We don’t need to keep guessing when the nation’s central bank is going to raise interest rates on the nation’s money supply and by how much. There are sources that tell us precisely what is going to happen: The Congressional Budget Office and a few carefully selected other sources.

US lending institutions and the entire financial industry as well as U.S. companies are hooked on near-free money issued by the nation’s central bank. This has created many zombie banks and companies as well as a stock market that is so propped one begins to wonder if any of these entities can survive an interest rate increase. [CBS Marketwatch July 31, 2015]

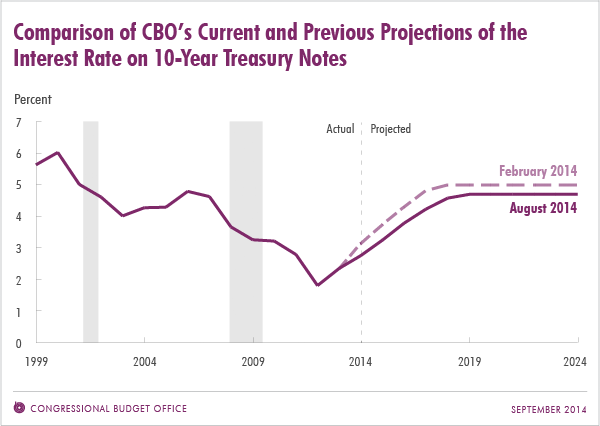

The Congressional Budget Office says…

Interest rates on money the Federal Reserve central bank issues to lender banks is going to gradually rise from 0.0-0.2% to ~3.5%. The Congressional Budget Office says this is going to happen in the second-half of 2015. That is the feared moment when the financial industry has to suddenly be weaned off of free money. [Congressional Budget Office]

This means that lenders will add two or three percentage points to that when they lend money to buy houses and automobiles, so consumers are likely to start paying 5.5-6.5% on a newly issued home mortgage instead of the prevailing 3.92%.

End the Fed

Buy New $9.99

(as of 11:15 UTC - Details)

End the Fed

Buy New $9.99

(as of 11:15 UTC - Details)

That will have serious repercussions in the housing market that will finally fall flat. The housing market has been falsely propped, first by no down-payment loans, then by low interest loans, then by those elite members of the financial classes who benefited from all this free money who bought $1+ million homes. Unless incomes begin to rise, the housing market is toast.

Savers will be partially rescued

Once interest rates rise on borrowed money from the Federal Reserve, banks are going to have to raise their interest rates on long-term savings accounts from less than 1% to maybe 3.0% to halt the continued erosion in the value of saved money (about $8 trillion in these savings accounts). That rate of interest does not match the rate of inflation, said to be 2.2% target rate by the Federal Reserve Bank but more like 5-6% from 2010 to 2015 according to ShadowStats.com (however ShadowStats.com now shows the US economy is in steep deflation with the inflation rate plunging like it did in 2009 after the banking collapse). [ShadowStats.com] But savers are finally going to lick their wounds and start earning meaningful interest on their money again. Savers will still be losing wealth, but just not as much.

The interest on the national debt headache

Commensurate with a rise in interest rates on borrowed money there will be a prodigious increase in the amount the government pays for money it has already borrowed — $13 trillion of the $18 trillion national debt is held by the public.

The national debt is simply the nation’s credit card bill. The aggregate lifestyle Americans live today has been facilitated by borrowed money. Without borrowed money there would be an unprecedented unemployment rate, beyond what one could ever imagine.

The Trillion-Dollar Co...

Best Price: $3.35

Buy New $8.09

(as of 08:20 UTC - Details)

The Trillion-Dollar Co...

Best Price: $3.35

Buy New $8.09

(as of 08:20 UTC - Details)

The national debt (credit card) has been frozen to show lender nations (Japan, China) that we intend to pay them back what has been borrowed. The US owes Japan and China ~$1.2 trillion each. [CNN Money April 2015] If these creditor nations cease lending to the US the whole economy crashes.

The Congressional Budget Office says the interest rate on the national debt will gradually rise from 1.8% to 3.9% over the coming decade. Interest payments will rise to $227 billion this year then double to more than $480 billion by 2019 and triple to $722 billion by 2024. [Congressional Budget Office]

Don’t believe the “no new taxes” rhetoric

The U.S. now collects ~$3.2 trillion in federal revenues annually. Don’t believe politicians when they say “no new taxes.” Less than 5 years ago federal revenues were just $2.4 trillion. [USGovermentRevenue.com]

The largest part of the budget is, and will remain, the mandatory spending programs of Social Security, Medicare and Medicaid. Mandatory spending is over $2 trillion and is set to double to $4 trillion by 2025. That is more than the entire federal revenues collected today just for these two programs, excluding defense.

More money is being sucked out of the private sector and funneled into paying collective bills for Medicare and Social Security as the portion of retirees in the population rises. Federal borrowing is going to crowd out additional private investment in a circuitous downward spiral that will doom the American economy.

Medicare And Social Security Trust Funds Are Partly Empty

Set Money Free: What E...

Best Price: $4.64

Buy New $12.46

(as of 01:35 UTC - Details)

Set Money Free: What E...

Best Price: $4.64

Buy New $12.46

(as of 01:35 UTC - Details)

The rising number of retirees receiving Medicare benefits and Social Security pension checks will force the government to admit the trust funds for these accounts mostly hold IOUs (US Treasury notes) and a portion of these funds will have to come out of the general fund, a fact that is being hidden from the public today. [LifeHealthPro.com]

While it is often said there are sufficient funds in Social Security to last till some date off in the future, the fact is a larger portion of pension checks are going to have to be paid out of the general fund. Which means, these trust funds are presently insolvent. Yes, every two weeks when American workers receive their paychecks another round of FICA payments are dumped into these funds, so they aren’t completely insolvent, they have cash flow.

A recently published report says Medicare Trustees “expect more than 45 percent of total program outlays to be covered by general revenues in the near future.” [LifeHealthPro.com]

A day is coming when the US can’t afford a military

For all the right-wingers out there who believe military spending must be a priority, unless taxes are steeply increased defense spending will predictably have to be halved (relative to 2012 levels as a percent of GDP). This is the Congressional Budget Office saying this.

The US military can mechanize and robotocize but where will all those displaced military personnel find jobs? Someone once said any nation that isn’t at war will experience 25% unemployment. But no one was thinking about robot soldiers. Historically bankrupt nations go to war to cover for their financial dereliction. [Global Research May 7, 2015]

The US is currently conducting economic war against Russia but that doesn’t keep troops in the field. But what if the US can’t afford a war? Then maybe it figures out ways to cull its population of retirees? [LewRockwell.com]

The Death of Money: Th...

Best Price: $0.25

Buy New $3.50

(as of 10:20 UTC - Details)

The Death of Money: Th...

Best Price: $0.25

Buy New $3.50

(as of 10:20 UTC - Details)

Only ways out

Gone are the days when utopians said America could grow itself out of its economic doldrums. It was Winston Churchill who once said: “Any country trying to spend it’s way out of debt is like a man standing in a bucket trying to lift himself up by the handle.”

The only other ways out of this mess are to (a) sell off trillions of dollars of assets and/or (b) print lots and lots of electronic money with resultant run-away inflation. Someone once said, tongue-in-cheek, just allow China and Japan to buy Alaska (more on this below).

There are those free spenders and money printers who say the US cannot become technically insolvent with respect to its own currency because we have a fiat money system and can print all the dollars we want. While run-away inflation (erosion of what the dollar will buy) would be the result, the fallback position is that the US dollar is the world’s reserve currency (currency used in international trade) and that props up demand for the US dollar. [Forbes.com]

But an overly strong dollar is being used against the US. Foreign nations buy up US dollars to prop up its price and then undercut it with their cheaper currencies to outbid US companies for business (what is called currency manipulation). This results in a half-trillion trade deficit that robs over 7 million jobs. [LewRockwell.com]

What to do now?

So what do we do? Hold our heads and agonize over a terrible day in the near future when the US economy crashes and the rest of the world economies get drawn down with it?

Everything doesn’t have to be gloom and doom. War doesn’t have to be the only way out. Here are four things that any bold leader could implement rapidly, some of it without a vote from Congress.

- Fly to China like Richard Nixon did and officially grandstand the idea of Chinese investment in the US. No, the Red Communist Chinese are not going to own America. If the Chinese buy US hotels, golf courses and mines, these assets will remain in the US. Go where the money is. There are over $3 trillion US dollars in foreign exchange reserves stuck on one side of the Pacific Ocean. We need to reinvigorate trust with China to get those US dollars back on this side of the Pacific so…. (hold your breath)….the US can buy more goods from China. [Wikipedia] Both economies get out of their rut. Any smart Presidential candidate ought to be pursuing a policy to return US dollars from Asia to spur the economy like the US did in its petrodollar scheme in the 1970s where the US purchased oil from Middle Eastern countries and those oil dollars returned by oil countries buying US Treasury notes. Tariffs and trade sanctions on goods made overseas that so many Presidential candidates talk about only breed war (remember Britain’s tea tax resulted in the Boston Tea Party and the Revolutionary War).

- Reduce corporate taxes steeply (even to zero) to induce US companies to return over $2 trillion they are hording overseas. [com]

- Stop currency manipulation by instructing the US Treasury Department to buy up a billion dollars of a foreign country’s currency when they buy a billion US dollars to manipulate the price of our currency upwards so they can sell their products at prices below US companies. [com]

- Lower taxes on the very rich so they will bring back the estimated $20 trillions of dollars they have secreted away offshore. [com]

So why aren’t any current or future Presidential candidates demanding these reforms and new directions?