The Fed is going to tighten an already tight labor market by making sure more of those workers who are already too-few in number are laid off in order to reduce production that was already lower this year than last year in order to lower prices that are too high because of production shortages.

If that makes sense to you, the Fed is your friend.

Where we’re going or where we are?

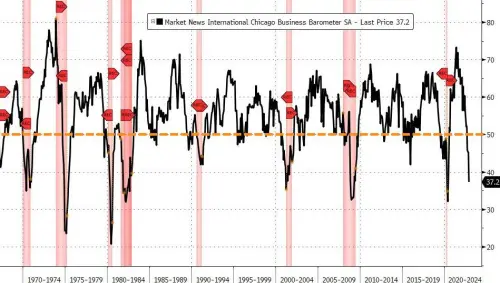

And, if you are a friend of the Fed, you will be among the many who believe we are not yet in a recession, even though the Chicago Purchasing Managers’ Index (PMI) has never been this low without ALREADY BEING IN a recession — often months into a recession:

OK, in the dot-com bust at the end of 2000 we were about a month shy of being in the declared recession when the PMI hit this level. But all other recessions were solidly in the red before this barometer hit this low level. However, I’ve been barking up this tree all year, and all I have to show for it so far is a mouthful of bark. So, go ahead and believe we’re not already in a recession, in spite of those two quarters of negative GDP earlier this year if you want.

And then you’ll be a friend of the Fed.

Before you do though, even Zero Hedge says this PMI level “screams recession“:

In 55 years, this level of Chicago PMI has never not failed to coincide with a recession.

I’m not sure what “never not failed” means, but I think what they really meant was “a reading this low has never failed to coincide with a recession.” Indeed, the graph shows the two always arrive hand-in-hand, but with recession leading the way, with the exception of that one time at the end of 2000 when recession slipped one shoulder in the door ahead of PMI. Not surprisingly, this recent reading was considerably lower than all twenty-five economists who were surveyed thought it would be. Economists rarely see a recession coming until it’s already half over.

Elon Musk says the Fed must cut rates ‘immediately’ to stop a massively amplified severe recession:

Trend is concerning. Fed needs to cut interest rates immediately. They are massively amplifying the probability of a severe recession.

— Elon Musk (@elonmusk) November 30, 2022

Recessions do tend to become amplified when you are rapidly raising interest rates after you are already in the recession. And I see Sven Henrich, whose work I always respect and oft’ quote, feels the same way I do about the track record of the Fed’s economists when it comes to seeing a recession (negative GDP growth) before it gets here. He even lays out the reason I’ve given for making my predictions — because I know the Fed will say, “No one could have seen this coming” (“unforeseen factors”), so I like to show in advance that the factors have been seen.

Even if you are friend to the Fed, the Fed is not your friend

The Fed took the governor off the economic engine and ran with the accelerator hammered to the floor through months of this “transitory inflation” as inflation’s momentum was building, and now YOU’RE paying the price for that reckless abandon of sense every day. Now they’re going to do the same thing with the brakes, hitting them hard and slamming the transmission into reverse right after running into the wall. When it comes to driving skills, these guys should never be allowed anywhere near a tricycle, let alone behind the steering wheel of a eighteen-wheeler.

Don’t worry, though, because the recession they already created will be as transitory as your life. And, while you might lose your livelihood, they will certainly keep theirs. They always do. No reason the perps should pay, nor the financial pervs who seem to thrive on your pain. It would be funny to watch the Fed try to stamp out the flames of inflation with their feet on fire, as they clearly are doing, if not for the fact that they’re wearing your best shoes. They stole the soles right off your feet because you pay for there mistake every day, and they openly plan to steal a lot more while you’re looking. These brazen bankster robbers even announce they’re coming. The don’t break in. They expect your government to leave the door open for them as it lets them run the economy that your existence depends on.

Next time you walk through the red-meat section of your grocery store, just close your eyes, turn three times, tap your ruby-red slippers and say, “It’s transitory; it’s transitory; it’s all transitory.” Those are the words that got us here; maybe they’ll get you out. Better are the odds, though, that, by the time you stop spinning and open your eyes, the prices will be higher still.

Dr. Jerome Powell, nevertheless, assures you you’ll only feel a pinch as he applies the cure and takes us into what he still says can be a soft landing. By which he means only some of you will have to sacrifice your livelihoods in the job crash that he says will not hurt as much as the pinch of rising inflation is sure to if he doesn’t apply the brakes hard enough to skid into the cliff-edged curve.

Powell’s soft landing promise is premised on the strong labor market that assures him the economy is strong and resilient, meaning it assures him those negative GDP numbers earlier this year were but the mirage of a distant desert you’ll never know and not the barren landscape of latter-day lockdowns, Covid and/or vaccine deaths and illness, supply chains first broken by trade wars then shattered into shrapnel by real war and then stomped into sand by sanctions.