The Donald seems to be continuing his bombing campaign, albeit this time by pivoting back to the home front and taking aim at “Too Late” Jay.

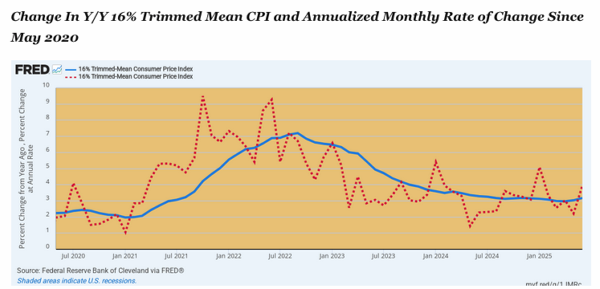

As usual, Trump has his facts all wrong about who has had how many rate cuts and that inflation has miraculously disappeared since January 20th. In fact, if anything, inflation has bottomed at an unsustainably high 3.0% level. Indeed, since March 2023, the annualized monthly change in our trusty 16% trimmed mean CPI has cycled between 2.5% and 4.0% with no indication that a return to the Fed-mandated 2.0% lane is imminent.

But at least this time the Donald is attacking the right target. The truth is, when it comes to verbal assault, you can’t drop enough bombs on the Fed or easily avoid the Donald’s bottom line conclusion: “We will be paying for his incompetence for many years to come”.

Unfortunately, the arrogant monetary mandarins who run the Fed are as unlikely to bend to the Donald’s verbal fusillades as the stiff-necked Netanyahu. Still, it is well worth pursuing the opening that the Donald’s latest missive provides.

How To Cut $2 Trillion...

Best Price: $4.31

Buy New $11.00

(as of 02:31 UTC - Details)

To be sure, he is not remotely correct in suggesting that the Fed should be pegging rates “two to three points” lower. Nor would its failure to push rates back toward the negative yield line in real terms amount to monetary malpractice per his echo chamber in the VP’s office.

How To Cut $2 Trillion...

Best Price: $4.31

Buy New $11.00

(as of 02:31 UTC - Details)

To be sure, he is not remotely correct in suggesting that the Fed should be pegging rates “two to three points” lower. Nor would its failure to push rates back toward the negative yield line in real terms amount to monetary malpractice per his echo chamber in the VP’s office.

Then again, JD Vance’s sheer ignorance on the economic policy front might well be explained by his misfortune of having taken economics courses at Yale:

“The president has been saying this for a while, but it’s even more clear: the refusal by the Fed to cut rates is monetary malpractice.”

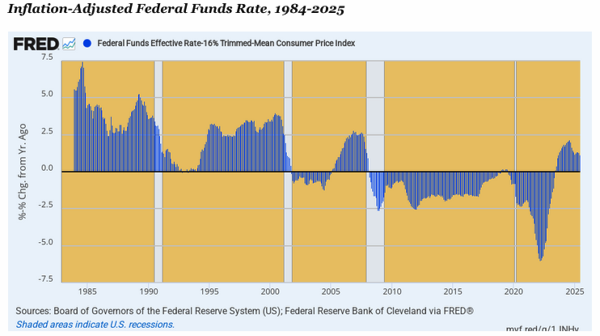

To the contrary, the real “malpractice” is the fact that the Fed drove rates down into the sub-basement of history, generating negative inflation-adjusted yields for most of the 25-year span since the turn of the century. Yet negative real rates are the devil’s workshop of economic distortion and malinvestment. They encourage excessive gambling on Wall Street via the carry trades and unhinged borrowing in Washington owing to the temporary, artificial suppression of the interest cost of the public debt.

And yet, after just a few quarters of real money market interest rates above the flatline, currently posting at just 1.2% after inflation, the Donald and JD are huffing and puffing for a 2-3% cut in nominal rates. Of course, that would push real yields back into negative territory, which most definitely will Make America Broke Again—not usher in the Donald’s ballyhooed Golden Age of Prosperity.

Besides, riddle us this JD: How in the world did we get the storied Reagan Boom in the 1980s and 1990s when real money market rates posted in the +2.5% to +5.0% range? That is to say, capitalist prosperity is absolutely not a function of dishonest, cheap money flowing from the printing press of the central bank.

The fact is, the Fed should not be pegging rates at all – up, down, or sideways. This whole business of pegging overnight rates and, by extension, the level and shape of the entire yield curve amounts to monetary central planning, not sound money policy. So in attacking the Fed’s rate-pegging errors, the Donald is at least getting the issue on the table of public debate.

But the Fed will always be in error in pegging rates based on the dubious wisdom of the 12 monetary central planners who sit on the FOMC. Monetary central planning via the frail tool of rate pegging just plain doesn’t work in an immensely complicated and opaque $30 trillion open economy that is deeply and inextricably intertwined with the capital, money, goods, and services markets of the world’s $110 trillion GDP. By definition, the leakage of global supplies and financial flows into the US economy and domestic demand and flows outward confounds any possible formula linking short-run inflation and employment to interest rates.

Yet the Fed never stops counting the number of economic angels sitting on the heads of its interest rate pins. It pretends to be astutely monitoring and assessing the “incoming data,” but in the short run, the official data is way too full of noise and error messages—volatile data points which subsequently get revised, often unrecognizably.

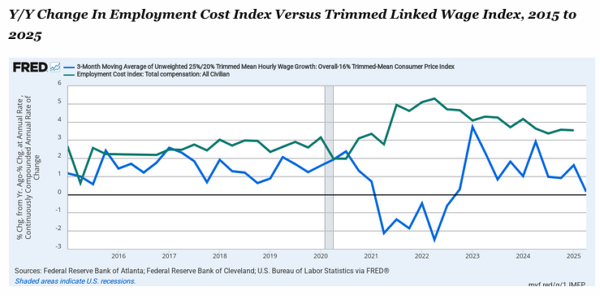

For instance, the Powell Fed claims to watch wage rate movement like a hawk, claiming the resulting cost pressure or lack thereof is a leading indicator of price movements. Well, here are two indicators of wage rate movement over the last 10 years.

The blue line is the three-month moving average of year-over-year changes in unweighted linked wages (i.e., same workers), but is smoothed to exclude each month the 25% highest wage changes in the basket and the lowest 20%. Moreover, this “trimmed” wage index excludes a different set of high and low wages each month, meaning that it embodies a reliable smoothing mechanism without arbitrarily excluding any sector of the wage market on a recurring basis, as does, for instance, the CPI ex food and energy. The other key feature of the index is that the wage basket is unweighted and includes the same set of wage payments month after month.

By contrast, the green line represents the BLS’s comprehensive wage cost metric, including both wage payments and all fringes and non-cash compensation such as employer health insurance plans or vacation and maternity leave pay. Also, this index is weighted by current activity levels in each measurement period or quarter.

Thus, if the low-wage food service industry were to be shut down, for instance, the employment cost index would lurch higher. But that would happen owing to reweighting of the measurement basket to higher pay sectors of the labor market, not due to any acceleration of wage rate growth on an apples-to-apples basis.

The graph below makes clear that these indices do not measure the same thing or emit the same signals in the short or even medium term. For instance, from 2015 to 2017, the year-over-year rate of change measured by the two wage indices was roughly similar, but the gap widened significantly to a 100 to 150 basis points difference in favor of the employment cost index from 2018 to 2020.

But during the turbulence of the pandemic lockdowns and stimmies from mid-2020 through 2022, the gap not only widened, but the two indices went in the opposite direction. The employment cost index (green line) soared upwards to 5.0% on a year-over-year basis, while the trimmed mean wage index plunged to a -2% rate of year-over-year change.

All things considered, the dramatic widening shown in the graph amounts to a live fire experiment in the foibles of monetary central planning. By order of Dr Fauci, upwards of 10 to 15 million low-wage workers were laid off in the spring and the balance of 2020, which caused the employment index to soar, but not because wage growth suddenly accelerated. The doubling of the green line rate of change during that period (from 2.5% to 5.0%) was simply an error message about the wage change rates that are embedded in the activity-weighted construction of the index.

By contrast, the trimmed mean linked wage index went down because, with unemployment rates in double digits due to the lockdowns, wage pressures sharply abated. Accordingly, actual same employee wage rates turned flat to negative during Q1 2021 to Q4 2022.

Needless to say, it is not obvious which wage change signal, if any, the monetary central planners in the Eccles Building should have been eyeballing. The employment index was overstating the rate of true wage change owing to mix change in the wage basket, while the trimmed, same-worker index was measuring distressed but transient labor market conditions, which evaporated quickly after the economy was firmly reopened in 2023.

To be sure, this lesson could be written off by the Fed’s fanboys as illustrative of an aberrant economic shock that is not typical of year-in and year-out conditions and trends. But we don’t think so because the very nature of a dynamic capitalist economy is that it is always in a state of flux and change.

Accordingly, the primitive price and wage indices churned out by government statistical bureaus are always rife with noise and error messages. There is simply no set of 12 macroeconomic geniuses who comprise the FOMC that can possibly keep the signal separated from the noise.

And even if they could, the purified knowledge would be of limited use to central bankers. That’s because their tool kits consist of primitive interest rate pegging and bond buying and selling tools that are so loosely linked to the blooming, buzzing mass of activity in the interior of the GDP as to be thoroughly unreliable and dangerous instruments of economic navigation.

Fortunately, there is an answer to the information deficiency and toolkit inefficiency problem of today’s Keynesian central bankers. Namely, the free market in interest rates, money, capital, and every other kind of financial instrument and derivative.

Stated differently, we don’t need a 12-man committee of Too Late Jays setting interest rates, nor do we need to replace them with an Always Easy Donald or any other elected politicians. In fact, nearly 100 out of 100 times the free market will find the right price for money, debt, and equity capital far more reliably and efficiently than either the Powells or Trumps of the world ever could.

Of course, central bankers and their fanboys on both ends of the Acela Corridor will insist that interest rates, US Treasury debt costs and stock market indices don’t dare be left to chance on the free market. But that self-serving claim is exactly why a free market in money and finance is the only viable way to get honest prices in financial markets, and thereby force government spenders and Wall Street speculators alike to face the true economic risks and costs of their activities.

Accordingly, there is one simple reform that would pave the way to honest financial markets. To wit, a return to the “bankers’ bank” model of the Fed’s founding father, Congressman Carter Glass. Crucially, the Glassian model had no macro-economic targets or remit, operated exclusively through a passive discount window and included no provision for the Fed to effectively create “new” central bank credit by buying government debt.

To the contrary, interest rates were to be set by free market forces in the member banking system, while Fed credit would be priced at this free market rate plus a penalty spread and offered only in return for the collateral of commercial receivables against goods already produced and sold.

The Triumph of Politic...

Best Price: $2.56

Buy New $15.99

(as of 05:55 UTC - Details)

The Triumph of Politic...

Best Price: $2.56

Buy New $15.99

(as of 05:55 UTC - Details)

Accordingly, Fed credit growth could not be “inflationary” because it was predicated upon liens on new goods already produced, thereby keeping demand in line with supply and essentially functioning under the truth of Say’s Law.

At the same time, the Glassian Fed was no friend of the Washington spenders because it had no remit to purchase government debt on the bias of fiat credits snatched from thin air. Similarly, it was no solace to the Wall Street gamblers, either: There was no possible “put” under stock prices, not artificial suppression of bond yields and cap rates, and therefore no artificial goosing of PE multiples.

In short, the Glassian Fed was perhaps needed by a fractional reserve banking system that was still regulated on the basis of required reserves. The entire regime of required reserves and central bank provision of such reserves was ended in March 2020 when reserve requirements were abolished and the regulatory structure was shifted fully to bank balance sheet regulation via required capital and liquidity ratios.

At the end of the day, the virtual disappearance of hand-to-hand currency in daily commerce means that “money” has become entirely a matter of digital ledger entries and a derivative of private credit. Accordingly, the American economy no longer needs a central bank to print “money” in either paper or digital form, as the case may be.

At the same time, a marketplace that can find ways to securitize the likes of credit card receivables and recorded music royalties doesn’t need central bank credit at all. The free market can both make the credit and price it based on the facts and circumstances of its issuance.

Given those realities, we can hope that the Donald’s verbal bombing of the Fed can also lead to a lasting truce under which Wall Street and the Washington spenders both give up their piggy banks in the Eccles Building. So doing, they would give the people of Main Street America once again the opportunity to pursue their own economic ends and betterments on a free market of honest money and credit where neither Too Late Jay nor Too Easy Donald has anything to do with it.

Reprinted with permission from David Stockman’s Contra Corner.