Two millennia ago, according to the bible, three wise men came to offer Jesus the gifts of gold, frankincense, and myrrh. The peak of the Roman Empire is considered to be at the time Jesus was born although it took until 476 AD until the Western Empire finally fell.

Today, just over 2000 years later, we might be standing at another historical peak in the global economy. There are certainly many similarities like deficits, debts, and decadence. Just like the Roman Emperors, current leaders have illusions of grandeur of a magnitude that the world has never seen before.

So let’s look at the modern version of the three wise men. What gifts are they bringing the world?As in the illustration below I have picked three central individuals in the world today; Draghi – head of the ECB, Li Keqiang – Premier of China and Abe – Prime minister of Japan. In themselves, they are not that important but the country or region they represent is.

Italy – the next nail in the EU coffin

Current Prices on popular forms of Gold Bullion

Let’s first look at Draghi the President of the ECB, obviously with the required Goldman Sachs connections. What gifts is he bringing to the world and especially to Europe. Very little as a matter of fact and certainly not gold or solid finances. Although Draghi can’t be blamed for all the problems of Europe, he certainly personifies them. The European Union is in the process of braking up. Brexit was just the first step but will be followed by many countries who will want to exit until the EU is no more. The Italian election on December 4th could be the next nail in the EU coffin. Initially, the EU and its predecessor EFTA was created for free trade between the member countries. But soon the power hungry elite decided that the EU should be a power center what would control Europe, politically, economically and militarily. But most 500 million EU Europeans have no desire to be controlled by an unelected and unaccountable elite in Brussels. The history, culture, and roots of individual European countries is much too strong to lose your identity in some anonymous superstructure. Britain, free from the shackles of the EU bureaucracy is likely to now prosper relative to its EU brothers.

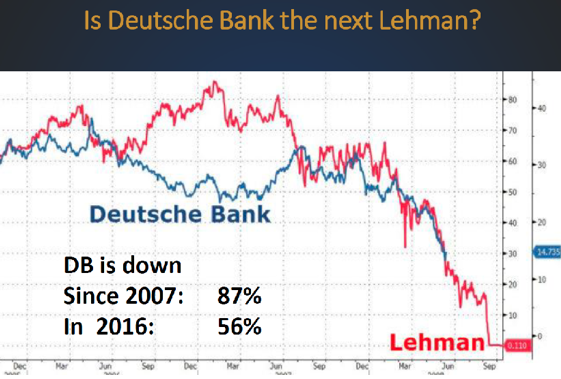

There are now so many problems in the EU but the biggest and the most urgent one is clearly the financial system. Most European banks would be bankrupt if they valued their toxic assets at market rather than maturity value. Currently, many European banks are on the verge of failure whether it is German, Greek, Italian, Spanish, Portuguese or French banks. Share prices of many major European banks are down 80-95% which clearly indicates that the markets consider their chances of survival to be very small. Deutsche Bank is one example which some of us identified a few years ago as a bank that is unlikely to survive. Its market value is now less than 1% of its balance sheet. With $60 trillion in virtually worthless derivatives, the German government will need to print a lot of money to postpone the inevitable demise of Deutsche. I don’t think that the German government will let DB fail before Germany does. Thus they are likely to fall together at some future point. The situation is the same for many other European banks so Draghi will have to use all his wisdom to save the European financial system. This means he will print unlimited amounts of money in coming years. But that will not have any effect. You can solve a debt problem by adding more debt. Thus “wise man” Draghi will sadly fail in his attempt to save Europe.

China’s credit expansion – a time bomb?

What about China’s Li, does he stand a chance? He has an impossible task. China’s spectacular growth has been accompanied by an even more spectacular increase in debt. China’s debt has exploded from $2 trillion to $35T this century. A lot of that is in the shadow banking system and total bad debts are 10X higher than officially admitted. The slowdown in world trade this year is also going to affect China badly. The collapse of one Hanjin Shipping, one of the largest shipping companies in the world, is clear evidence of the downturn in global trade. Shipping rates for a container from Asia to Europe are now down to $760. Breakeven is $1,400 per container. The largest shipping companies are projected to lose up to $20 trillion this year. The main reason for this is what is happening in China. Sadly, China fell into the Western pattern of expanding credit irresponsibly and spending a major part of the money on speculative investments that will fail. The bad debt in China will lead to major defaults, money printing and a fall of the yuan. Yes, the Chinese are wise and they do realize the importance of gold. That is why they will probably emerge from the coming economic debacle better than many countries, barring major political upheaval. Li and his successors will need all their Chinese wisdom to survive the coming ears.