Saudi Arabia is scheduled to begin building the world’s tallest tower next week, which will soar 1km in to the sky when completed, reports The Telegraph.

The Kingdom Tower in the coastal city of Jeddah will measure 3,280 feet (1km), some 568 feet (173 meters) taller than the current Guinness world record holder, Dubai’s Burj Khalifa, which stands at 2,716 feet (827 metres).

Does this signal another global economic crash is near/

Economist Mark Thronton has written in the past:

The skyscraper index, created by economist Andrew Lawrence shows a correlation between the construction of the world’s tallest building and the business cycle. Is this just a coincidence, or perhaps do skyscrapers cause business cycles? A theoretical foundation of “Cantillon effects” for the skyscraper index is provided here showing how the basic components of skyscraper construction such as technology are related to key theoretical concepts in economics such as the structure of production. The findings, empirical and theoretical, suggest that the business-cycle theory of the Austrian School of economics has much to contribute to our understanding of business cycles, particularly severe ones…

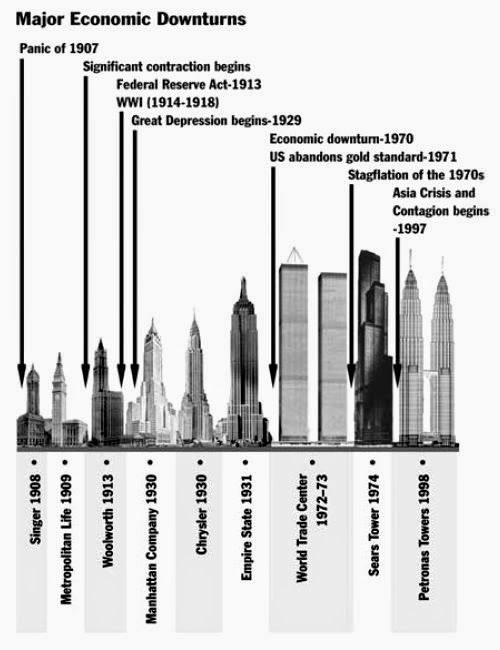

The skyscraper is the great architectural contribution of modern capitalistic society and is even one of the yardsticks for 20th-century superheroes, but no one had ever really connected it with the quintessential feature of modern capitalistic history — the business cycle. Then in 1999, economist Andrew Lawrence created the “skyscraper index” which purported to show that the building of the tallest skyscrapers is coincidental with business cycles, in that he found that the building of world’s tallest building is a good proxy for dating the onset of major economic downturns. Lawrence described his index as an “unhealthy 100 year correlation.”

The ability of the index to predict economic collapse is surprising. For example, the Panic of 1907 was presaged by the building of the Singer Building (completed in 1908) and the Metropolitan Life Building (completed in 1909). The skyscraper index also accurately predicted the Great Depression with the completion of 40 Wall Tower in 1929, the Chrysler Building in 1930, and the Empire State Building in 1931. There are, however, important exceptions in the ability of the index to predict, so the first question is: how good of a predictor is the skyscraper index?

Second, what is the nature of the relationship between skyscraper building and the business cycle? Surely, building the world’s tallest building does not cause economic collapse, but just as clearly, there are economic linkages between construction booms and financial busts. What theoretical connections can be made between skyscraper building and business cycles? Andrew Lawrence noted overinvestment, monetary expansion, and speculation as possible foundations for the index, but did not explore these issues…

Thornton continues and writes with regard to an analysis he completed:

The general relationship between the business cycle and skyscraper building is examined with respect to the role of “Cantillon effects” in skyscraper cycles. The unique and distinguishing features of abnormally large swings in the business cycle, as manifested in record-setting skyscrapers, are then shown to be uncommon features of most business-cycle theories and a unique feature of the Austrian School’s theory of the business cycle.

Note: I do not believe that there is an absolute correlation between the end of a business cycle and new record tall skyscrapers, and I am sure Thornton would agree with me on this. Indeed, it is entirely conceivable that during a period when there is no central bank money manipulation but savings are very high in an economy, new record tall skyscrapers could emerge that wouldn’t signal a future collapse.

That said, given that there is significant money manipulation by central banks around the globe in the world we now live in and that record high skyscrapers require significant amounts of capital (which can be provided by central bank money priting), it certainly becomes the case that record high skyscrapers are often built near the peak of central bank money manipulations, though there is nothing to absolutely prevent one record high skyscraper to be surpassed by even more money printing and an even taller record skyscraper in the same business cycle before a collapse occurs.

Reprinted with permission from Economic Policy Journal.