Brexit, Quitaly and Grexit. Debt Defaults, Stock Shocks, Bond Bubbles, Properties Popping, Derivative Defaults and Banks Busting.

Well that is just some of the events that will take place in the next few years.

But the world is living in ignorant bliss of what is coming next.

As the song tells us:

“In every life we have some trouble

But when you worry you make it double

Safe and Lock Box - Sa...

Buy New $49.99

(as of 02:05 UTC - Details)

Safe and Lock Box - Sa...

Buy New $49.99

(as of 02:05 UTC - Details)

Don’t worry, be happy

Don’t worry, be happy now

don’t worry”

Well this well-known song says it all. Risk in the world is growing exponentially but no one is worrying.

GLOBAL DEBT OUT OF CONTROL

Global debt has trebled since 1999 from $80 trillion to $240+ trillion today. And since the Great Financial Crisis started in 2006, debts have doubled. But Don’t Worry be Happy!

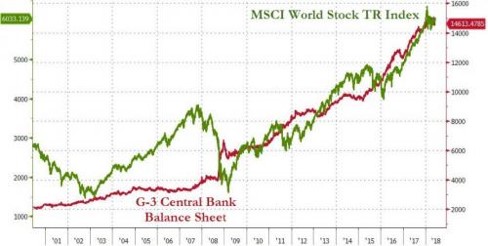

STOCKS ONLY RISE DUE TO MONEY PRINTING

And Central banks of course won’t let us down. They have printed $16 trillion since 2006. So they must continue to make the rich richer and the poor believing that all is well. So Don’t Worry.

And world stock markets are up 4x since 2009. So Don’t Worry, this will go on for ever.

Stocks are up and debt is up what a great formula. Just print more and give more credit and all will be well. Be Happy!.

But what happens if central banks stop printing and banks stop lending. The song has a solution for that too:

Ain’t got no cash, ain’t got no style

Ain’t got no gal to make you smile

Don’t worry, be happy

‘Cause when you worry your face will frown

And that will bring everybody down

Nakabayashi Co,Ltd. Di...

Buy New $55.57

(as of 02:10 UTC - Details)

Nakabayashi Co,Ltd. Di...

Buy New $55.57

(as of 02:10 UTC - Details)

So don’t worry, be happy

Don’t worry, be happy now

What a Wonderful World as Louis Armstrong sang. All the central banks need to know is to print more money and and we can all Be Happy.

But wait, these mental central bankers are now stopping to print money and embarking on another programme with a name that no one understands – Quantitative Tightening – QT. For us normal people, it means that rather than printing more money, they will actually reduce their debt.

For some obscure reason, these central bankers seem to forget that it is only their money printing that artificially has kept the illusion up that All is Well on the Western Front, and also on the Eastern front of money printers like Japan and China.

Stock, bond and property markets are totally ignoring what the effect of QT will be. Bullish investors are totally in denial of the fact that markets have only appreciated because of the biggest money printing and credit expansion in history. Once this stops, so will the bonanza in investment markets.