This article concludes that quantitative easing as a means of stimulating economies and financing government deficits will fail. The underlying assumption is that the transmission of additional money to non-banks in order to inflate financial assets, and to banks to cover government finances, will become too great in 2021 for it to succeed without undermining fiat currencies and financial markets. Admittedly, this opinion stands in stark contrast to the common Keynesian view, that once covid is over economies will start to grow again.

To help readers to understand why QE will fail, this article describes how its objectives have changed from stimulating the economy by raising asset prices, to financing rapidly increasing government budget deficits. It walks the reader through the inflationary differences between QE subscribed to by banks and by non-bank financial institutions, such as pension funds and insurance companies.

Having exhausted the reduction of interest rates as the principle means of economic stimulation, central banks, and especially the Fed, have embarked on pure monetary inflation. Before the end of 2019, that became the driving force behind the Fed’s monetary policy. Since March 2020 the objective behind QE altered again to financing the US government’s budget deficit.

In this current fiscal year, just to fund budget deficits and in the absence of net foreign demand for US Treasuries, QE is likely to escalate to a monthly average of $450bn. Almost impossible with a stable exchange rate, but with the dollar being sold down on foreign exchanges and for commodities, the everything dollar bubble will almost certainly collapse.

Introduction

Keynes Hayek: The Clas...

Best Price: $1.80

Buy New $7.99

(as of 02:40 UTC - Details)

Now that the US has elected a new president who will appoint a new administration, we must forget recent political events and focus on future economic and monetary policies. It is a statement of the obvious that President-elect Biden and his new Treasury Secretary will be naturally more Keynesian than Trump and Mnuchin, and it is likely that the economic focus will be more on stimulating consumption than on supply side economics. Policies are likely to be closer to modern monetary theory, which is highly inflationary — certainly much more so than under Trump’s presidency.

Keynes Hayek: The Clas...

Best Price: $1.80

Buy New $7.99

(as of 02:40 UTC - Details)

Now that the US has elected a new president who will appoint a new administration, we must forget recent political events and focus on future economic and monetary policies. It is a statement of the obvious that President-elect Biden and his new Treasury Secretary will be naturally more Keynesian than Trump and Mnuchin, and it is likely that the economic focus will be more on stimulating consumption than on supply side economics. Policies are likely to be closer to modern monetary theory, which is highly inflationary — certainly much more so than under Trump’s presidency.

An important change is therefore bound to occur in monetary policy, and for the purpose of this debate we can forget any idea that the Fed, of for that matter any central bank, is an independent government agent prepared to restrict monetary growth responsibly. Beyond routine public expressions of independence, the Fed will fall in line with the Federal Government’s fiscal policies: it is up to the Fed to find a way to comply without losing face. However, in the early days of the new Biden administration this should not be too difficult because last March the Fed had already reduced the funds rate to the zero bound and announced unlimited quantitative easing, initially set at $120bn every month, as well as a range of other expansionary measures.

More QE is likely to be central to future monetary policies. But other than a bald assumption that QE is a sure-fire way to rescue an economy in difficulty, the consequences are poorly understood. In today’s context and other than the Japanese experiment with it which started long before, it was originally intended to be limited to the rescue of national economies following the Lehman banking crisis. But the precedent having been created it should be no surprise that it has become a permanent fixture for the Fed and other major central banks.

Doubtless, through linguistic prestigitation the term quantitative easing was meant to detract from public accusations of inflationary financing. If so, it succeeded. Public awareness of what is involved is apathetic in nature, and its monetary effects remain insufficiently understood. And the political class, not usually endowed with economic and monetary knowhow, sees little or no danger of the consequences of monetary inflation, having placed the matter entirely in their central banker’s hands.

The original objective is encapsulated in a few words in a Bank of England paper published in its 2014 Q1 Quarterly Bulletin, Money creation in the modern economy:

“QE is intended to boost the amount of money in the economy directly by purchasing assets, mainly from non-bank financial companies…. raising the prices of those assets and stimulating spending in the economy.”[i]

The statement in this quote that stands out is about raising the prices of (financial) assets, being an admission of deliberately pursuing a John Law policy of printing money to rig market prices. Apologists for monetary policies might say that central banks have been manipulating asset prices for some considerable time, which is true. But a train of thought accelerating on the rails of a policy’s objectives towards the buffers at the end of the line always ends in disaster. All further considerations of the consequences are blanked out. The consequential impoverishment of everyone other than the state and its licenced banking intermediaries through monetary debasement does not deserve a mention.

The other processes of monetary creation described in the Quarterly Bulletin paper are certainly informative, and worth studying for those fuzzy on the subject. But while the article in the Quarterly Bulletin goes on to explain the intended outcome of QE at that time, things have clearly moved on and an update is due. In examining monetary flows from QE in detail, this article goes further than the Bank’s paper and does so from an independent standpoint.

Understanding the role of bank reserves

Under QE, monetary stimulation is channelled through commercial banks, ending up crediting their reserve accounts at the central bank. Understanding how these reserve accounts operate is important for a full understanding of QE’s mechanics, and can be boiled down to the following bullet points:

The Global Addiction t...

Buy New $17.98

(as of 06:51 UTC - Details)

The Global Addiction t...

Buy New $17.98

(as of 06:51 UTC - Details)

• Only licenced commercial banks are permitted to have an account with the central bank. Any interaction between a central bank with a non-bank is conducted through a commercial bank’s reserve account.

• The balance on a reserve account is recorded as an asset on the commercial bank’s balance sheet and is therefore one of several line items under its asset column.

• Just as in any banking relationship, there are active and passive roles. In this case, only the central bank can activate changes in total reserves. A bank cannot initiate a sale or purchase of reserve funds to or from the central bank.

• If a central bank lends money to a commercial bank, it is credited to its reserve account. This is not widely appreciated, but it undermines statistical analysis.

A bank can exchange its reserves with another bank with a reserve account at the central bank.

• Being an asset on a commercial bank’s balance sheet, reserves held on its account with a central bank are an active source of finance for its liabilities.

From the foregoing, it will be clear that reserves are just one of a commercial bank’s means of funding its liabilities. Broadly, those liabilities are comprised of chequing and deposit accounts due to customers, bonds and bills issued by the bank, wholesale market funding, and shareholders’ funds. An increase in reserves permits a commercial bank to increase its liabilities by expanding bank credit. But the degree to which this is possible is governed by the gearing relationship between total assets and shareholders’ funds, which is a separate matter.

Stimulating the financial sector

The Bank of England’s paper posits that once interest rates reach the lower bound, the central bank cannot stimulate the economy any further by cutting interest paid on commercial banks’ reserves. It is at that point that asset purchases are considered as the means of getting more money into the economy, and as the authors put it, it requires a shift of policy from interest rate management to directly expanding the quantity of money. The original intention was to access non-bank financial institutions such as pension and insurance funds, buying government debt from them and encouraging them to reinvest the cash gained in higher yielding assets: in other words, to adopt greater investment risk, reflected in higher yields on non-government debt and from prospective returns in equities.

QE has certainly worked in this respect by feeding cash through these institutions into financial markets, driving prices ever higher. QE aimed at large investment funds is the link between accelerating rates of monetary inflation and the equity market bubble, a point missed by those who believe that financial markets must be grounded on assessments of fundamentals and risk. But the central bank view is that rising prices for financial assets floats all boats, and the wealth effect stimulates both confidence and economic activity. But it is a mistake to think that all QE ends up in pension and insurance funds. Increasingly, it has become a means of financing government deficits with commercial banks acting as principals in QE transactions, rather than just puffing up financial assets. And the delineation between banks and non-banks is important, because the monetary and market consequences are different.

How QE for non-banks works

The Bank of England’s paper makes a distinction of QE transactions taken up by non-bank financial institutions for good reasons. It has little to do directly with funding of a government deficit, which it was assumed at the time the paper was published would be through normal channels. Furthermore, the inflationary effects of QE targeted at non-banks, such as pension funds and insurance companies, is entirely different from that when a commercial bank subscribes for government debt.

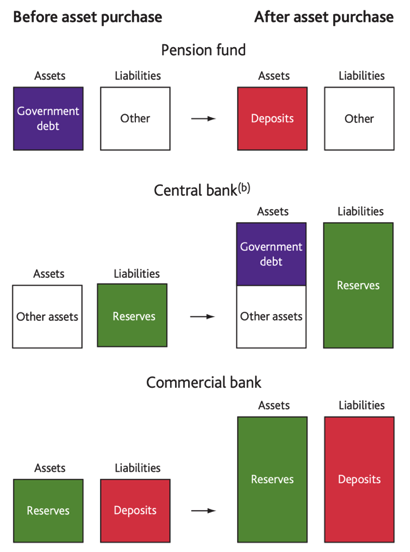

In order for a central bank to deliver monetary stimulus to non-banks it must do so through a commercial bank, because only commercial banks have accounts with the central bank. The chain of payments is for the central bank to credit the reserve account of the fund’s bank, against which the bank credits the fund’s account with a matching entry. In the case of the Fed, the financial asset being bought, usually Treasury or agency bonds, is delivered out of the fund’s name and reregistered to the Fed’s account. The schematic diagram below, taken from the Bank of England’s article, summarises the transaction.

Having disposed of its holding of government debt, the pension fund has newly issued money to invest credited to its account at the commercial bank. It invests it either by buying into new issues of regulated investments, including fixed interest and equities, or by buying existing stocks and bonds in the markets. The newly created money then moves from the pension fund into new hands with different consequences for prices. An investment into a new issue gets distributed through the non-financial sector and pursues a Cantillon course, driving up prices of goods and services in the wake of its absorption into the wider economy. An investment into existing stocks and bonds will mostly remain in circulation in the financial sector, being reinvested by the sellers in other securities.

If the pension fund invests in an exchange traded fund (ETF) it leads to an expansion of the ETF, which can either feed into purchases by the ETF of financial or non-financial investments in accordance with the ETF’s remit. By transmitting newly created money through pension and insurance funds into purchases of commodity ETFs, commodity prices are thereby increased by investment flows whose origin is QE.

This explains how central banks through QE increase financial asset prices by monetary inflation, and how it also affects commodity prices. In the case of the Fed, the mechanism requires government or agency debt to be available for purchase from insurance and pension funds. But there is a mismatch to overcome: both pension and insurance funds have long-term liabilities against which they wish to hold long-term risk-free investments. Consequently, the government debt they are normally prepared to sell to the central bank tends to be naturally restricted to shorter-dated maturities, which they own principally for liquidity purposes. Therefore, if they are to sell short-term maturity debt, they end up subscribing for new issues with similar maturities in the absence of their actuary’s recommended changes in overall investment strategy. The introduction of longer-term financing is a different issue, by which deliberate central bank intervention in the shape of the yield curve is used by a central bank to access non-bank ownership of longer-term bonds. This form of “operation twist” is discussed later in this article. For now, we must examine a second monetary objective, to be regarded as separate from the original intention behind QE: the financing of the government’s deficit.

The New Great Depressi...

Best Price: $1.94

Buy New $10.64

(as of 08:31 UTC - Details)

The New Great Depressi...

Best Price: $1.94

Buy New $10.64

(as of 08:31 UTC - Details)

Financing the government’s deficit

A pension fund which subscribes for new issues of government debt, only to sell it on to the central bank through its commercial bank is engaged in a different operation to that described above. Where a purchase of government debt is matched to its sale, the monetary effect is the same as that of a bank when it acts as a principal to a QE transaction

While rules and procedures vary between central banks, the effects are always the same. A commercial bank applying for a new issue of government bonds does so off its own balance sheet. QE then allows the bank to sell the bonds to the central bank for a turn. The proceeds of QE are credited to the commercial bank’s reserves at the central bank. Other than the profit on the transaction, the purchase and sale effectively net each other out and there is no material change in the money in general circulation as a result of the transaction.

In this, the monetary effect is fundamentally different from the end seller being a non-bank, such as a pension fund, selling an existing asset in its portfolio to the central bank. The sale of a previously existing bond to the central bank does not benefit government finances. But the pass-through of new government bonds via a commercial bank acting off its own book to the central bank does.

The inflationary effect from bank-funded QE comes from government spending of the raised funds and depends how that money is spent. It is also worth repeating that if a non-bank similarly subscribes for government debt and then sells it into the central bank’s QE programme via its commercial bank, following completion of the transaction there is no monetary expansion, other than the profit on the transaction. In any case where government bonds are bought only to be sold to the central bank the transaction does not involve monetary stimulus at the initial level. All one can say is there is no crowding out of private sector bond demand from increased government bond issuance, as there would be if QE was not involved. The monetary inflation comes from government spending of the funds raised.

In the current economic environment, where government deficits are growing rapidly, QE is increasingly deployed as a means of financing government spending instead of it being directed to stimulate financial asset prices. The original intention as described in the Bank of England’s 2014 article has not been the paramount objective since September 2019, so far as the Fed is concerned.

In the case of the US Government’s issues of treasury bills and bonds, until September 2019 there were ready buyers from foreign sources recycling dollars gained through America’s trade deficit, and from large hedge funds in a carry trade through the fx swap market; the latter being in effect the borrowing of euros and yen to invest in higher-yielding US Government debt. The significance of September 2019 was that was when the US banking system ran out of balance sheet space to finance fx swaps, and the repo rate exploded higher, fully 8% above the Fed’s funds rate which stood at 2%.

The unwinding of fx swaps was followed by a diminishing foreign appetite for US Treasuries and bills, made more acute by the Fed’s reduction of the funds rate to the zero bound in March 2020. To an extent, this fall in foreign demand was masked by continuing demand from captive insurance companies in centres such as the Caymans, reinvesting their dollar denominated premiums to match their US dollar liabilities.

But with the Fed funds rate at the zero bound, the process of squeezing risk premiums lower through QE is finite. The attraction to pension funds and insurance companies of a role in QE diminishes. Furthermore, the economic malaise from the impact of covid lockdowns has increased investment risks. As well as moving the emphasis of QE from inflating financial assets to funding a rapidly growing budget deficit, it appears that the momentum behind the inflation of investible financial assets is in danger of slowing down. New measures are called for, and the two possibilities are an “operation twist” to unlock access to non-bank medium and long-dated Treasury debt, and a venture into negative rates.

In a new operation twist, the Fed would reinvest maturing treasury and agency debt in medium and longer maturity bonds, keeping its fund rate at zero but reducing bond yields along the curve. When the Fed used this tactic in 2011, it was part of an economic stimulation package, and against a background of foreign demand for new US government debt. A new operation twist would be different, in that its primary objective would be to fund government spending in the absence of foreign demand for treasury debt.

The plan would be to replace, at least to a degree, the stimulus of QE to non-bank investors with a new stimulus in falling yields for ten-to-thirty-year maturities. If the 10-year Treasury bond yield could be returned to less than 0.75% from its current 1.1% that could prolong the wealth effect in financial assets without tapping the non-banks, while using QE to fund government deficit spending.

In other words, the stimulus for markets returns to lowering interest rates along the yield curve, but without breaking the zero bound. The banks operating off their own books can deal in billions for gains measured in basis points for a while, but already this thesis is running into the headwinds of benign assumptions.

The first assumption is that falling interest rates for the US dollar can continue into negative territory in order to enable QE funding to continue, the important part for the banks being their ability to use negative funding costs on their reserves for a yield pick up on subscriptions for government debt, which subsequently gets sold to the central bank. Precedents exist in euros and yen and are being debated for sterling. But with the dollar as the world’s reserve currency, negative rates would drive all commodities into nominal backwardations with spectacular unintended consequences. Furthermore, if passed on by commercial banks to their customers, it would be a tax on foreign deposits, accelerating the recent fall in the dollar on the foreign exchanges.

The second assumption concerns the deflection of bank business in favour of government funding from funding the private sector’s credit requirements. While banks in the current economic climate are not inclined to increase private sector lending anyway, an increase in the Fed’s QE can only encourage and accelerate a shift away from private sector financing through bank credit in favour of profiting from the QE roundabout. Remember, bank balance sheet capacity is strictly limited, irrespective of their reserve balances.

Furthermore, it must be assumed that there will be no feedback loops from a falling dollar or from prices rising in the non-financial economy, as a consequence of the government’s deficit spending — an assumption that appears unwarranted.

The increasingly inevitable failure of QE

It would appear that in 2021 the rate of QE will increase significantly compared with the rates for the central banks which deployed it last year. In the case of the Fed, it could soon find itself funding unprecedented amounts, just to cover the government’s budget deficit in the current fiscal year. The budget deficit in the second half of the last fiscal year (March-September 2020) was an astonishing $2.774 trillion out of a total $3.3 trillion for the whole year.[ii] If, as seems likely, US government deficits for fiscal 2021 run at a similar pace to that of the second half of last fiscal year, it implies the full year deficit to be financed will be close to £5.5 trillion, requiring an average funding rate through QE of about £460bn every month.

In the wake of the presidential election, Keynesian thinking has got little further than hoping that as soon as covid lockdowns end, economic activity will rapidly return to normal. All it requires is just one more stimulus package, currently in negotiation. Then, the Keynesians say, the Fed can begin to normalise its balance sheet and allow interest rates to gradually rise. Proof of this view was expressed recently by the regional Fed chiefs of Dallas, Atlanta, Chicago and Richmond suggesting in unison that the Fed might start to wind down QE later this year, with rises in interest rates to follow.[iii]

It probably has an element of politicking, staking out the ground ahead of Biden’s first budget stimulus. But as non-banks look to their investment risks at a time of stalling bank credit, deflationary forces in credit markets are set to undermine the effectiveness of QE in managing to keep financial asset prices supported.

There is also a growing threat that pension funds and insurance companies, which need to keep core balances of government bonds, are in danger of running these balances too low and will be reluctant to sell any more to the central bank for cash, certainly in the quantities likely to be needed to support financial markets. The stimulus to markets from the reinvestment of this cash will then slow down to a point where markets begin to slide. Furthermore, the Fed is likely to find itself having to absorb selling by foreign holders of US Treasury bonds and bills as well, undermining attempts to keep short-term rates close to the zero bound.

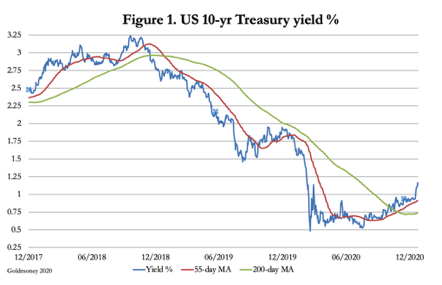

The trend is already forming. Figure 1 below shows how the yield on the US Treasury 10-year bond is now rising, despite all the new money from QE being pushed into financial markets, which has suppressed bond yields until now.

Keynesians are presumably hoping that far from being a worry, higher bond yields are anticipating their vaunted economic recovery, and the Fed’s prospective tapering later this year. But that estimation is in the face of indisputable facts. Businesses in non-financial sectors are going bust on an unprecedented scale and any analysis of systemic risk shows that a major bank failure is on the cards, driven by a confluence of excessive bank balance sheet gearing and escalating bad debts. Bank share prices around the world, notably of some major G-SIB banks in the Eurozone, China and the UK, are trading at substantial discounts to book value. So, why is the UST 10-year yield rising?

The answer is disturbingly singular: markets see the value of the dollar being lower in the future. Holders of dollars therefore require a higher level of time preference to compensate them for their expectations of the purchasing power of the dollar. This is confirmed by rising prices across the board for commodities, and the funk money going into bitcoin. The fact that gold rose 26% last year is an additional indicator that this is so.

Therefore, the prospect of flooding bond markets with more government debt at an unprecedented scale has dollar bond yields rising they will continue to do so. The whole scheme, whereby the Fed prints dollars through its non-bank financial agents to continue to inflate financial asset prices, is set to fail. And as the John Law experience in France three centuries ago proved, the best way to benefit from today’s Keynesian replay on a global scale is to short the central bank’s money for sound money. In late-1719, Richard Cantillon shorted Law’s livre against English pounds and Dutch guilders in the foreign exchanges in London and Amsterdam in preference to shorting shares in Law’s Mississippi bubble. Today he would short dollars for gold, the only sound money available today.

[i] See the Overview on pp 14.

[ii] See figure 2 in https://www.goldmoney.com/research/goldmoney-insights/global-inflation-watch

[iii] Quoted from today’s The Daily Telegraph — an article by Ambrose Evans-Pritchard: “Biden’s spending blitz fires starting gun on a fresh Fed taper tantrum”.

Reprinted with permission from Goldmoney.