Our paint by the numbers central bankers have given the notion of being literalistic a bad name. For years they pumped money like mad all the while insisting that the bogus “lowflation” numbers were making them do it. Now with the lagging measures of inflation north of 5% and the leading edge above 10%, they have insisted loudly that it’s all “transitory”.

Well, until today when Powell pulled a U-turn that would have made even Tricky Dick envious. That is, he simply declared “transitory” to be “inoperative”. Or in the context of the Watergate scandal of the time,

“This is the operative statement. The others are inoperative.” This 1973 announcement by Richard Nixon’s press secretary, Ron Ziegler, effectively admitted to the mendacity of all previous statements issued by the White House on the Watergate scandal.

Still, we won’t believe the Fed heads have given up their lying ways until we see the whites of their eyes. What Powell actually said is they might move forward their taper end from June by a few month, implying that interest rates might then be let up off the mat thereafter.

But in the meanwhile, there is at least six month for the Fed to come up with excuses to keep on pumping money at insane rates still longer, while defaulting to one of the stupidest rationalizations for inflation to ever come down the Keynesian pike: Namely, that since the American economy was purportedly harmed badly, and presumably consumers too, with the lowflation between 2012 and 2019, current elevated readings are perforce a “catch-up” boon. That is, more inflation is good for one and all out there on the highways and byways of main street America!

You literally can’t make up such rank humbug. Even then, what the hell are they talking about?

The shortest inflation measuring stick in town is the Fed’s (naturally) preferred PCE deflator, but here it is since the year 2000. The 21 years gain is 1.93% per annum; and the 9-year gain since inflation targeting became official in January 2012 is 1.73%. Given that the PCE deflator is not a true fixed basket inflation index and that these reading are close enough to target for government work anyway, even the “catch-up” canard fails. That’s especially true because given the virtual certainty of another year or two of 4-6% CPI inflation, even the cumulative measures of inflation will register well above the Fed’s sacrosanct 2.00% target.

Moreover, importantly, pray tell what did this really accomplish for the main street economy?

On the one hand, savers and fixed income retirees have seen their purchasing power drop by 39% since 2000 and 18% since 2012. At the same time, wage workers in the tradable goods and services sectors got modest wage gains with uniformly bad spill-over effects. To wit, millions lost their jobs to China, India and Mexico etc. because their nominal wages were no longer competitive in the global supply base, while those that hung on to their domestic jobs often lost purchasing ground to domestic inflation.

Consequently, the chart below is an unequivocal bad. It is the smoking gun that proves the Fed’s pro-inflation policies and idiotic 2.00% target is wreaking havoc on the main street economy and middle class living standards.

Loss of Consumer Purchasing Power, 2000-2021

In short, the group-think intoxicated Fed heads, and their Wall Street and Washington acolytes, are hair-splitting inherently unreliable and misleading numbers as if the BLS inflation data was handed down on stone tablets from financial heaven itself. At the same time, the rampant speculative manias in the financial markets that their oceans of liquidity have actually generated is assiduously ignored or denied.

We call this a tale of two inflations because the disaster of today’s rampant financial asset bubbles is rooted in pro-inflation monetary policies which are belied by both theoretical and empirical realities, which we address below.

First, however, consider still another aspect of the inflationary asset bubble which is utterly ignored by the Fed. In this case, the group think scribes of the Wall Street Journal inadvertently hit the nail on the head, albeit without the slightest recognition of the financial metastasis they have exposed.

We are referring to a recent piece heralding that private-equity firms have announced a record $944.4 billion worth of buyouts in the U.S. so far this year. That 250% of last year’s volume and more than double that of the previous peak in 2007, according to Dealogic.

As the WSJ further observed,

Driving the urge to go big are the billions of dollars flowing into private-equity coffers as institutions such as pension funds seek higher returns in an era of low interest rates. Buyout firms have raised $314.8 billion in capital to invest in North America so far in 2021, pushing available cash earmarked for the region to a record $755.6 billion, according to data from Preqin.

As the end of the year approaches, big buyouts are coming fast and furious. A week ago , private-equity firms Bain Capital and Hellman & Friedman LLC agreed to buy healthcare-technology company Athenahealth Inc. for $17 billion including debt. A week earlier, KKR and Global Infrastructure Partners LLC said they would buy data-center operator CyrusOne Inc. for nearly $12 billion. And the week before that, Advent International Corp. and Permira signed an $11.8 billion deal for cybersecurity-software firm McAfee Corp.

The recent string of big LBOs followed the $30 billion-plus deal for medical-supply company Medline Industries Inc. that H&F, Blackstone Inc. and Carlyle struck in June in the largest buyout since the 2007-08 financial crisis.

Needless to say, these LBOs were not done on the cheap, as was the case, oh, 40 years ago. In the case of AthenaHealth, in fact, you have a typical instance of over-the-top “sloppy seconds”. That is, it was taken private by Veritas Capital and Elliott Management three years ago at a fulsome price of $5.7 billion, which is now being topped way up by Bain Capital and Hellman & Friedman LLC in the form of an LBO of an LBO.

According to Fitch, AthenaHealth had EBITDA of about $800 million in 2020, which was offset by about $200 million of CapEx or more. That means that at the $17 billion deal value (total enterprise value or TEV), the transaction was being priced at 28X free cash flow to TEV.

That’s insane under any circumstances, but when more than half of the purchase price consists of junk debt ($10 billion out of $17 billion), it’s flat out absurd. The reason it is happening is the Fed’s massive financial market distortion: Bain Capital and Hellman & Friedman are so flush with capital that it is burning a hole in their pocket, while the junk debt is notionally so “cheap” that it makes a Hail Mary plausible.

But here’s the thing. This is a generic case: the Fed’s radical low interest rate policy is systematically driving the allocation of capital to less and less productive uses. And clearly private equity sponsored LBOs are the poster boy, owing to the inherent double whammy of misallocation described by the WSJ above.

On the one hand, capital that should be going to corporate blue chip bonds is ending up on the margin in private equity pools as pension funds, insurance companies and other asset managers struggle to boost returns toward exaggerated benchmarks inherent in their liabilities.

At the same time, private equity operators are engaged primarily in the systematic swap of equity for debt in LBO capital structures, such debt taking the form of soaring amounts of junk bonds and loans.

The higher coupons on junk debt, in turn, attract more misallocation of capital in the debt markets, while at the same time grinding down the productivity and efficiency of the LBO issuers. That because the hidden truth of LBOs is that on the margin they are nothing more than a financial engineering device that strip-mines cash flows that would ordinarily go into CapEx, R&D, workforce training, marketing, customer development and operational efficiency investments and reallocates these flows to interest payments on onerous levels of the junk debt, instead.

That’s the essence of private equity. The underlying false proposition is that 29-year old spreadsheet jockeys at private equity shops tweaking budgets downward for all of these “reinvestment” items – whether on the CapEx or OpEx side of the ledger – know more about these matters than the industry lifetime veterans who typically man either public companies, divested divisions or pre-buyout private companies – before they are treated to the alleged magic of being “LBO’d.”

In fact, there is no magic to it, notwithstanding that some LBO’s generate fulsome returns to their private equity owners. But more often than not that’s a function of:

- Short-term EBITDA gains that are hiding severe underling competitive erosion owing to systematic under-investment;

The steady rise of market PE multiples fueled by Fed policies, which policies have drastically inflated LBO “exit” values in the SPAC and IPO markets. - So at the end of the day, the Fed’s egregious money-pumping is fueling a massively bloated LBO/junk bond complex that is systematically curtailing productive main street investment and therefore longer-term productivity and economic growth.

And, of course, the proceeds of buyouts and junk bonds end up inflating the risk assets, which are mostly held at the tippy top of the economic ladder. And that’s a condition which has gotten far worse since the onset of Greenspanian “wealth effects” policy in the late 1980s. As shown below, between Q4 1989 and Q2 2021:

- Top 1%: Share of financial assets rose from 21.0% to 29.2%;

- Bottom 50%: Share of financial assets fell from 7.2% to 5.6%

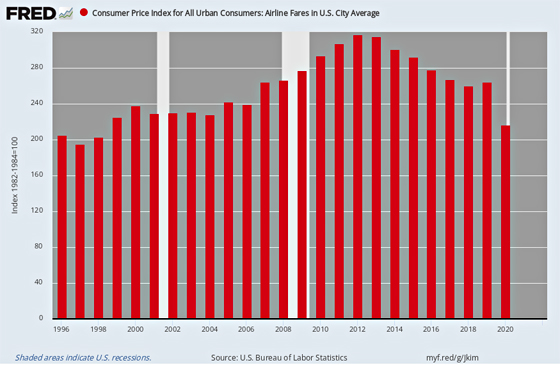

Meanwhile, the good folks are WSJ saw fit to provide a parallel analysis that further knocks the Fed’s lowflation thesis into a cocked hat. In this case, the authors looked at the average domestic airline ticket price and found that it is about the same today as 25 years ago, $260 today versus $284 in 1996.

And that’s before adjusting for cost inflation. So the question recurs: How is it possible that the airline industry hasn’t increased ticket prices in over two decades while its fuel and labor costs, among others, have been marching steadily higher?

As the WSJ noted,

It isn’t possible really. Most of us are paying a lot more to fly today, thanks to a combination of three covert price increases. First, airlines have unbundled services so that fliers pay extra for checking luggage, boarding early, selecting a seat, having a meal and so on. The charges for these services don’t show up on the ticket price, but they are substantial. Second, the airplane seat’s quality, as measured by its pitch, width, seat material and heft, has declined considerably, meaning customers are getting far less value for the ticket price. And third, many airlines have steadily eroded the value of frequent-flier miles, increasing costs for today’s heavy fliers relative to those in 1996.

Now, did the hedonics mavens at the BLS capture all these negative quality adjustment in airline ticket prices?

They most decidedly did not. As shown below, the BLS says ticket prices have only risen by 5.6% during the same 24 year period or 0.23% per annum. But you wonder with jet fuel costs up by 294% during that period and airline wages higher by 75% – why aren’t they all bankrupt and liquidated?

The answer, of course, is that the BLS numbers are a bunch of tommy rot. Adjusted for all the qualitative factors listed above, airline tickets are up by a hell of a lot more than 0.23% per year. Yet the fools in the Eccles Building keep pumping pro-inflation money – so that the private equity game of scalping main street cash flows thrives and middle class living standards continue to fall.

CPI for Airline Fares, 1996-2021

Moreover, the backdoor prices increase embedded in airline fares are not unique. These practices are also common in other industries, whether it’s resort fees in hotels, cheaper raw materials in garments and appliances, or more-stringent restaurant and credit-card rewards programs. As the WSJ further queried,

Consider the following comparison: Which one is cheaper, a 64-ounce container of mayonnaise at a warehouse club that costs $7.99, or a 48-ounce bottle of the same brand at a supermarket for $5.94?

Most people will guess the warehouse club because of its low-price image. If you do the math, the price per ounce is roughly the same. But if you consider that the warehouse club requires a separate mandatory membership fee, the customer is actually paying more per ounce at the warehouse club.

Known as two-part pricing, the membership fee camouflages the actual price paid by customers – and is behind the success of Costco, Amazon and likely your neighborhood gym. (A gym’s initiation fee, a landlord’s application or administrative fee, and an online ticket seller’s per-transaction processing fee all serve the same purpose.)

Yet this is just a tiny sampling of the complexity of providing apples-to-apples pricing trends at the item level over time – to saying nothing of proper weighting of all the items that go into the index market basket.

The implication is crystal clear. As per Powell’s belated recant on the “transitory” matter, the Fed doesn’t know where true inflation has been or have the slightest idea of where it is going.

So the idea of inflation targeting against an arbitrary basket of goods and services embodied in the PCE deflator, much of which consists of “imputations” and wildly arbitrary hedonic adjustments, is just plan nuts.

They only “inflation” measure that is in the proper remit of the Fed is monetary inflation – something at least crudely measured by its own balance sheet.

On that score the Fed is a infernal inflation machine like no other.

And for want of doubt that the resulting massive asset inflation and rampant financial engineering on Wall Street that flows from Fed policies is wreaking havoc on the main street economy, note this insight from the always perceptive Bill Cohan:

AT&T bought TimeWarner for a total of $108 billion, including debt assumed, and three years later agreed to spin it off it to Discovery for – what? – $43 billion in stock, cash and assumed debt. By my calculation, that’s a $65 billion destruction of value in three years. That’s not easy to do.

He got that right. At the end of the day these massive accounting write-offs are just a proxy for the underlying economic destruction.

As we said, a tale of two inflations. And neither of them imply anything good.

PEAK TRUMP, IMPENDING CRISES, ESSENTIAL INFO & ACTION

Reprinted with permission from David Stockman’s Contra Corner.