These three dynamics render capital increasingly vulnerable to catastrophic losses as backstops and distorted markets fail.

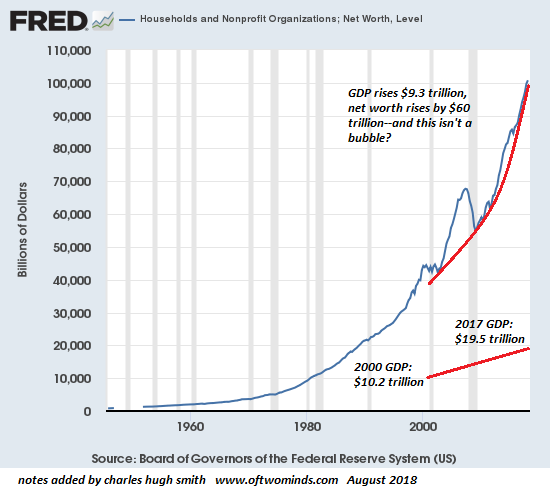

The undeniable reality of the 21st century economy is that capital has gained while labor has stagnated. While various critics quibbled about his methodology, Thomas Piketty’s core finding–that capital expanded faster than GDP and wages/salaries (i.e. earned income from labor)–is visible in these charts.

Real wages have gone nowhere for decades. Only the top 5% of wage earners have outpaced inflation’s erosion of the purchasing power of their earnings.

Household net worth has soared $60 trillion while GDP expanded by $9 trillion. Compare the relative growth trajectories of the economy and net worth of assets. Clearly, capital has expanded at rates far above the expansion rate of the economy.

Assets (capital) have exploded higher while real-world inflation (including wages) has remained in line with GDP growth: modest at best.

Check Amazon for Pricing.

Check Amazon for Pricing.

Get a Job, Build a Rea...

Buy New $6.95

(as of 04:50 UTC - Details)

Get a Job, Build a Rea...

Buy New $6.95

(as of 04:50 UTC - Details)

Amazon.com Gift Card i...

Buy New $15.00

(as of 03:50 UTC - Details)

Amazon.com Gift Card i...

Buy New $15.00

(as of 03:50 UTC - Details)