On May 21, Jersey City will vote on Ordinances 25-056 and 25-057, proposals to ban the use of algorithmic pricing software—tools that help landlords analyze market conditions to price their units accurately. According to critics, this software allows landlords to “maximize profit,” which they think creates an uncompetitive market. That argument misunderstands how markets work. Supply and demand is not price manipulation—it is the mechanism of free exchange.

Algorithmic pricing tools are now a fixture of modern commerce. Anyone who’s bought or sold a car has likely consulted Carvana or Kelley Blue Book, which uses supply and demand trends to gauge fair value. No one calls that price-fixing. Rental pricing tools function the same way—evaluating demand, neighborhood data, seasonal shifts, and inventory to provide landlords with a snapshot of market rates.

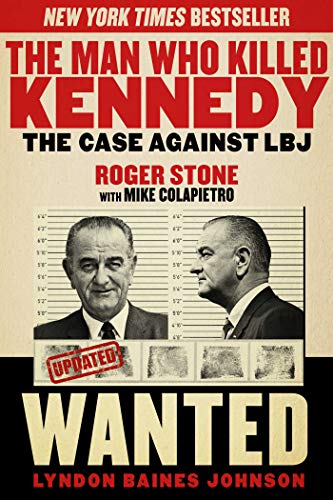

The Man Who Killed Ken...

Best Price: $4.24

Buy New $5.41

(as of 07:15 UTC - Details)

The Man Who Killed Ken...

Best Price: $4.24

Buy New $5.41

(as of 07:15 UTC - Details)

Yes, rents rose across Jersey City in recent years, but the cause wasn’t software. Housing shortages, supply chain disruptions, and trillions in federal stimulus all overheated demand, raising prices. New Jersey’s pandemic-era eviction bans made matters worse, as many small landlords went months—or years—without being paid, unable to recoup losses. Once restrictions lifted, landlords adjusted prices in response.

Other factors that pushed prices up included outdated zoning laws and a permitting process that’s notoriously opaque and slow. In Jersey City, layers of regulation also often block the very housing projects that would bring rents down. If the council wants lower rents, the answer isn’t banning software—it’s building more housing.

The market is already self-correcting. According to CoreLogic, “Single-family annual rent growth slowed in November to the lowest rate in about 14 years.” In Jersey City, some rents are already down 12 percent year-over-year. If pricing software were artificially inflating rents, why are they dropping?

The answer is simple: the software doesn’t set prices—it reflects them. It shows what the market can bear at a given time, based on actual data. As demand or inflation cools, rents adjust downward. That’s the invisible hand at work.

Landlords—especially smaller, independent ones—use this technology to make informed decisions. Without it, only the biggest firms will have access to sophisticated analysis, leaving mom-and-pop property owners flying blind. Ironically, banning these tools could lead to less transparency and more arbitrary pricing.

The Long Emergency: Su...

Best Price: $0.25

Buy New $2.99

(as of 05:35 UTC - Details)

The Long Emergency: Su...

Best Price: $0.25

Buy New $2.99

(as of 05:35 UTC - Details)

In a free society, the role of government is not to dictate prices but to remove barriers to entry and allow markets to function. That means clearing the path for new construction, reforming zoning, and fixing the permitting process—not punishing innovation.

In addition, the proposed ordinance does not obey Article I, Section I—Rights and Privileges–of the New Jersey Constitution, which states, “All persons are by nature free and independent, and have certain natural and unalienable rights, among which are those of enjoying and defending life and liberty, of acquiring, possessing, and protecting property, and of pursuing and obtaining safety and happiness (emphasis added). Elected officials therefore must not undermine landlords’ property rights with Ordinances 25-056 and 25-057.

Hopefully, the Jersey City council consults an economist—and a constitutional lawyer — before the May 21 vote. It’s their residents’ only hope for obtaining rational, data-driven housing and constitutional policies.

This article was originally published on JCityTimes.com and was reprinted with the author’s permission.