The consensus holds there will be another bubble after the Everything Bubble pops, but this might be misplaced confidence in the godlike powers of central banks.

The consensus holds that central banks–the Federal Reserve in the US–will gradually inflate away the world’s rising debt burden while propping up assets and the economy with the usual bag of monetary magic: suppress interest rates so debt service costs ease, increase the money supply and credit to prop up asset bubbles in stocks and housing, and thereby generate growth in consumption via the elixir of “the wealth effect:” as assets loft higher, everyone feels richer and so they borrow and spend more.

Well, not everyone, because only the top 10% own enough assets to feel “the wealth effect,” but since they account for 50% of all consumer spending, that’s enough to maintain the status quo, in which the bottom 90% lose ground (especially the bottom 60%) and the top 10% are doing splendidly.

Cancer and the New Bio...

Best Price: $13.52

Buy New $18.07

(as of 03:15 UTC - Details)

Cancer and the New Bio...

Best Price: $13.52

Buy New $18.07

(as of 03:15 UTC - Details)

Should the bubble du jour pop, no worries, central banks will rush to the rescue as they have for 25 years, goosing money supply and credit, opening the floodgates of liquidity, pushing interest rates down so everyone and every entity can borrow and spend / speculate more, more, more.

This is a nice story, and proponents have the past 25 years of history to back it up. But beneath the surface appeal of this story–a Hollywood ending every time, as the Fed will inflate another bubble, one after the other in an endless loop–there are stirrings in the deep that suggest the Everything Bubble is the last bubble of its kind, and attempts to inflate another bubble when this one pops will collapse the entire rickety contraption.

In other words, everything is forever until it is no more. Let’s consider some points that speak to the nature of speculative bubbles.

1. Speculative bubbles don’t require central banks increasing money supply and manipulating interest rates. Recency bias leads us to imagine that central bank policies inflate and pop speculative bubbles via monetary levers, but the colossal South Seas Bubble in 1720 that popped with such devastating consequences arose and fell in the pre-central bank era. The madness of crowds–or more specifically, the greed-driven madness of greedy crowds is the core driver of speculative frenzies / bubbles.

2. Confidence is the foundation of speculative frenzies. Yes, confidence, as in a con. Back in 1720, the South Seas Company was supported by the establishment, and so confidence was high that it was a can’t lose proposition. The riches skimmed by early investors encouraged this confidence.

Today, confidence that the Fed will rush to the rescue should the Everything Bubble pop is high, as is the confidence that the AI Bubble isn’t a bubble because AI is going to change everything and that transformation will be immensely profitable–if not for the gold miners, then for those selling the miners picks and shovels.

3. Quasi-religious fervor, confidence, staggering gains and speculative frenzies all meld into one overflowing river, sweeping all before it. The primary force here is the belief that this isn’t irrational, or speculative–it’s all based on solid facts. That this was the exact same belief that powered bubbles in 1720, 1925-1929, 1998-2000 and 2004-2008 is brushed aside, for as we all know, this time it’s different. Of course it is, but perhaps not in the way that the consensus anticipates.

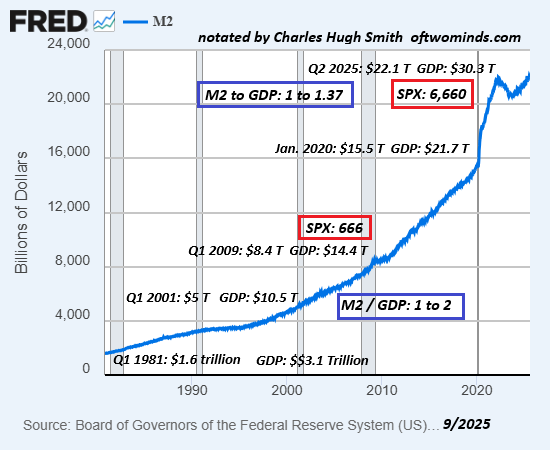

Just as a break from all the fun and games, let’s consider a chart of M2 money supply, generally conceded as the driver of stocks rising, and compare it to GDP–a measure of economic expansion–and the S&P 500 stock index (SPX).

It’s interesting to note the ratio of M2 and GDP. That money supply and economic expansion would rise together qualifies as common sense, but what makes this interesting is the slippage in the ratio.

For two decades, GDP was roughly double M2. In 1981, M2 was $1.6 trillion and GDP was $3.1 trillion. In 2001, M2 was $5 trillion and GDP was $10.5 trillion. So far so good.

The 5-Ingredient Cookb...

Best Price: $1.78

Buy New $8.50

(as of 07:31 UTC - Details)

The 5-Ingredient Cookb...

Best Price: $1.78

Buy New $8.50

(as of 07:31 UTC - Details)

In Q1 2009, at the bottom of the stock market crash / Global Financial Crisis, there was bit of slippage: M2 was $8.4 trillion and GDP was $14.4 trillion–no longer 1 to 2.

By the pre-Covid high watermark of Q1 2020, M2 was $15.5 trillion and GDP was $21.7 trillion. After the Covid crash and stimulus, here in Q2 2025 M2 is $22.1 trillion and GDP is $30.3 trillion– 1 to 1.37.

There’s a phrase that describes this: diminishing returns. Goosing money supply is no longer goosing GDP to the same degree it once did.

Meanwhile, back in Speculative Frenzy-Land, the SPX is up 10X, from the biblical low in Q1 2009 of 666 to today’s high of 6660 (well, 6656, but close enough).