It’s very easy to get sucked into the mini dramas playing out across our digital screens.

Trump Tweeted this while the stock market did that. Uh oh! Somebody’s experiencing something awful, or having a stroke of great fortune. Hey, look: Kittens!

Watching CNN often feels like the inept product of a university committee that sought to create a program of sensitivity training for adult sufferers of acute ADHD. After just five minutes you know what it’s like to be trapped in a brain that’s distracted part way through every thought pattern and cannot maintain enough attention to form a coherent sequitur.

However, if we set these entirely useless distractions aside it’s quite apparent that something big is going on. And it’s not positive.

It’s a complex story with lots of moving pieces and it takes a bit of effort to puzzle it all out, but more and more people are arriving at the same conclusion; something is going to break.

To resolve the dots into a coherent picture, we need to take two giant steps back and take in the whole canvas.

The cliff notes version is this: The numbers just don’t add up.

Reinventing Collapse: ...

Best Price: $3.92

Buy New $1.99

(as of 10:45 UTC - Details)

Reinventing Collapse: ...

Best Price: $3.92

Buy New $1.99

(as of 10:45 UTC - Details)

Big changes are underway. Specifically, the unsustainable cogs in the global economy are slowly grinding to a halt.

Giant Step #1: Growth

The age of unrestricted growth is over. It was a good run. But now we’ve got to live within certain ecological and resource budgets which means we’ve also got to live within some fiscal and economic budgets.

Virtually nobody in power wants to do either. Maybe a few here and there, most of them recently retired or close to it. The remainder all want business-as-usual (BAU) to continue, especially those that just hooked a finger around the brass ring of success.

The big problem with BAU is that it’s a broken model without a future. Economic growth was the solution to every problem. Now it is the problem.

Worst of all, it’s not just growth we’ve become addicted to, but exponential growth. For a quick and powerful review of this vital concept, please watch this video. It’s less than 5 minutes. Fair warning, you might not be the same afterwards:

There are a hundred exponential charts we could discuss, and they are all important in their own right, but there’s one that stands far above them all.

It’s so prevalent in your life that you probably take it for granted and might not appreciate all that it provides. You are the fish and it is the water.

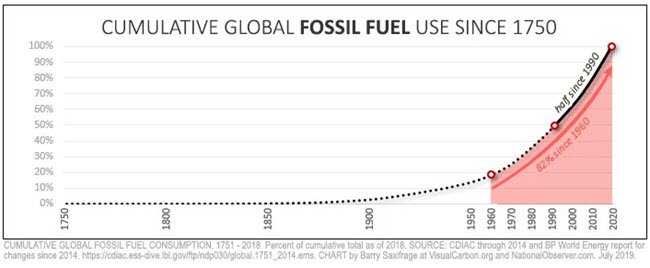

Here it is:

(Source)

Fossil fuel energy is responsible for providing every creature comfort and material abundance in your life and it’s has been growing exponentially for your entire life.

Here’s the brain buster. Squint at that chart carefully and you’ll see that fully half of all the fossil fuels ever burned throughout all of history have been burned since 1990.

Which means that if you are 29 years old, you’ve been alive when half of all the fossil fuels ever burned throughout all of human history have been burned. Half! In just 29 years!

If that doesn’t shock you, then I need you to re-read it and think about it some more, because it’s a really profound insight. Especially once I connect it to the second giant step below.

Here’s another idea. What if we converted the fossil fuel energy we consume into human slaves? That is, the amount of work that a fit human could provide if they were digging ditches or crushing stones or hauling a cart, except it’s the fossil fuel providing the work energy.

By this method we discover that each year’s fossil fuel use is equivalent to 500 billion human energy slaves working to keep our houses cooled, food on the table, and moving ourselves and our innumerable goods about the face of the planet.

With only 7.8 billion people on the planet that’s as if there were 64 human energy slaves per person. Given that those slaves are not evenly distributed it’s more like people in rich countries have several hundred energy slaves each. It makes life very easy and sweet.

If or when your energy slaves go away, life will become a lot more difficult, but not in any ways that would be remarkable to your great grandparents.

When it comes to oil the data is even more surprising. To have been alive when half of all the oil ever used throughout all of human history you only need to be 22 years old. 22!

In just the past 22 years, as much oil energy as used throughout human history has been used. It’s moved your personal vehicle, massive container ships and airplanes. It’s dug up vast mineral ore deposits and installed wind towers, as well as spread plastic throughout the oceans. It’s trawled, and cut and scraped and plowed the dwindling natural habitats.

It’s very difficult to overstate just how much material abundance it has brought to the world. “All of it” would be closest to the truth. Water to a fish.

Ask yourself, now – how long will it be before another volume equal to all of that ever burned throughout history will be consumed? That is, how long before the next doubling – another half equal to the last half?

At current rates, that would be just another 21 years.

Weird, eh? But it’s how it works. It’s the miracle of compounding. Each doubling consumes as much as all the prior ones before it. This is awesome when it works for you in a portfolio, sneaky and treacherous when it’s working against you as it has for the actuarially deficient pension plans.

Einstein called compounding “the eighth wonder of the world” and said that “He who understands it, earns it; he who doesn’t, pays it.”

I know that energy extraction is complex arena and I’m not asking you to become a world-class petroleum or coal geologist or anything – but merely to use your intuition.

How many more doublings do you think we’ve got? One more? Can we manage to find and burn another amount of coal, oil and natural gas equal to all that has come before? Even if your intuition says that we’ve got one more doubling, or possibly two, you know there’s a hard limit in there somewhere.

Sooner or later there’s a limit to the exponential extraction and use of fossil fuels. Someday it just becomes too difficult to extract the remaining dregs and dribbles at a faster pace. That’s when the peak occurs. Then everything we take for granted changes. The water drains from our tank. We will rather suddenly become acutely aware of the water’s absence.

That day is not as far off as you might imagine. A decade, perhaps two.

With this one giant step back so much becomes clear about the future and what it can, and what it cannot, offer. One thing we cannot assume any longer, is an endless horizon of exponential growth in energy extraction. With that one insight, literally everything about investments and economic growth suddenly changes.

If you have money invested in the markets, and you care about the future, the next step is going to really matter to you a lot.

Giant Step #2: The Economy & Energy

Economic growth depends on energy.

It is this concept, more than any other, that serves to cast light on the future.

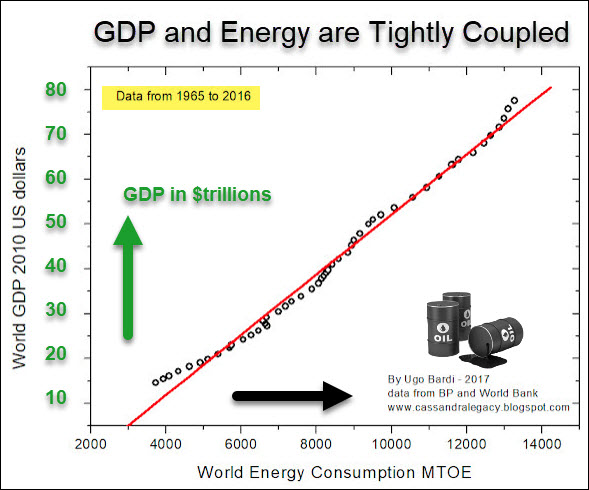

Out of all the economic charts and data I have, and I have a lot, this next one is the most robust, rock-solid of them all. It shows that economic growth (GDP) and growth in energy consumption over the past 50 years have been tightly coupled.

See how nice and straight that line is? See how the data points all fall neatly on or about the straight red trend line?

That tells us there’s a very tight relationship between global economic activity and global energy consumption. The units can be defined.

The Long Emergency: Su...

Best Price: $1.24

Buy New $1.99

(as of 10:49 UTC - Details)

The Long Emergency: Su...

Best Price: $1.24

Buy New $1.99

(as of 10:49 UTC - Details)

If you want (expect, require, are counting on…) X-units of economic growth then you’re going to need Y-units of additional energy consumption.

It’s pretty simple and dead linear. Nothing complicated about it. More economic growth requires more energy use. That’s been true for the past 50 years, and there’s nothing yet anywhere to suggest that this has or will change.

This is a profoundly important concept. It matters to every investor, saver, and citizen who cares about preserving their wealth and leaving behind a world worth inheriting (our mission at Peak Prosperity).

Here’s why. The economy and its enabler, the financial system, are 100% built around the idea of perpetual exponential growth.

Well, as we pointed out above that exponential economic growth is based on energy growth, and that cannot continue forever (or even very much longer).

So the operative question becomes, what happens to the linked economic and financial systems when they cannot grow exponentially anymore?

Nobody really knows but perhaps we got a taste of that back in 2008 when the financial system almost blew to smithereens. The entire banking system almost seized up and ceased to function. They were desperate times. Why?

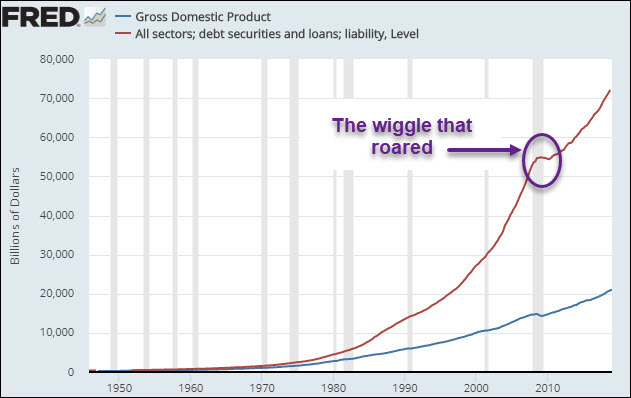

Simply because credit stopped growing exponentially, for the first time since the 1950’s. That tiny wiggle on the chart below almost wrecked the global financial system.

Really? We have built for ourselves a system of credit and money that is either happy but growing exponentially or it’s collapsing? Those are its two states?

If you’re like me, you find that somewhat troubling.

Connect the Dots

I’m leaving aside all of the profoundly worrying signals from the natural world – the missing insects, the melting ice and a hundred other signs that the age of growth is well and truly over – which is a whole other ‘dot’ to connect here.

For our purposes today it’s sufficient to connect these two dots:

- The financial system requires exponential growth

- Fossil fuels are finite

Okay, one other point to weave in here. Currency (“money”) and debt are not wealth, they are claims on real wealth.

It’s pretty common to mistake of money & debt as wealth. If you own a billion dollars of US Treasury notes and corporate bonds you are said to be very wealthy.

But what do you really own? Well, you own a billion dollars (plus interest) of claims on the future cash flows of the issuers of the bonds. But the bonds themselves are not real wealth in the sense that you can eat them, live in them, or do anything with them except admire them in your portfolio. We own claims on wealth so we can someday consume or possess actual wealth.

To do anything useful with bonds you have to first convert them to dollars (themselves liabilities of the Federal reserve).

It’s only once you’ve done this that you can then exchange those dollars for the real goods and services that you actually consume, like houses and oil wells and land and gold and food.

And that’s the point. Everything that we popularly call “wealth” (currency, stocks and bonds) are merely claims on the final items containing real value that we wish to own or consume.

Which means there needs to be a balance between the claims and the things. Too few claims and that’s deflation. Too many and that’s inflation.

Well, in this story the Fed, et al., have been fostering the exponential accumulation of claims at roughly 2x the rate of real GDP growth and without any indication of concern for the fact that the earth is, in fact, finite.

Take another look at this chart. The blue line is GDP and it represents the real stuff (the “things” in this story) while the red line represents the claims.

Is it not completely, totally, utterly obvious that the claims are increasing faster than the stuff? The data shows that debts are compounding at 2x the rate of GDP and have been since 1971.

Is that sustainable? Nope. How could it possibly work out? Only if GDP growth comes roaring back and is 2x the pace of debt growth for many decades into the future. How likely is that? Well, let me tell you a story about how energy and the economy are linked…

Constantly increasing debts is an implicit bet on the idea that the future will be larger than the present.

Exponentially larger given the interest involved. The real wealth to justify those claims will show up. Magically. It always has. Unfortunately, Peak-All-Sorts-Of-Things militates against that view.

What I’m saying here is that the commonly held conventional view of the world and the future has got it all wrong. Dangerously and very badly wrong.

The Vital Role of Hard Assets

Okay, you are asking, what’s to be done here? What should you do?

Against the State: An ...

Best Price: $5.02

Buy New $5.52

(as of 11:35 UTC - Details)

Against the State: An ...

Best Price: $5.02

Buy New $5.52

(as of 11:35 UTC - Details)

The solution is to understand that human nature has not changed at all in the past 5,000 years. Which means that when confronted with such a major development as I’ve laid out above, the normal human tendency will be to ignore it as long as possible and do some really dumb things to try and prevent reality from intruding on the fantasy.

What have humans done hundreds of times throughout history when their dreams were economically unworkable? They printed, or debased, their money.

Can’t afford a war? Clip the coins! Empire too large? Go into debt! (And then print your way out of your pickle.)

Global economy no longer growing, debts too large, and the claims too many? Quantitative easing (QE)!

Really there’s nothing new under the sun here. Same old, same old.

In every case when the “solution” was printing or its equivalent, fortunes were made and lost, but mostly lost. Claims on wealth were mistaken for actual wealth. When the claims evaporated in various panics the holders were financially ruined.

That’s going to happen again for the same reasons as before, only this time it’s a global phenomenon. There are no borders to scurry across and hide out while things blow over.

Seen from a comfortable distance what actually happens during these times is a wealth transfer. From those who don‘t see it coming to those who do. Broadly speaking, from those clinging onto the claims on wealth towards those who hold the actual wealth.

This is where hard assets come in.

The real wealth, again, are the real things that either are the source of real wealth (farmland, oil wells, mines, timberlands, etc.) or are the tangible things that come from those assets. Gold, silver, lithium, copper, lumber, cash flowing real estate and the like.

By far the simplest and easiest thing you can do, as a starting point, is to have a portion of your wealth safely tucked into gold and silver.

By the way, the big, smart money has already started this process which means you’d better get moving if you want to join that parade. There may well come a day when the big money floods in that direction and then – good luck finding any to buy!

Here’s some data for you. For a variety of reasons too numerous to go into here, the world’s central banks are too far down the QE rabbit hole to do anything but print and then print some more! This has resulted in over $15 trillion of negative yielding debt across the world. That number is exploding and sure to go even higher in the future.

If you were forced to choose between the certain losses of negative yields (which means paying an entity to lend them money) and holding gold, which at least offers a zero yield, which is more attractive?

The answer screams “own gold!” to many investors which explains why this chart of the total amount of negative yielding debt and the price of gold line up so well:

Do You Love Your Family?

I have three adult children whom I love very much. And while I don’t have any grandchildren yet – and I already love them, too.

And because I do, I own lots of gold and silver.

I’ve taken the time to study history, clear my head of the common narrative that has so many things so desperately wrong. I actively reject the usual anti-gold propaganda that infects the US financial press. It’s a weird position that’s not reflected or repeated anywhere else in the world and I don’t have a good explanation for it.

I’ve taken is as my role to provide them as solid a start as I can, the same as in many other families. And it’s a role I take seriously.

A core position in gold and silver – physical gold and silver, not ETFs or miners – is an essential part of that strategy. It’s the durable insurance fund that a financial fire cannot destroy. If you love your family and you take the role of providing and protecting seriously, gold and silver are a critical “must have” in your holdings.

After that, the next layers involve income-producing real estate (for which we have an excellent webinar series), productive farmland, a resilient homestead, ownership in high-quality mines and energy plays, and other hard assets. What makes sense for you is a complex equation involving your age, financial status, geographical location, family circumstances, etc.

We strongly advise that any money you have in the financial markets, or ““markets”” as we like to call them due to their excessively deformed nature, be managed by people who understand these many risks and actively manage for the future you think is coming. Our endorsed financial advisers at New Harbor will be glad to provide you with a free, no obligation consultation as they have for many hundreds of our readers.

They will help you develop a plan and determine which assets make the most sense to explore and invest in.

Finally, be sure to discuss these powerful and important ideas with those you love and care about. The world is changing, and people will either be prepared for those changes or they will be caught unawares.

This isn’t doom & gloom. It’s just reality.

However, as has been historically true, reality isn’t very popular with the masses. That’s why so much opportunity exists.

To see it, you just have to take two giant steps back to understand the larger picture.

Reprinted with permission from Peak Prosperity.