TACO Man at Bat

October 4, 2025

Well, here’s hoping that the TACO man (Trump Always Chickens Out) finally grows a pair, steps up to the plate and is willing to ride this shutdown to a new record beyond the 35 days it took him to capitulate in January 2019. After all, these are desperate times fiscally—so anything that might wake-up the somnolent public to the budgetary disaster that is careening down the pike is worth some serious bumps and grinds on the national stage.

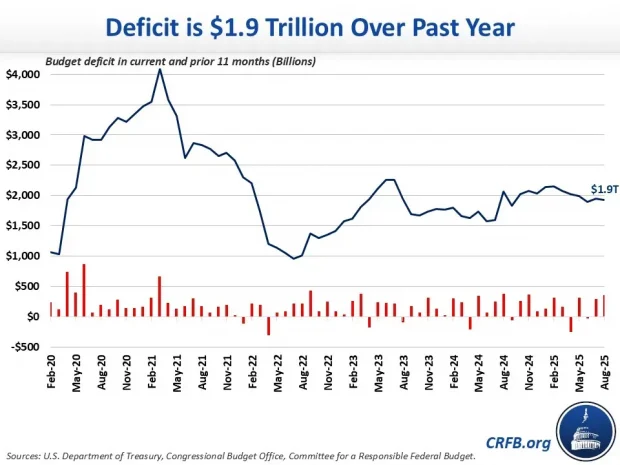

Indeed, it is no exaggeration to say that Washington has gone from the ridiculous to the sublime when it comes to managing the nation’s fiscal affairs. The chart below shows the Federal deficit on a rolling 12-month basis and the scandal of it literally screams out.

First, on the eve of the pandemic and lockdown collapse in February 2020, the Federal government was still running a $1 trillion or 4.9% of GDP deficit at a point in the business cycle fully 128 months after the Great Recession bottomed in Q2 2009. By all historic standards—even by Keynesian counter-cyclical fiscal doctrine—-the Federal budget was supposed to be in near balance by then because the fiscal equation had already benefited mightily from the longest continuous economic expansion in American history.

The Chronological Guid...

Check Amazon for Pricing.

The Chronological Guid...

Check Amazon for Pricing.

Secondly, a traditional reason for fiscal consolidation during the post-recession recovery period was to position the government to weather any adverse economic or international storms which might come down the pike in the future. And, of course, the mother of all calamities incepted within months when the real GDP plunged at a staggering 33% annualized rate in Q2 2020 in response to the pandemic and the sweeping Washington-ordered lockdowns of the US economy.

At that point, the normal cyclical contraction of revenues and surge of safety net spending threw the Federal budget into deep deficit in its own right. But that was drastically compounded by a never before imagined Covid relief spending bacchanalia over 2020-2021 that piled $6 trillion of added spending on top of the regular budget.

Accordingly, the 12-month rolling deficit reached $4.05 trillion in April 2021, which figure computed to an unheard of 17.3% of GDP. That should have been a big enough shock to scare the living bejesus out of every politicians inside the beltway, sentient or otherwise.

Alas, it didn’t. When the US economy re-opened thereafter, and notwithstanding unprecedented monetary stimulus, the Washington pols sat on their hands, even as Sleepy Joe Biden piled on even more spending for pork barrel infrastructure, Green New Deal waste and corporate welfare for the likes of Intel. Consequently, the Federal deficit remained stuck in the $2 trillion range.

So here we are five years on from the pandemic recession bottom and with a so-called Republican government in control of the House, Senate and White House. And yet the 12 month rolling deficit just clocked in at 6.3% of GDP, representing a level of wanton fiscal profligacy like never before.

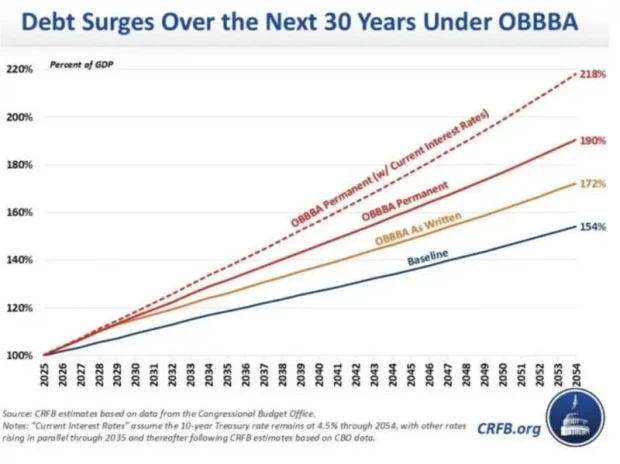

Nevertheless, the above chart is only a warm-up. The real disaster coming down the pike is owing to the fact that three months ago the Trumpified GOP enacted the MOABB (mother of all budget busters) aka the One Big Beautiful Bill Act or OBBBA. It will result in a cool $155 trillion being added to the public debt by mid-century.

The OBBBA, in fact, turned the Federal budget into a Fiscal Doomsday machine that is literally unstoppable by means of ordinary legislative decorum. So you need a budgetary crash landing like the one hopefully triggered today at 12:01 AM to have any hope of arresting the current plunge into fiscal calamity.

As it happened, the OBBBA as written would have resulted in a Federal fiscal posture that would add $117 trillion to the public debt by 2054, which figure would rise to +$133 trillion when you price out OBBBA without the accounting gimmicks. Still, how anyone thinks that quintupling the publicly-held debt from today’s $30 trillion to $163 trillion over the next three decades, is a plausible route to the Golden Age of Prosperity is pretty hard to figure.

Even then, the truth is surely far worse. Just remove one brick from the edifice of CBO’s Rosy Scenario economic forecast—perpetually low interest rates—-and the fiscal dragons truly come surging from the Federal budget’s vasty deep. That is, if you assume the weighted average UST yields will clock in at4.25% rather than 3.5% over the next three decades, the added debt with the permanent extension of the OBBBA would amount to $155 trillion.

That’s right. Faced with a veritable Fiscal Doomsday Machine as embodied in the current CBO baseline, the Trumpified GOP has essentially embraced a budgetary path to a $185 trillion public debt by mid-century, representing a crushing 218% of GDP.

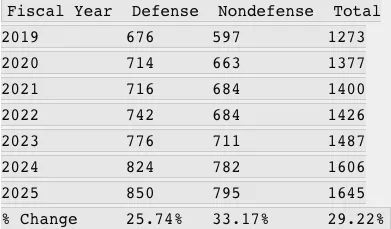

To be sure, neither wing of Washington’s UniParty is putting anything on the table that will slow the rising dotted red line in the graph above by even a whisker. The so-called “clean CR” championed by the GOP Congressional leadership, for instance, amounts to a ratification of all the unhinged discretionary spending increases enacted during the pandemic under the Trump 1.0 COVID-relief spending bacchanalia plus all of Sleepy Joe’s additional pork that was layered on top thereafter.

So what we have is this: Total appropriated spending (discretionary) in the GOP’s ballyhooed “Clean CR” will be up by +29% from the already pork-ridden budget of Trump 1.0 in FY 2019, and higher by+33% on the nondefense side of the ledger. And this is the plan of the so-called good guys!

Discretionary Appropriations, FY 2019 to FY 2025

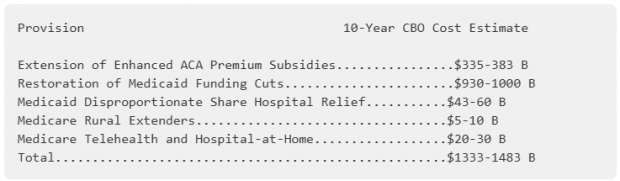

Still, the GOP’s proposed spend-a-thon isn’t the half of it. The Dems are refusing to embrace the CR unless that GOP agrees to cancel the modest Medicaid savings contained in the OBBBA and extend yet again the costly ObamaCare “enhanced” subsidies which were layered on during the pandemic spending madness.

So as shown in the table below, capitulating to the Dems’ demands would generate $1.3 to $1.5 trillion of additional red ink over the next decade on top of the mountainous debt already baked into the fiscal cake.

10-Year Cost Of Senate Dems’ Health Care Spending Demands

Needless to say, the Medicaid cuts contained in the OBBBA were eminently plausible. They included $700 billion of 10-year savings owing to a requirement that able bodied Medicaid recipients need to “work” 80 hours per month—albeit “work” was defined so broadly as to include just ambling around looking for a job or taking any kind of job training, whether in lawn bowling or tiddly winks. Of course, we’d say hell yes to tossing off the Medicaid rolls any and all non-disabled adults who can’t manage to “work” 20 hours per week in this manner.

The OBBBA also required that the states stop enlarging the scam by which they purportedly “tax” medical providers. That’s because, in turn, the state Medicaid programs then slip the same loot back to doctors, hospitals and other providers in the form of higher reimbursement payments compliments of Uncle Sam.

That’s right. At the present time states raise upwards of $45 billion per year from so-called “provider taxes”, which providers, in turn, get the $45 billion back as reimbursements for their “cost” of service. While there have been various Federal efforts to block such scams, the current 6% cap on provider taxes as a share of patient revenues tells you all you need to know. State fiscal authorities have been on a path toward round-tripping their entire share of Medicaid costs to Washington, but the modest tightening of the cap (to 3.5% of provider revenues) contained in the OBBBA is apparently more than the Senate Dems can live with.

Then there is the ObamaCare topper subsidies and coverages that were signed into law during the pandemic. These included lifting the original 400% of the poverty line cap on ObamaCare subsidy eligibility, meaning an added layer of free stuff regardless of income. The “enhanced” ObamaCare features also included Federal subsidies for ObamaCare health insurance after premium costs reach 8.5% of income, down from nearly 10% under prior law.

These enhancements to the original ObamaCare subsidies were way over the top by any stretch of the imagination, but were justified at the time by the so-called pandemic emergency. Accordingly, the were made subject to an early sunset clause (December 2025) that has now come due.

But holy moly. Just a smidgen of historical perspective reveals how the Trumpified GOP has utterly abandoned the party’s assigned role as the sentinel of fiscal rectitude in the process of democratic governance in America.

Thus, back in the day we thought the Medicaid rolls were already bloated at 20 million recipients, representing about 8.8% of the US population in 1980. So the Reagan budget proposed to modestly rollback the Federal matching payment ratio, which would have cut baseline Medicaid spending of $21 billion per year by 7.5%. These cuts were then passed in watered-down form but subsequent history shows that they were not nearly up to the task.

By the eve of the sweeping ObamaCare expansion, therefore, the Medicaid rolls as of 2008 had already increased to 50 million, representing 16.4% of the US population. Of course, with the Obama expansion the Medicaid rolls were off to the races, reaching 70.2 million and 21.7% of the US population by 2016.

Needless to say, Donald Trump’s noisy 2016 campaign pledge to repeal ObamaCare never got off the ground in the UniParty politics of Washington. In fact, rather than repeal ObamaCare the Donald signed—and bragged about—the massive expansion of Medicaid embedded in the $2 trillion CARES act of March 2020. By the time the dust had settled on Donald Trump’s sweeping expansion of free stuff during the final year of his first term, the Medicaid rolls hit 90 million and 27% of the US population by 2022!

Since then, there had been a slight reduction t0 8o million recipients, as some of the pandemic era coverages expired. Yet what we had prior to the modest OBBBA reforms was a vastly bloated Medicaid safety net that had expanded way beyond its original contours. That is, after being focused for several decades narrowly on the dependent poor population receiving family assistance or SSI for the blind, disabled and elderly poor, Medicaid had been expanded since 2009 to cover fully 24% of the entire US population. That’s nearly 3X the coverage rate that most GOP legislators had been willing to rollback in 1981.

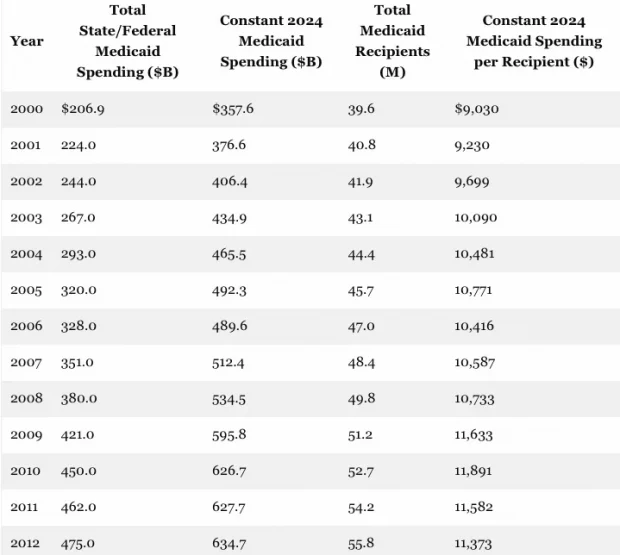

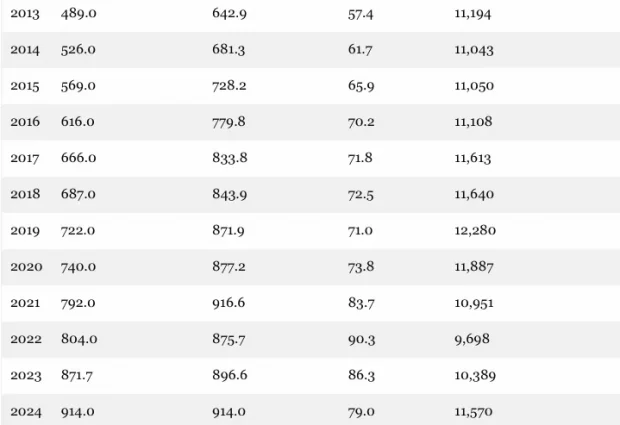

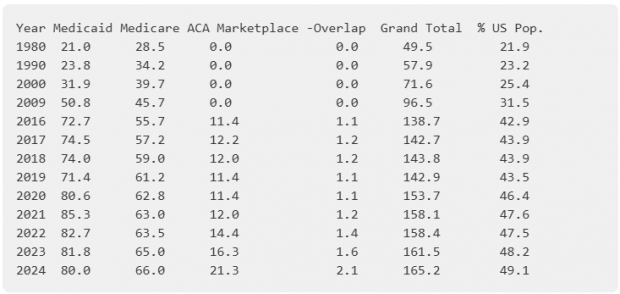

As a result, just since the turn of the century constant dollar Medicaid spending has soared from $358 billion (2024$) to $914 billion or by 2.6 X. But as the table also makes clear, the major cause of that spending explosion has been the doubling of the recipient rolls from 40 million to 80 million, even as constant dollar spending per recipient has risen by +28% per the last column below.

Total Federal/State Medicaid Spending and Recipients, 2000–2024

In short, if the TACO man again capitulates to the Dems after a few weeks of shutdown in order to keep the government open and his ratings from sagging further, it will mark a very important turning point. It will literally mean that any serious attention to the nation’s soaring public debt is likely over and done—at least through 2028; and after that point the debt/bond yield/interest expense doom loop may be too powerful for any democratic government to stop.

After all, notwithstanding the modest OBBBA cuts the Medicaid safety net is still standing mighty tall. While CBO estimated it would marginally reduce the current 80 million Medicaid roll by 11 million or so, the program would still cover 21% of the entire US population. That’s nearly 2.5X more than the 1980 level and 50% more than the pre-ObamaCare coverage ratio.

Turning to the larger picture, it is plainly evident that the UniParty has been crab-walking the nation into socialized medicine through the backdoor. And now by attempting to restore the pandemic era add-on to ObamaCare and repeal the OBBBA Medicaid cuts the Congressional Dems are attempting to ratify exactly that.

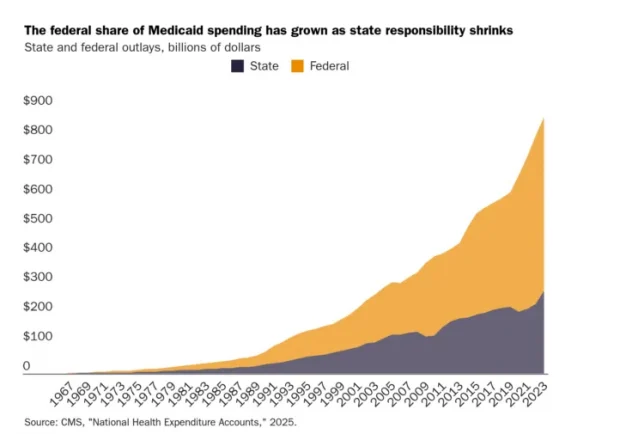

As shown in the tables below, enrollment in Federal medical insurance programs stood 49.5 million and 21.0% of the population in 1980, when Ronald Reagan came to town vowing to shrink the Welfare State, including the encroachments of socialized medical care. Alas, the Gipper and his heirs and assigns on the GOP side of the aisle whiffed, allowing the UniParty to push expansions that have now taken Federal medical insurance coverage to 165 million or damn near 50% of the US population

Enrollment In Government Medical Insurance Programs, 1980 to 2024

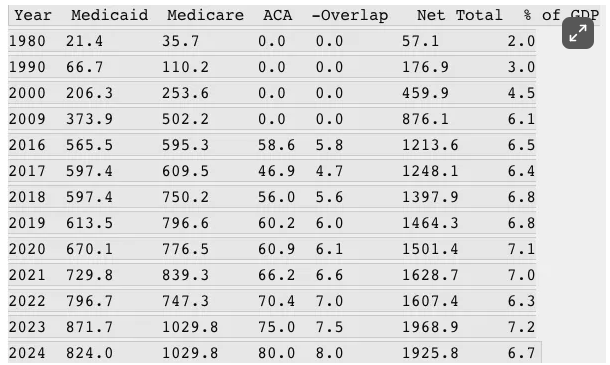

Needless to say, supplying 165 million American with medical care doesn’t come cheap. Back in the day when the Reagan Revolution put its sights on shrinking the Welfare State, total government spending for medical insurance programs amounted to $57.1 billion and just 2.0% of GDP.

By the time the Donald got to the Oval Office the first time he inherited a medical insurance spending tab from Obama and all the other UniParty expansions that had gone before which stood at $1.214 trillion and 6.5% of GDP. By 2020, however, the very un-Reaganite Trump Administration had presided over the rise of government medical insurance outlays to $1.501 trillion or 24% more than big spender Obama.

Needless to say, the $1.926 trillion level in place in 2024 wasn’t nearly enough for the Congressional Dems, and, actually the RINOs and UniParty Republicans who are waiting in the wings to capitulate to the Dem health care demands after a few weeks of performative whining about “runaway” spending and deficits.

That’s right. As a practical matter we are already beyond $2 trillion per year of spending for socialized medical care, and the only thing that can even modestly restrain that fiscal tidal wave is the hoped for resolve of the TACO man. And, yes, “hope” is not usually an efficacious strategy.

Government Spending For Medical Insurance, 1980 to 2024

In short, 45 years on from the abortive Reagan assault on the Welfare State, the GOP as a functioning majority has given up the fiscal ghost. Indeed, if you can’t rollback the runaway growth of socialized health care, in fact, it’s all over except the shouting.

Indeed, the GOP’s ability to slow the tide of fiscal red ink by even a tad now depends entirely on whether the Donald has the gumption to force Senator Chuckles Shumer and his legions of big spenders to blink.

It’s actually “Casey at the bat”. If Trump fails the test it will be all over except the shouting because the GOP has already mostly surrendered in the battle against the Welfare State. Here is the current 10-year baseline cost of the major Welfare State programs, and what the GOP was willing to cut at the time of OBBBA’s enactment: Namely, small nicks from Medicaid and Food Stamps, which amount to just 2% of baseline spending for these programs.

All the rest—Social Security, Medicare, ObamaCare, SSI, family assistance and school lunches and veterans benefits—have been given a hall pass by the Donald and the GOP leadership.

Human Heart, Cosmic He...

Check Amazon for Pricing.

Human Heart, Cosmic He...

Check Amazon for Pricing.

2026-2035 Baseline Spending for Major Welfare State Programs and Proposed GOP Cuts:

- Social Security: $21.3 trillion.

- Medicare:$16.4 trillion.

- Medicaid/ObamaCare: $10.1 trillion.

- Food Stamps: $1.1 trillion.

- Supplemental Security Income(SSI): $0.8 trillion.

- School lunches and family assistance: $0.8 trillion.

- Veterans comp and pensions: $3.2 trillion.

- Total Major Welfare State Programs: $53.7 trillion.

- GOP Medicaid cut: ($0.8 trillion).

- GOP Food Stamps cut: ($0.3 trillion).

- Total GOP Welfare cuts: ($1.1 trillion).

- GOP Welfare Cuts As % of 10-Year Baseline:-2.1%.

So these GOP two percenters are surely dreaming somewhere off in fiscal la la land. When in addition to the above Welfare State budget you further set aside $9.2 trillion for defense and $9.0 trillion for interest expense over the next decade you have $72 billion of baseline spending out of the $88 trillion 10-year total (FY 2026 to 2035) or 81% . That is to say, three months ago the GOP struggled to consolidate its ranks to pass just $1.1 trillion of cuts in a small corner of the Welfare State.

Yet even these minimal “cuts”, which amounted to exactly 1.25% of total baseline spending, are about to get shit-canned in the name of keeping the government open. Well, unless the Donald decides that the current blood sport battle with Shumer and the Dems will be good for his ratings—something that only time will tell.

Reprinted with permission from David Stockman’s Contra Corner.

Copyright © David Stockman