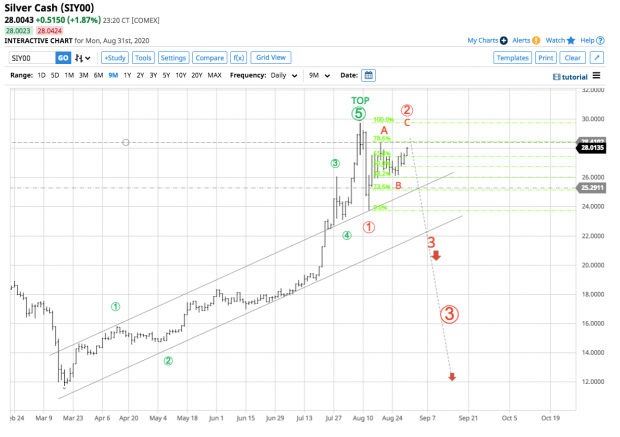

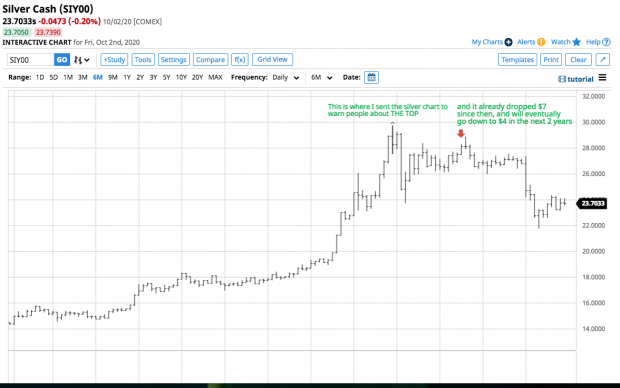

The two charts below, at bottom, are disturbing. They show the market price of silver on August 31, 2020 and Oct. 1, 2020. There has been a decline in the market price of silver. The top chart also shows an even steeper predictive future decline in the value of silver, from $28/oz. to $12/oz.

Here is what is not being said about silver.

It is out in the open now that bankers have been manipulating gold and silver prices. Suddenly, we read news headlines about JP MORGAN has paid an unprecedented $920 million fine for precious metals manipulation. The fraud involved the practice of spoofing, placing an order for gold or silver, then withdrawing it before it was completed. Deutsche Bank traders were also fingered for manipulation of gold and silver prices. The Bank of Nova Scotia has also agreed to pay a fine to settle charges of metals market manipulation.

This may mean regulators are not going to tolerate precious metal manipulation any longer. There must be some hidden impetus behind these punitive rulings.

The Big Silver Short: ...

Buy New $20.65

(as of 04:57 UTC - Details)

The Big Silver Short: ...

Buy New $20.65

(as of 04:57 UTC - Details)

These revelations of manipulation of precious metals prices suggest a lid is about to come off of gold and silver and allowed to find true price discovery in the marketplace.

For unknown reasons, the World Gold Council website doesn’t address the problem of price manipulation. But it has long been suspected.

The primary reason why gold and silver prices have been manipulated is that central bankers cannot have investors running to support gold and silver ahead of fiat paper money. Any asset-backed currency, be it by gold, silver or some other durable, portable, divisible, acceptable and uniform asset, would be in demand ahead of unbacked paper money.

Any threat that a foreign country would introduce a gold-backed currency gets a couple of US aircraft carriers of its coastline. That action would be destructive to the US fiat dollar which serves as the world’s reserve currency.

Economist Martin Armstrong teaches that as the value of the US dollar declines, gold and silver rise. But these are not normal times. A monkey wrench is being thrown into world fiat currencies.

We actually have a game-changing event that is not a surprise event, but rather a stated threat from the European-based World Economic Forum – – to coerce world populations into acceptance of a global digital currency, which globalists intend to usher into use by January of 2021 in what it calls the GLOBAL RESET.

This is not a black swan anomaly, it is a planned overthrow of all governments – no sovereignty, no borders, no history, no religion, no racism are their mottos. The International Monetary Fund and The World Bank in league with the World Economic Forum. They will predictably prohibit paper money and get the masses to demand a global digital currency.

Rigged: Exposing the L...

Best Price: $15.32

Buy New $14.96

(as of 05:13 UTC - Details)

Rigged: Exposing the L...

Best Price: $15.32

Buy New $14.96

(as of 05:13 UTC - Details)

We already see paper money being shunned by retailers as a carrier of the COVID-19 coronavirus and a request for the public to turn their piggy banks with coins into banks because of a contrived shortage of coins. I hope you are not missing the meaning of this. Let it be said that an abandonment of US currency and coins is already underway. This is not an imagined event or conspiracy theory.

What is anticipated is a conjured-up report that paper money is a major source of transmission of the COVID-19 coronavirus. Then suddenly US paper money in circulation, about $1.95 trillion of it, is suddenly kaka.

The US Treasury Department is talking about introduction of a digital currency of its own. The Federal government has incentive to convert from paper to digital money. It will collect an additional $500 billion in taxes and it will save $700 million a year printing replacement dollar bills. And of course, there would be no bank robberies as all money would be digital.

With the masses begging for digital money to replace paper money, people who hold US paper money would likely be informed they have till a certain date to return their money to the bank in exchange for the digital money. Maybe Americans will get 80-cents on the dollar, which is the average value of currencies in the currency exchanges.

The masses who use cash will be hit hardest by this. The unbanked, barbers, taxi drivers, hot dog street vendors, who largely accept cash as payment for their goods and services and often don’t report their income earned from cash, will be hit the hardest by this currency crisis.

The Last Gold Rushu202...

Buy New $28.00

(as of 04:04 UTC - Details)

The Last Gold Rushu202...

Buy New $28.00

(as of 04:04 UTC - Details)

Meanwhile, withdrawal of US currency will buoy US bank reserves by $1.95 trillion.

Economist Peter Schiff says there is no way now to get your money out of the banking system. You have to buy something. That would be silver. US-minted silver eagles. Gold is a storage of wealth. Silver is for survival.

I believe there may be staged shortages of food and other commodities.

Forget about the market price of silver. I’m talking about silver being used to buy food and essentials. If I go to an egg ranch and offer a silver dollar for $50 of eggs, and I negotiate that price, the value of the silver dollar in that instance is $50.

I don’t expect to go to a chain grocery store and get anything more than face value ($5) for a silver dollar. But I can go to farms, and with nobody having any money, and farmers crops facing spoilage, farmers would bargain food in exchange for silver with me. Otherwise, with no paper money, and maybe nobody having any credit left on their credit cards, there is no money to buy anything. Forget about schemes to re-sell silver “in the market.” Market price is one thing, survival is another. The silver charts are meaningless in a world where there is no paper money, and restricted or no credit. Silver would then be a lifeline.