earlier recession cycles were caused either by the wind-down of over-heated wartime economies as in 1953-1954 and 1969-1970; or occurred owing to excessive monetary stimulus by the Fed, which had to be corrected by an abrupt resort to the brakes. Clearly that was the case in 1974-1975. It is even more evidently the reason why the Volcker’s triumph over double digit commodity and consumer inflation during the early 1980s required a deep slump to cleanse the inflationary excesses of the 1970s; and it is also the reason why the Greenspan money printing panic after the 1987 stock market meltdown was followed by the recession of 1990-1991.

We can leave the myths of the 1930s Great Depression for another day, but the short of it is summarized in the attached excerpt from the Great Deformation. The Great Depression was a left-over consequence of the massive debts and currency inflation created during the Great War and the failed efforts to restore a sound money gold standard and liberal international trade and financial order during the 1920s.

But it was not due to a suicidal depression wish in the bosom of capitalism or Hoover’s failure to embrace fiscal deficits after 1929. And most especially, it was not due to the Fed’s failure to go on a bond-buying QE style campaign in 1930-1932 as Milton Friedman and his academic subaltern, Ben Bernanke, argued first in the backwaters of academia; and than memorialized through a sweeping real world experiment after 2008.

So the sum of it is this: The Fed does not need to manage interest rates, and therefore does not need to embrace Bernanke’s spurious answer to the question of “what rate”:

The Fed’s actions determine the money supply and thus short-term interest rates; it has no choice but to set the short-term interest rate somewhere. So where should that be? The best strategy for the Fed I can think of is to set rates at a level consistent with the healthy operation of the economy over the medium term, that is, at the (today, low) equilibrium rate.

And what might that “equilibrium” rate be? Why its the Wicksellian solution—–more than 100 years old and counting. Here are Bernanke’s comments on the “equilibrium real interest rate”. They amount to pure gibberish—–academic jargon for unbounded, plenary power to manage the entire pricing machinery of the world’s $300 trillion financial system.

Indeed, lurking in the intellectual mush below is the true rationale for the greatest exercise in mission creep during the entire history of the modern state.

….it helps to introduce the concept of the equilibrium real interest rate(sometimes called the Wicksellian interest rate, after the late-nineteenth- and early twentieth-century Swedish economist Knut Wicksell). The equilibrium interest rate is the real interest rate consistent with full employment of labor and capital resources, perhaps after some period of adjustment. Many factors affect the equilibrium rate, which can and does change over time. In a rapidly growing, dynamic economy, we would expect the equilibrium interest rate to be high, all else equal, reflecting the high prospective return on capital investments. In a slowly growing or recessionary economy, the equilibrium real rate is likely to be low, since investment opportunities are limited and relatively unprofitable.

There is nothing in that paragraph that can be objectively measured or tangibly pegged at any given point in time. It is evident that even the Fed no longer knows what the “full employment” unemployment rate is. Bernanke himself postulated a few years ago that it was in the range of 6.0-6.5%. Now Yellen says its in the range of 5.0-5-2%.

Besides that, the potential labor pool as measured currently by the BLS omits upwards of 50 million adults who are not employed or on OASI retirement; and it ignores entirely the real labor pool, which is the world market. The fact is in a open world market, “full employment” of labor resources is a function of the price of labor, not arbitrary utilization rates within an imaginary US economy that resembles a bathtub.

As to full utilization of “capital resources”, does that include Sears stores and Borders big boxes that have been obsoleted by Amazon and UPS? Or just the one-twelfth of the footage used for pop-up stores in these empty facilities around Halloween? And does it include furniture factories and cold rolled sheet mills that have moved to China or fracking sand mines and crude oil tank cars idled by the Saudi decision to maintain 10 mb/d of production even at $45 per barrel? The monetary politburo sitting in the Eccles Building cannot possibly know.

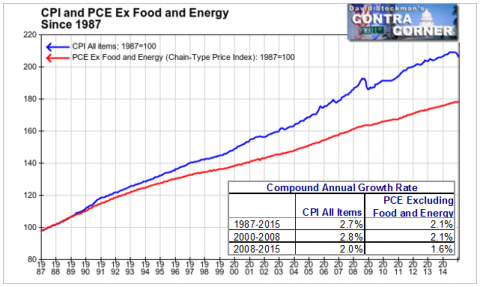

Likewise, how can you measure the real interest rate when there is no obvious basis for utilizing one over another of the multitude of inflation indices now available. As is shown in the graph below, over the period of Keynesian central banking since Greenspan’s arrival in 1987, there has been a persistent 60 basis points annual difference between the CPI and the PCE deflator less food and energy. That difference amounts to fully one-third of the raging 2% argument between Janet Yellen and her right-wing kissing Keynesian cousin, Professor John Taylor, as to the appropriate real equilibrium interest rate under present conditions.

The truth is the real world of capitalism is far, far too complex and dynamic to be measured and assessed with the exactitude implied by Bernanke’s gobbledygook.

In fact, what his purported necessity for choosing a rate “somewhere” actually involves is the age old problem of socialist calculation. It can’t be done—–and most especially not in the most fluid, complex and fastest moving markets known to man. That is, the global financial markets for debt, equity, loans, commodities and all their derivatives.

So thanks for the blog, Ben. Now we know the real answer. Its called the free market.

Why The Lack Of QE Did Not Cause The Great Depression During 1930-1933.

FRIEDMAN’S ERRONEOUS CRITIQUE OF THEDEPRESSION-ERA FED OPENED THE DOORTO MONETARY CENTRAL PLANNING

The historical truth is that the Fed’s core mission of that era, to rediscount bank loan paper, had been carried out consistently, effectively, and fully by the twelve Federal Reserve banks during the crucial forty-five months between the October 1929 stock market crash and FDR’s inauguration in March 1933. And the documented lack of member bank demand for discount window borrowings was not because the Fed had charged a punishingly high interest rate. In fact, the Fed’s discount rate had been progressively lowered from 6 percent before the crash to 2.5 percent by early 1933.

More crucially, the “excess reserves” in the banking system grew dramatically during this forty-five-month period, implying just the opposite of monetary stringency. Prior to the stock market crash in September 1929, excess reserves in the banking system stood at $35 million, but then rose to $100 million by January 1931 and ultimately to $525 million by January 1933.

In short, the tenfold expansion of excess (i.e., idle) reserves in the banking system was dramatic proof that the banking system had not been parched for liquidity but was actually awash in it. The only mission the Fed failed to perform is one that Professor Friedman assigned to it thirty years after the fact; that is, to maintain an arbitrary level of M1 by forcing reserves into the banking system by means of open market purchases of Uncle Sam’s debt.

As it happened, the money supply (M1) did drop by about 23 percent during the same forty-five-month period in which excess reserves soared tenfold. As a technical matter, this meant that the money multiplier had crashed. As has been seen, however, the big drop in checking account deposits (the bulk of M1) did not represent a squeeze on money. It was merely the arithmetic result of the nearly 50 percent shrinkage of the commercial loan book during that period.

As previously detailed, this extensive liquidation of bad debt was an unavoidable and healthy correction of the previous debt bubble. Bank loans outstanding, in fact, had grown at manic rates during the previous fifteen years, nearly tripling from $14 billion to $42 billion. As in most credit fueled booms, the vast expansion of lending during the Great War and the Roaring Twenties left banks stuffed with bad loans that could no longer be rolled over when the music stopped in October 1929.

Consequently, during the aftermath of the crash upward of $20 billion of bank loans were liquidated, including billions of write-offs due to business failures and foreclosures. As previously explained, nearly half of the loan contraction was attributable to the $9 billion of stock market margin loans which were called in when the stock market bubble collapsed in 1929.

Likewise, loan balances for working capital borrowings also fell sharply in the face of falling production. Again, this was the passive consequence of the bursting industrial and export sector bubble, not something caused by the Fed’s failure to supply sufficient bank reserves. In short, the liquidation of bank loans was almost exclusively the result of bubbles being puncturedin the real economy, not stinginess at the central bank.

In fact, there has never been any wide-scale evidence that bank loans outstanding declined during 1930–1933 on account of banks calling performing loans or denying credit to solvent potential borrowers. Yet unless those things happened, there is simply no case that monetary stringency caused the Great Depression.

Friedman and his followers, including Bernanke, came up with an academic canard to explain away these obvious facts. Since the wholesale price level had fallen sharply during the forty-five months after the crash, they claimed that “real” interest rates were inordinately high after adjusting for deflation.

Yet this is academic pettifoggery. Real-world businessmen confronted with plummeting order books would have eschewed new borrowing for the obvious reason that they had no need for funds, not because they deemed the “deflation-adjusted” interest rate too high.

At the end of the day, Friedman’s monetary treatise offers no evidence whatsoever and simply asserts false causation; namely, that the passive decline of the money supply was the active cause of the drop in output and spending. The true causation went the other way: the nation’s stock of money fell sharply during the post-crash period because bank loans are the mother’s milk of bank deposits. So, as bloated loan books were cut down to sustainable size, the stock of deposit money (M1) fell on a parallel basis.

Given this credit collapse and the associated crash of the money multiplier, there was only one way for the Fed to even attempt to reflate the money supply. It would have been required to purchase and monetize nearly every single dime of the $16 billion of US Treasury debt then outstanding.

Today’s incorrigible money printers undoubtedly would say, “No problem.” Yet there is no doubt whatsoever that, given the universal antipathy to monetary inflation at the time, such a move would have triggered sheer panic and bedlam in what remained of the financial markets. Needless to say, Friedman never explained how the Fed was supposed to reignite the drooping money multiplier or, failing that, explain to the financial markets why it was buying up all of the public debt.

Beyond that, Friedman could not prove at the time of his writing A Monetary History of the United States in 1965 that the creation out of thin air of a huge new quantity of bank reserves would have caused the banking system to convert such reserves into an upwelling of new loans and deposits. Indeed, Friedman did not attempt to prove that proposition, either. According to the quantity theory of money, it was an a priori truth.

In actual fact, by the bottom of the depression in 1932, interest rates proved the opposite. Rates on T-bills and commercial paper were one-half percent and 1 percent, respectively, meaning that there was virtually no unsatisfied loan demand from credit-worthy borrowers. The dwindling business at the discount windows of the twelve Federal Reserve banks further proved the point. In September 1929 member banks borrowed nearly $1 billion at the discount windows, but by January 1933 this declined to only $280 million. In sum, banks were not lending because they were short of reserves; they weren’t lending because they were short of solvent borrowers and real credit demand.

In any event, Friedman’s entire theory of the Great Depression was thoroughly demolished by Ben S. Bernanke, his most famous disciple, in a real world experiment after September 2008. The Bernanke Fed undertook massive open market operations in response to the financial crisis, purchasing and monetizing more than $2 trillion of treasury and agency debt.

As is by now transparently evident, the result was a monumental wheelspinning exercise. The fact that there is now $1.7 trillion of“excess reserves” parked at the Fed (compared to a mere $40 billion before the crisis) meant that nearly all of the new bank reserves resulting from the Fed’s bond-buying sprees have been stillborn.

By staying on deposit at the central bank, they have fueled no growth any different.

Reprinted with permission from David Stockman’s Corner.