Even if the Fed hadn’t institutionalized perverse incentives to borrow and speculate in asset bubbles, the economy would still be generating far fewer winners than losers.

If we scrape away the shuck and jive (a difficult task when the majority of what the media presents is shuck and jive) the whole economy boils down to who reaps the gains and who eats the losses. While conventional economics focuses on how much the pie is expanding (GDP is higher, yea!), the real action is in how the pie is sliced up and distributed.

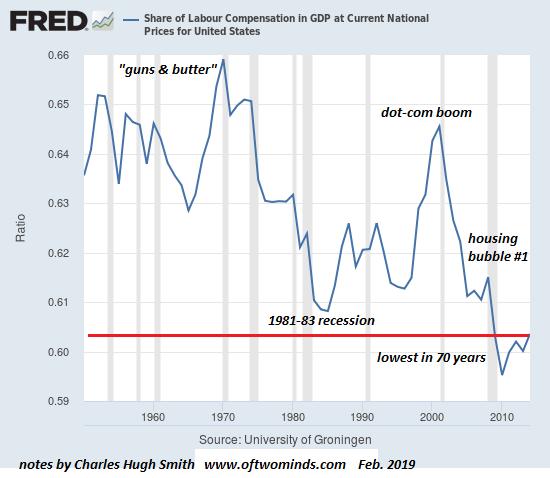

Since the end of the dot-com boom (see chart below), which actually increased labor’s share of the gains, the gains have all flowed to those holding assets that have bubbled higher while the losses have been distributed to 95% of those selling their labor for wages, and to everyone exposed to high inflation in big-ticket expenses such as healthcare insurance, rent and college tuition.

Get a Job, Build a Rea...

Buy New $6.95

(as of 04:50 UTC - Details)

The central bank shenanigans that exacerbated this remarkably unequal distribution were sold as promoting “the wealth effect”: as assets bubbled higher, the lucky recipients of this unearned wealth would feel richer and would then start borrowing and spending freely, propping up a sickly economy which was no longer expanding organically.

Get a Job, Build a Rea...

Buy New $6.95

(as of 04:50 UTC - Details)

The central bank shenanigans that exacerbated this remarkably unequal distribution were sold as promoting “the wealth effect”: as assets bubbled higher, the lucky recipients of this unearned wealth would feel richer and would then start borrowing and spending freely, propping up a sickly economy which was no longer expanding organically.

But since only the top 5% of households own enough assets to matter, this amounted to a stealth “trickle down” policy in which the top slice of asset owners would be so enriched they would spend more, and this spending would trickle down to the bottom 95%.

As this chart shows, the spending of the top 5% has far outpaced the spending of the bottom 95%, but as the chart of labor’s share of the economy reveals, very little has trickled down.

Not much trickled down. The Mercedes salesperson got a commission and the bistros and bars are crowded with free-spending top-5ers and wannabes living on debt, but this trickle hasn’t been enough to push wages higher.

Meanwhile the neofeudal structure of the American economy– an economy dominated by state-cartels that enforce monopolistic rentier skims on vast swaths of the economy (healthcare, higher education, national defense, etc.)– guarantees prices rise while wages stagnate. Many of us have addressed the reality that official inflation (Consumer price Index) doesn’t accurately reflect real-world price increases, especially in big-ticket expenses such as healthcare, higher education, housing/rent, vehicles, services, etc.

Also missing in the statistics is the enormous difference between those protected from real-world price increases via government employment or subsidies, and those fully exposed to the unrelenting leaps in costs the unprotected.