Here’s the dirty little secret. It was the GOP which killed sound money. And its replacement, the Fed’s bad money, is at the root of all statist evil – from imperialist wars abroad to suffocation of free markets, personal liberty and individual responsibility at home.

Surely, no Fed has been as far off the deep-end as the mindless money printers in charge of the Eccles Building today. The world’s ablaze with rising goods and services inflation, as we learned again Wednesday morning from the 5.4% rise in the September CPI, and also the ongoing financial asset bubbles the likes of which put the Dutch Tulip Bulb mania to shame.

And yet five of the six evil-doers on the Federal Reserve Board in Washington were effectively GOP appointees. Four of these knuckleheads were appointed by the low interest man himself, Donald Trump, whose views on monetary policy were perhaps the worst of any American president including William Jennings Bryan, who actually wasn’t.

The Trump appointees include groupthink Keynesians Christoper Weller, Michelle Bowman, Randall Quarles and Richard Clarida. But for all practical purposes you needs include Jay Powell himself, even though he was technically appointed to fill an unfinished term in 2012 by Obama.

Here’s the back story. Powell was a young lawyer on the make at the penultimate Wall Street establishment firm, DavisPolk, in the 1980s. From there he was recruited to be a bag carrier at Dillon Read by turncoat Republican CEO, Nick Brady, who became Bush the Elders’ Secretary of the Treasury and confidant of Bubbles Alan Greenspan’s transformation of the Fed into a pro-Wall Street “wealth effects” and monetary central planning agency in the 1990s.

After that stint Powell went to the go-go precincts of Banker’s Trust – one of the incubators of the 2008 Wall Street meltdown, especially after its merger with Deutsche Bank. Next he punched his ticket as an authentic leveraged buyout guy at the Carlyle Group from 1997 to 2005, and then slinked around Washington for the next several years burnishing his “bipartisan credentials” at think tanks including the Global Environment Fund and the Bipartisan Policy Center, where he helped quash the debt ceiling revolt of genuine Tea Party Republicans during the August 2011 showdown with the Obama White House.

Still, the piece de resistance is that he was paired as a token Republican by the Obama White House to get a stalled pro-regulation Democrat thru the GOP Senate. So in December 2011, along with Jeremy Stein, Powell was nominated to the Federal Reserve Board of Governors by Obama. According to Wikipedia,

The nomination included two people to help garner bipartisan support for both nominees since Stein’s nomination had previously been filibustered. Powell’s nomination was the first time that a president nominated a member of the opposition party for such a position since 1988.

Needless to say, Powell has not disappointed his Dem co-opters or the bipartisan duopoly which ratified his nomination. Under his horribly benighted “leadership” the Fed has been perverted into a rampant monetizer of the public debt and thereby destroyer of fiscal sanity; and also and simultaneously a handmaid of Wall Street that has monkey-hammered every semblance of honest price discovery, while inflating financial asset prices and the wealth of the tippy top of the income ladder like never before in recorded history.

Of course, Powell has gotten a lot of help in justifying his insane money-printing campaign from fellow GOP appointees, especially the Keynesian academic Richard Clarida. Together these geniuses keep pumping into the canyons of Wall Street $120 billion per month of fiat liquidity allegedly to support the economy and goose full-employment – when it is damn obvious that the labor market is red hot and doesn’t need no stinkin’ help from the Fed.

Consider the chart below, which shows that voluntary job quit rate relative to the total labor force. It’s at the highest level ever recorded since the series was begun at the turn of the century. In fact, nonfarm job quitters in August totaled 4.29 million, up from 3.57 million in February 2020 during Donald Trump’s allegedly booming pre-Covid Greatest Economy Ever and just 1.56 million at the Great Recession’s bottom in August 2009 when jobs were temporarily genuinely scarce.

So for crying out loud. Workers are walking off the job with alacrity because there are plenty of job openings – a record 11.1 million in July according to the BLS. Again, that compared to just 7.2 million during the booming economy of January 2020 and a paltry 2.3 million in August 2009, when the macroeconomy was actually still on its recessionary knees.

Record Nonfarm Job Quit Rate

So have the Fed’s “labor market objectives” been met?

Why, hell yes, unless you want to give credence to the utterly flaky and useless U-3 unemployment rate, which came in at 4.8% last month. That’s not all that high, of course, and especially so given that it is a pure artifact of stupid bureaucrat rules about who is considered to be in the labor force and therefore unemployed.

For want of doubt, consider the labor force participation rate of adult men, which came in at a record low (save for the Covid Lockdown freeze in April-May of 2020) of 67.7% in September. To put a fine point on it, that was a horror show from the Washington stimmie machine and compares to the historic levels shown below.

And BTW, we include men only not out of retrograde chauvinism, but due to its opposite – the traditional pall of cultural values and discrimination that kept most women out of the labor force as indentured and unpaid homemakers (and therefore unrecorded “workers” in the eyes of the BLS) until late in the 20th century.

In any rate, here is why we have a so-called “high” U-3 unemployment rate and why it’s as phony as a trillion dollar platinum coin, despite the Fed’s bogus claim that it proves the labor market still needs more “stimulus” (aka $120 billion per month of monetary fraud called QE):

Labor Force Participation Rate For Adult Men:

- September 2021: 67.7%;

- January 2020: 69.3%;

- December 2007: 73.1%;

- January 1990: 76.7%;

- October 1949: 87.4%.

Needless to say, the labor-market-needs-help canard has gotten so threadbare that even the Fed heads only give it lip service. In truth, they have simply invented an even stupider excuse for planning to print money like there is no tomorrow well into mid-2022.

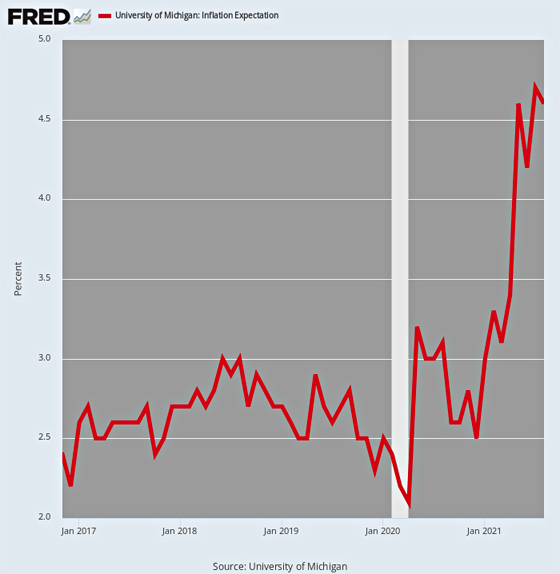

To wit, the claim that CPI inflation, which is now running at 270% of its sacred 2.00% target, doesn’t count because it’s “transitory” and not yet reflected in an invisible collective mind-game called “inflation expectations”. And the latter is measured by utterly news-driven and backward looking surveys of consumer sentiment.

That’s right. If consumers don’t yet expect the inflationary mayhem that will result from the Fed’s insensible money-printing spree – because it has not happened in recent years for the good and substantial reason we have described as the Red Ponzi deflation interval elsewhere – then do not believe what even the BLS tells your lying eyes today after this aberrant imported durable goods inflation sabbatical has come to a crashing halt!

Yet, here is what the lead crackpot Republican academic on the Fed, Richard Clarida, who basically puts words into the mouth of Jay Powell’s empty suit, is saying about why 5.4% inflation is no sweat whatsoever:

Fed Vice Chairman Richard Clarida said Tuesday that the underlying rate of inflation in the U.S. economy is near the Fed’s 2% longer-run objective and, thus, that the recent surge will prove “largely transitory” once the supply bottlenecks clear. However, he said the Fed would raise rates if it saw evidence that households and businesses were beginning to expect higher inflation.

“Monetary policy would react to that,” Mr. Clarida said. “But that is not the case at present.”

There you have it. Academic gibberish on a near criminal scale: Since the Sheeples allegedly do not yet understand that prosperity doesn’t flow from a hyper-active central bank printing press, then 5.4% is, well, actually the new 2.00%!

Astounding, that. And yet even the inflation expectations ruse is a lie. After all, here the granddaddy University of Michigan survey of consumer sentiment. Does that not suggest at 4.6% that even everyday consumers are starting to get the joke and that Clarida is just plain full of horse pucky?

University of Michigan Consumer Inflation Expectations, 2016-2021

So this gets us to the rip-roaring inflation revealed yesterday in the September CPI release. And like always, we turn to the 16% trimmed mean version of the CPI to remove the so-called “base effects” of the outlier components, which plunged in the spring and summer of 2020 and have then sharply rebounded this year.

That is, here’s the underlying inflation trends without the recent downside and upside outliers. What kind of nincompoop thinks this chart bespeaks “transitory”.

Well, apparently, it’s the camarilla of Republican central bankers who have now delivered the coup d’ grace to sound money and thereby everything the the Republican Party stood for about fiscal rectitude, free market enterprise and personal liberty back in the day.

YoY Change In 16% Trimmed Mean CPI, July 2012- September 2021

Alas, with each passing month today’s monetary scam comes closer to its Waterloo. That because the purchasing power of the workers’ dollar is now visibly plunging, meaning that the Sheeples are about to get aroused and militant for the first time in decades. After all, in September the dollar’s purchasing power was already down by nearly 18% from what it would buy as recently as January 2012, when the Fed officially adopted its misbegotten experiment in inflation-targeting.

In this respect, we are reminded of Walter Bagehot’s rendition of a 19th century saying about money during England’s gold standard heyday:

…..the nineteenth-century saying, quoted by Bagehot, that “John Bull can stand many things, but he cannot stand 2 per cent.”. If this is true, then asking owners of money wealth to accept (interest) rates of 2 percent, or perhaps much less, will face political resistance.

To paraphrase the above, American consumers recently accepted 2.00% inflation, but at 3%-5% or more, we think not. And when the public finally gets on the anti-inflation warpath, the so-called “independent” Fed will not be far behind.

Purchasing Power of the Consumer Dollar Since January 2012

Still, the chart-monkeys are attempting to rally the S&P 500 back to 4400 this morning, notwithstanding the September CPI report.

Why?

Very simply, the entire financial system has been wired to the believe that markets never stop going up, and that economic data always benignly bends toward a position that allows still more Fed money-pumping. The very idea that the Fed could be forced to take restrictive actions which would anger the entitled gamblers and bullies of Wall Street has simply been ruled out a priori.

Of course, that’s what generates the boiling frog syndrome. The temperature in the financial pot has been rising for years, but the frogs aren’t dead yet because until recently the Fed’s favorite inflation thermometer – the PCE deflator – told it to keep pumping in liquidity coolant.

Yet even that totally flawed index is now invalidating the story. During the past year, the PCE deflator for goods is up by a robust 5.0% and the deflator for services – which has exceeded the 2.00% target all along – is still up by 3.2%.

So really, how long are these madmen in the Eccles Building going to get away with the lowflation-cum-transitory-inflation ruse based on what had otherwise been the single benign but misleading inflation prints of the PCE deflator?

Change In PCE Deflator For Goods And Services From Year Ago

Well, when you look at the five heaviest items in household budgets – shelter, medical services, food & beverages, gasoline and durable goods – the answer would appear to be for not much longer.

Here we take out the “base effects” via the two-year stacked annualized rate of change, and the resulting data tell you all you need to know. The Sheeples will soon be coming with torches and pitchforks, meaning that the Fed will forced to drastically and unexpectedly retreat, thereby bringing the greatest financial bubble in history to a thundering end.

Two Year Stack Based Annualized Increase in CPI Components, September 2019 to September 2021

- Shelter: 2.60%;

- Medical Services: 2.90%;

- Food & Beverages: 4.15%;

- Gasoline 9.7%%;

- Durable Goods: 7.23%;

- Meat, Poultry, Fish And Eggs: 8.40%

And guess what? Both the shelter and medical care indices are currently aberrantly low owing to the complete shambles in the seasonal adjustments caused by last year’s Lockdown swoon.

Accordingly, they will be rising back to 3-4% soon, and then it will be showers time for the GOP prosperity wreckers at the Fed.

And not a day too soon.

PEAK TRUMP, IMPENDING CRISES, ESSENTIAL INFO & ACTION

Reprinted with permission from David Stockman’s Contra Corner.