The CBO has just published a new version of Rosy Scenario, which is a wonder to behold. Its updated long-term budget projections presume that:

- There is no recession for the next ten years, although we have had one on average every six years since 1954;

- The Inflation Genie is stuffed back into the 2.0% bottle within two years, again with no recession in 2023-2024 to help it along;

- The weighted average cost of interest on the massive Federal debt never rises above 3.2% as far as the eye can see, albeit at this very moment all UST rates from 3-month bills to 30-year bonds are trading at yields above that level; and,

- For the piece de resistance, the revenue projections incorporate Donald Trump’s hidden $235 billion per annum “outyear” Federal tax increase, which is assumed to be fully implemented by 2027.

The first three of these are pretty standard head-in-the-sand fare of the kind that make CBO’s budget projections a running farce. But the massive Trump tax increase is in a class of budget chicanery all by itself.

To wit, the Trump/GOP tax cut was alleged to cost “only” $1.6 trillion over 10 years, but it was hideously front-loaded to mesh exactly with the Donald’s 2020 re-election campaign. Accordingly, the revenue loss peaked at $257 billion in FY 2020, which figure shrinks to just $20 billion in 2027.

That is to say, compared to the election year hall pass, individual income taxes will be $202 billion higher in 2027 and business levies will be $35 billion higher. That’s what happens, of course, when you craft a “tax cut” statute in which all the cuts are written in disappearing ink and expire after 2025.

What we actually have, of course, is another iteration of the 2012 “fiscal cliff”. Back then it was the Bush tax cuts which were set to expire, but election year politics made no never mind. Obama and his pro-little guy administration gladly signed a permanent extension into law, and that was that. The GOP sponsors of this politically devious “fiscal cliff” didn’t even need to draw much political blood.

So they did it again in 2017, whether the Donald got the joke or not. And in the 2024 general election campaign you can bet your bottom dollar that Sleepy Joe or his surrogate will pull an Obama and pledge to save the public from a massive tax increase—one that its GOP authors will be yelping in full war paint against.

In any event, the picture is self evident. The new CBO 10-year forecast is at least $5 trillion light on its red ink projections. In the case of interest rates alone, even a 3.9% average carry cost (versus the assumed 3.2%) would add $2.5 trillion to interest expense over the 10-year period.

That small rate difference results in a massive increase in debt service for a self-evident reason. Namely, the public debt has become so massive ($55 trillion by 2033) that the CBO baseline assumes $10.4 trillion of interest payments over the decade, even under Rosy Scenario’s benign interest assumptions.

On top of that add about 0.4% of GDP in lower revenues for what is sure to be the bipartisan removal of the Donald’s outyear fiscal cliff and you have another whopping big clot of red ink. That’s because the CBO assumes cumulative nominal GDP of $332 trillion over next ten years, meaning that the cost of removing the fiscal cliff (i.e. middle class tax increase) would total about $1.3 trillion through 2033.

There is also certain to be another recession sometime before 2033, if not actually in the year smack ahead, which would add another $700 billion, at minimum. As it is, CBOs Rosy Scenario assumes only $50 billion per year of unemployment insurance benefits, when the payout in 2009 was $130 billion and the 18-month payout during the pandemic totaled $800 billion. And that’s to say nothing of the double digit hit to Federal receipts which invariably accompanies a recession.

Beyond that there is at least another $500 billion of odds and ends that needs be added to the prospective red ink. Foremost among these is the deficit impact of assumed out-year spending cuts and tax loophole closings, which deficit-reducers are perennially kicked down the road at the 11th hour. And there is also the the tens of billions of pork which gets added to the defense and non-appropriations bill each year in order to get the votes to avoid a Christmas Eve government shutdown.

Here’s the thing. What’s material here is not merely the $5 trillion or more of red ink over the next decade that CBO has swept under the rug, but the $20.3 trillion that they have actually counted!

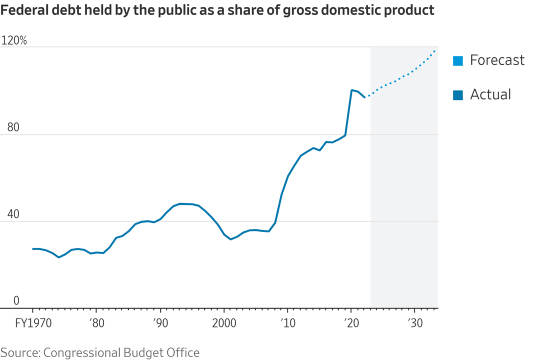

That’s right. Rosy scenario and all, CBO still came up with a record 10-year add-on to the public debt. And one that causes the public debt-to-GDP ratio to get dynamically worse over time, as depicted in the chart below.

Thus, from a current year deficit of $1.4 trillion and 4.6% of GDP, the CBO baseline projects a $1.9 trillion and 5.9% of GDP deficit by FY 2028 and $2.9 trillion and 7.3% of GDP deficit by 2033.

Then again, toss in the $5 trillion over the next decade they forgot to factor-in, and you have a round $4.0 trillion and 10% of GDP deficit by 2033. You also have the budget on a path that would lead to a 200% of GDP public debt ratio well before the year 2050.

That is to say, national fiscal bankruptcy is baked into the cake for all practical purposes. And yet here we are with the mainstream press harrumphing against a corporal’s guard of Republicans who refuse to vote for an increase in the current $31.4 trillion debt limit without attaching at least a token effort at spending cuts.

For want of doubt that the Federal budget has become the equivalent of a doomsday machine, just considered the progression of the 10-year deficit projections since the Donald stumbled into the Oval Office.

CBO’s 10-Year Deficit Projections:

- At Trump’s 2017 Inauguration: $10.0 trillion;

- At Biden’s Inauguration: $13.9 trillion;

- May 2022 CBO baseline: $15.7 trillion;

- February 2023 CBO baseline: $20.3 trillion;

- 2023 Baseline With Stuff CBO Forgot: $25.0 trillion.

Needless to say, there is not a snowball’s chance in the hot place that anything will be done about this fiscal hellscape under Washington’s current political arrangements. That is, a modus operandi where the Government Party (Dems) stoutly defends virtually every dime of Federal spending, while the so-called opposition Party (GOP) demands sweeping spending cuts, except for all the sacred cows it has lined-up in the Washington barnyard.

By now, of course, it’s a damn long line which includes the following items as per the attestation of GOP leaders in recent weeks, starting with Speaker McCarthy’s clear message that Social Security and Medicare are “off the table.”

And thanks to CBO’s latest report we now have up-dated 10- year estimates for the fiscal girth of every one of these favored bovines.

These start with Social Security, where spending will double, from $1.2 trillion in fiscal 2022 to almost $2.4 trillion in 2033. As a percentage of GDP, it will grow from 4.8 percent to 6 percent over that span, and the jump begins immediately, with a $123 billion increase in fiscal 2023, a 10 percent spike. That’s largely due to the huge 8.7% cost-of-living increase for Social Security beneficiaries that took effect last month.

Likewise, Medicare spending will more than double over the same span, from $710 billion in the last fiscal year to more than $1.6 trillion in 2033, when it will represent 4.1 percent of GDP.

So before we even get started on the longer list, the GOP has ring-fenced sacred cows which will consume 10% of GDP by 2033, and keep on rising from there.

Still, that’s not the half of it. It is also now clear, if there was ever any doubt, that when you add defense, interest, veterans programs, law enforcement and legally obligated Federal military and civilian pensions to the herd of GOP Sacred Cows, what’s left is a tiny corner of the Federal expenditure budget which is actually smaller than the projected deficits!

That’s right. In order to even partially eliminate the massive impending deficits you would need to cut nearly 100% of spending outside the sacred herd. This would include wiping out the national parks and forests, NASA, the National Institutes of Health, the National Science Foundation, water resources programs, farm subsidies, the highway programs, the air traffic control system, disaster relief, deposit insurance outlays, and even the Congressional budget, among many like and similar areas.

For want of doubt, here are the newly projected outlays for the GOP’s herd of sacred cows for the FY 2024-2033 period:

- Social Security: $18.4 trillion;

- Medicare: $14.8 trillion;

- Net Interest: $10.4 trillion;

- Defense: $9.8 trillion;

- Veterans pensions, comp and hospitals: $4.0 trillion;

- Federal retirement obligations: $2.4 trillion;

- Law Enforcement: $1.0 trillion;

- Total, GOP Sacred Cows: $61.3 trillion.

That’s some kind of herd!

It actually amounts to 77% of the $80.0 trillion of total Federal spending CBO has projected for the next ten-years. Or stated differently, there is only $19 trillion left outside the ring-fence, meaning that to make a difference in the $20-$25 trillion of projected deficits everything which moves and everything which stands still in the balance of the Federal budget would have to be slaughtered.

And that’s by the absurd budgetary math of the so-called fiscally conservative party.

Reprinted with permission from David Stockman’s Contra Corner.