Donald Trump as Our Mad Emperor of the Bubble

October 15, 2025

These days the Wall Street Journal probably ranks as America’s most influential and credible print outlet, so Friday morning’s front-page story describing a sudden new escalation in our episodic trade war with China caught my attention.

As emphasized in the first several paragraphs, the Chinese had suddenly imposed an unprecedented new wave of licensing requirements on the import and use of the rare earths that they mine and refine, as well as the vital small magnets produced from those compounds. These extremely severe restrictions would now apply to any companies around the world whose goods contained as little as 0.1% of their value in that category, apparently encompassing an enormous range of major industries including cars, solar panels, and chip-making equipment. The entire supply-claim for phones, computers, data-centers, and AI systems would be covered, requiring individual permissions from the Chinese authorities for their use to continue on a case-by-case basis.

The Power Elite

Best Price: $6.00

Buy New $12.72

(as of 12:35 UTC - Details)

The Power Elite

Best Price: $6.00

Buy New $12.72

(as of 12:35 UTC - Details)

China’s newest restrictions on rare-earth materials would mark a nearly unprecedented export control that stands to disrupt the global economy, giving Beijing more leverage in trade negotiations and ratcheting up pressure on the Trump administration to respond.

The rule, put out Thursday by China’s Commerce Ministry, is viewed as an escalation in the U.S.-China trade fight because it threatens the supply chain for semiconductors. Chips are the lifeblood of the economy, powering phones, computers and data centers needed to train artificial-intelligence models. The rule also would affect cars, solar panels and the equipment for making chips and other products, limiting the ability of other countries to support their own industries. China produces roughly 90% of the world’s rare-earth materials.

Global companies that sell goods with certain rare-earth materials sourced from China accounting for 0.1% or more of the product’s value would need permission from Beijing, under the new rule. Tech companies will probably find it extremely difficult to show that their chips, the equipment needed to make them and other components fall below the 0.1% threshold, industry experts said.

The article emphasized that China has control over 90% of the refining and production of these small but vital technological components, with no obvious substitutes available. One quoted source described it as the “economic equivalent of nuclear war” and something that could “destroy the American AI industry.”

These new Chinese economic sanctions even extended to all the technologies and equipment related to the mining, refining, and fabrication of rare earth products. Such steps were obviously aimed at preventing any foreign competitors from developing alternate future supply chains able to weaken China’s current stranglehold. The total extraterritorial scope of China’s new restrictions was also dramatic.

As the MoA blogger brought to my attention, these issues were set forth most forcefully by Arnaud Bertrand, a longtime China observer based in that country:

This is actually big, potentially huge, notably because China’s new rare earth export controls include a provision (point 4 here: https://mofcom.gov.cn/zwgk/zcfb/art/2025/art_7fc9bff0fb4546ecb02f66ee77d0e5f6.html) whereby anyone using rare earths to develop advanced semiconductors (defined as 14nm-and-below) will require case-by-case approval.

Which effectively gives China de-facto veto power over the entire advanced semi-conductor supply chain as rare earths are used at critical steps throughout – from ASML (who use rare earths for magnets in their lithography machines: https://asml.com/en/news/stories/2023/6-ingredients-robust-supply-chain) to TSMC.

The export controls are also extra-territorial: foreign entities must obtain Chinese export licenses before re-exporting products manufactured abroad if they contain Chinese rare earth materials comprising 0.1% or more of the product’s value.

So China is effectively mirroring the US semiconductor export controls that were used against them, with its own comprehensive extraterritorial control regime, except with rare earths.

Naturally, the response of President Donald Trump was volcanic, and he quickly declared:

“It is impossible to believe that China would have taken such an action, but they have, and the rest is History.”

By late Friday the Journal reported that Trump had declared his plans to impose new, 100% tariffs on all Chinese trade goods, above and beyond the tariffs he had previously levied, along with sweeping new software export controls. These huge new tariff rates would amount to reestablishing a near embargo on Chinese imports so the result was a heavy selloff in the S&P 500, the worst since the president’s original tariff announcement in early April.

In recent weeks, trade relations between China and America had seemed to stabilize, so this sudden Chinese announcement might have seemed like a bolt from the blue. Only towards the bottom of the original article did the Journal writers explain that the new Chinese restrictions were in direct retaliation for similarly sweeping American export restrictions against Chinese technology companies imposed a dozen days earlier but given much less attention in our mainstream media outlets.

This merely continued the pattern of the last few years, with American economic sanctions suddenly imposed against China followed by waves of national outrage after the latter country responded with retaliatory measures.

For example, the Journal mentioned:

Vice Premier He Lifeng believed an informal “freeze” on new export controls had been agreed upon following recent talks in Madrid, according to people familiar with the discussions. But that understanding was shattered when the U.S. introduced new controls on foreign-owned companies.

According to the Journal, Chinese President Xi Jinping had grown weary of this endless game, and decided to hit back extremely hard, as indicated by the severity of the new retaliatory sanctions.

The Journal writers noted that earlier this year, American automakers warned that they would be forced to cease production in many of their factories if the supply of Chinese rare earth magnets were halted, stoppages as extreme as those caused by the Covid-19 outbreak, but that the current round of Chinese export restrictions could be even more severe.

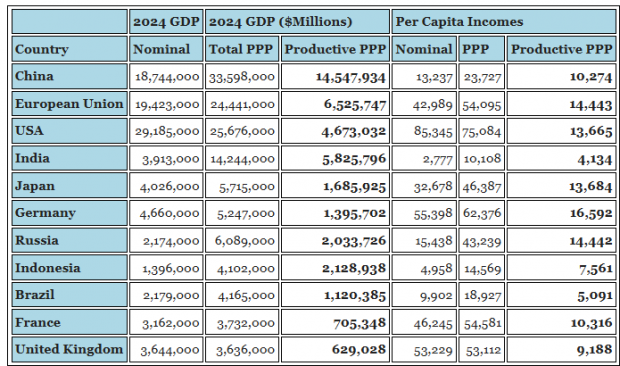

Last month I updated the standard international estimates of the economic power of the world’s major countries and blocs to incorporate the latest 2024 financial statistics. These figures merely confirmed that the Real Productive size of China’s economy—sometimes considered the most reliable measure of true international economic strength—was now considerably larger than that of the entire West, even augmented by our Japanese vassal state:

In that same article, I also emphasized how the latest round of Trump’s outrageous international demands and tariff policies had finally driven populous, fast-growing India into the opposing camp, further strengthening the unfavorable correlation of forces arrayed against America and perhaps emboldening China’s new retaliation against the antics of our President Trump and his sycophantic subordinates.

I think that these potentially momentous developments illustrate the extreme recklessness of the Trump Administration and the tremendous risks that a country faces if its economic and trade policies continue to be governed by the autocratic whim of a Mad Emperor rather than carefully hammered out in public legislation. As I wrote soon after Trump’s original April tariff announcements:

Across thousands of years, the world has seen many important countries ruled by absolute monarchs or all-powerful dictators, with some of these leaders even considered deranged. But I can’t recall any past example in which a major nation’s tax, tariff, or tribute policies have undergone such rapid and sudden changes, moving up and down by huge amounts apparently based upon personal whim. Certainly Caligula never did anything so peculiar, nor Louis XIV nor Genghis Khan nor anyone else who comes to mind. Lopping off the heads of a few random government officials was one thing, but drastic changes in national financial policies were generally taken much more seriously. I don’t think that Tamerlane ever suddenly raised the tribute he demanded from his terrified subjects by a factor of ten, then a few days later lowered it back down by a factor of two.

This potentially devastating Chinese economic response would be bad enough but it came just after some new information revealed the extreme fragility of the American economy.

An October 7th article in Fortune described the important economic calculations of Harvard’s James Furman, echoed by other experts. According to his estimates, if we excluded investment in data centers and other information processing technology, American GDP growth during the first half of 2025 was almost nil, only 0.1% on an annualized basis. Consider also that probably almost all of this data investment has been due to the ongoing AI and Crypto booms, and that these have probably provided other major contributions to GDP growth, as the Financial Times argued:

The hundreds of billions of dollars companies are investing in AI now account for an astonishing 40 per cent share of US GDP growth this year. And some analysts believe that estimate doesn’t fully capture the AI spend, so the real share could be even higher.

AI companies have accounted for 80 per cent of the gains in US stocks so far in 2025. That is helping to fund and drive US growth, as the AI-driven stock market draws in money from all over the world, and feeds a boom in consumer spending by the rich.

Since the wealthiest 10 per cent of the population own 85 per cent of US stocks, they enjoy the largest wealth effect when they go up. Little wonder then that the latest data shows America’s consumer economy rests largely on spending by the wealthy. The top 10 per cent of earners account for half of consumer spending, the highest share on record since the data begins.

But without all the excitement around AI, the US economy might be stalling out, given the multiple threats…

Foreigners poured a record $290bn into US stocks in the second quarter and now own about 30 per cent of the market — the highest share in post-second world war history. Europeans and Canadians have been boycotting American goods but continue buying US stocks in bulk — especially the tech giants…

What that suggests is that AI better deliver for the US, or its economy and markets will lose the one leg they are now standing on.

Taken together, these results suggest that except for the torrid pace of AI and Crypto investments, America might have already fallen into recession during the first half of this year, and there are very widespread concerns that our AI/Crypto economy constitutes a classic bubble, only one far larger than the dot-com bubble of a quarter-century ago.

Late last week, a lengthy post on the Naked Capitalism blog cited much of this evidence, quoting a critical analysis by Ed Zitron:

Thriving Beyond Fifty ...

Best Price: $12.32

Buy New $18.22

(as of 11:31 UTC - Details)

Thriving Beyond Fifty ...

Best Price: $12.32

Buy New $18.22

(as of 11:31 UTC - Details)

Where we sit today is a time of immense tension. Mark Zuckerberg says we’re in a bubble, Sam Altman says we’re in a bubble, Alibaba Chairman and billionaire Joe Tsai says we’re in a bubble, Apollo says we’re in a bubble, nobody is making money and nobody knows why they’re actually doing this anymore, just that they must do it immediately.

And they have yet to make the case that generative AI warranted any of these expenditures.

Indeed, according to one recent MIT study, 95% of the AI pilot projects at companies are currently failing.

Others have noted that although many past investment bubbles have collapsed, most of the investment value was eventually recovered, with the over-built railways of nineteenth century Britain later getting use and the same also being true for the huge quantities of fiber-optic cable laid in the late 1990s.

However, a large fraction of all the current AI investment is going into cutting-edge AI chips, and within just a few years these tend to be supplanted by newer generations of much more powerful chips, so their value rapidly declines. This suggests that if and when the bubble bursts, a major portion of that invested value will be permanently lost.

The following day another lengthy Naked Capitalism post by an academic argued that the strong Trump endorsement of Crypto-based “Stablecoins” and other related derivatives has probably been fueling the growth of a huge and uninsured new “Shadow Banking” sector whose volatility could easily produce a new crisis along the same lines of the sub prime financial crisis of the 2000s, adding a financial bubble to the one possibly inherent in current stock valuations.

Copyright © The Unz Review