“We would like all quotations and invoices in USD if that’s no problem,” read the message from one of my biggest clients.

I stared at the screen for a moment. Indonesia officially mandated the use of the rupiah (IDR) for all domestic business transactions through Law No. 7 of 2011 on Currency, with its implementing regulation, Bank Indonesia Regulation No. 17/3/PBI/2015, which became effective on 1 July 2015. Laws in Indonesia don’t really take effect until the appropriate ministries issue regulations to enforce them.

At the time, everyone scrambled to change menus, websites, price lists, and so forth from US dollars (USD) to rupiah, particularly in Jakarta, Bali and Medan, which were hot spots for international business and visitors. Many people I know in middle and upper management were paid in dollars and banks allowed folks to have USD-denominated accounts. Not no mo’.

Grow or Die: The Good ...

Best Price: $3.75

Buy New $12.24

(as of 04:31 UTC - Details)

Grow or Die: The Good ...

Best Price: $3.75

Buy New $12.24

(as of 04:31 UTC - Details)

In 2011 (law), the rupiah was running about 8,700 to the dollar, and in 2015 (regulation), it was up to 13,000. Just this morning, it was 16,100.

The election of Joko (Jokowi) Widodo (2014-2024) represented a wave of nationalism and protectionism that swept the country. Not satisfied with being a major source of raw materials, agricultural products, and cheap labor for China (yes, China outsources), the new administration wanted Indonesia to become a manufacturing and shipping hub to the world.

And then came the regulations.

First, it was the oil and gas industry. For years, Indonesia was a member of OPEC+ and a net exporter of hydrocarbons. All the majors were here, busily drilling and pumping. Then the administration decided the majors should take all the risks of exploration and development, give the government a bigger slice of the pie, oh and any equipment they bring in automatically becomes property of the state. By the way, did we mention you can’t sell fuel here, as that would compete with the national oil company?

Needless to say, there was a giant sucking sound of foreign investment evacuating the country.

Then came the cabotage law. Indonesia demanded that all ships plying national waters or loading at national ports be Indonesian flagged. This meant that every ship that stopped in Indonesia had to reflag, or meet an Indonesian flagged vessel at an imaginary line in the middle of the ocean and swap cargo. You can probably guess that Indo flagging regulations chase potential customers to Vanuatu.

Cue the giant tidal wave of shipping interests paddling to the border.

Then the administration decided that all local oil had to be refined in Indonesia, which might have worked, except that the handful of refineries in the country keep blowing up, because no foreign entities want to do business here. So now the oil has to be shipped to Singapore, refined, and then repurchased at a higher price and brought back to Indonesia—presumably all on Indo-flagged vessels.

Cue the giant gurgling sound of empty gas tanks.

Then the administration decided it was time to nationalize all mining, and the raw materials had to be processed domestically before being exported. This included some of the largest gold, coal, tin and nickel operations in the world. The companies had already invested billions in regional smelters (not in Indonesia), and they weren’t about to build new ones just to create a few local jobs.

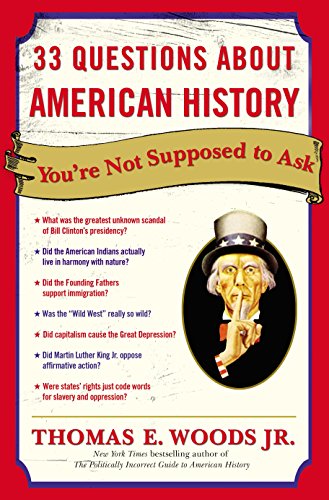

33 Questions About Ame...

Best Price: $2.91

Buy New $9.99

(as of 07:05 UTC - Details)

33 Questions About Ame...

Best Price: $2.91

Buy New $9.99

(as of 07:05 UTC - Details)

Cue the giant landslide of mining heading for the exits.

This went on and on, with industry after industry—palm oil, auto manufacturing, textiles. As the economy slowly tanked, the administration decided (thanks to EU NGOs) that the Big Problem was infrastructure. What the country needed was better roads, rail, and ports, so they launched a massive building campaign of toll roads, bridges, high-speed rail, and super ports without a cohesive vision for how all this was integrated, without a regulatory environment that encouraged foreign investment, and without the traffic to support it.

Aha! said the administration. No one is using all this nifty disjointed infrastructure because we need to be a world leader in making EV batteries, even though the one resource Indonesia does not have in abundance is lithium, not to mention the bottom falling out of the EV market because no one wants them.

Cue the giant self-oxidizing bonfire of the EV industry.