The coming hyperinflation will start slowly and few people will realise what is coming. But once the first real inflation signals are appearing, the process will speed up fast as the currency debasement accelerates.

Right now we are most probably seeing the first signs of inflation. The rising CRB index, together with rising oil, silver and interest rates are all telling us that inflation is coming. Initially, we will see a gradual increase but soon inflation will accelerate until we in the next few years reach hyperinflation.

HYPERINFLATION IS A CURRENCY EVENT

Of course, nobody sees hyperinflation as a credible outcome of todays’s low growth environment. But hyperinflation is a currency event and it will come as a result of all major currencies finishing the move that started with the creation of the Fed in 1913. Since then, all currencies have fallen 97-99% in real terms. So there is only 1-3% to go to reach zero. But the problem is that they won’t just fall 1-3% but 100% from today. This will be achieved by massive money printing in an attempt to save a debt infested global economy.

The New Case for Gold

Best Price: $0.25

Buy New $6.99

(as of 11:36 UTC - Details)

The New Case for Gold

Best Price: $0.25

Buy New $6.99

(as of 11:36 UTC - Details)

So why will central banks now succeed with creating inflation when they have failed for so long? They have for some time used their two major tools to create inflation by printing money and lowering interest rates to zero or negative. But why do they want inflation since it destroys the value of money? For example, an inflation rate of average 3% halves the value of money in 24 years. What is desirable about that?

The simple answer is that inflationary growth creates the impression of real growth. Inflation gives the illusion that people are better off whilst it instead makes them poorer and destroys the value of their savings.

WHY LOW INFLATION DESPITE MASSIVE QE

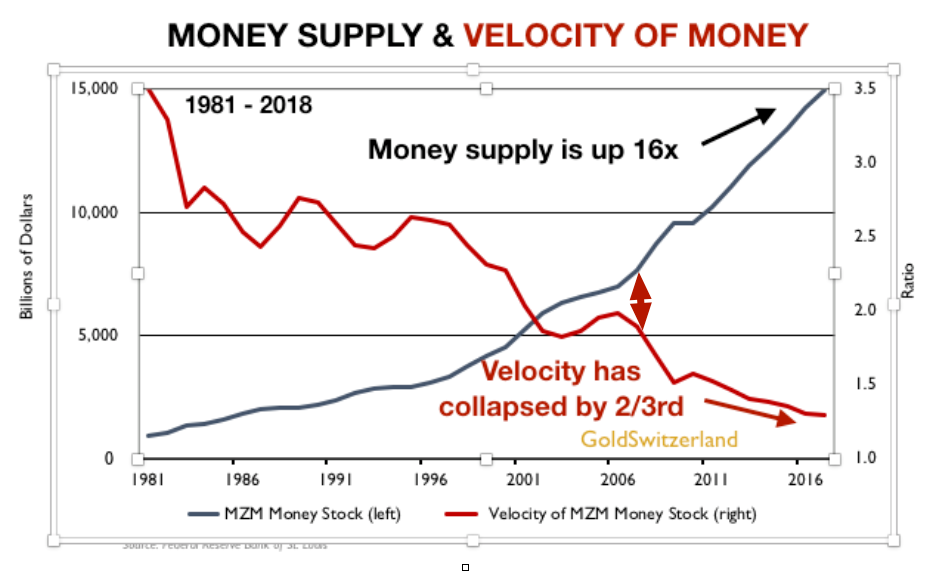

So in spite of unlimited money printing and credit creation, governments around the world have failed to create their desired growth by inflation. The reason for this is that the velocity of money has declined to the lowest levels for over 60 years. As the graph shows, money supply is up 16x from $0.9 trillion to $15 trillion since 1981. At the same time the velocity of money has declined by almost 2/3rd.

The more money that is printed, the less it is used. As the chart shows, money printing has gone exponential from 2006 whilst velocity has crashed. This is really a paradox and a new phenomenon. There are some simple explanations. Firstly, the printed money is not reaching the people. The banks have not been lending the printed money as they were more interested in shoring up their weak balance sheets. So where has all this printed money gone? The banks have used it for their own trading. It has also gone to the benefit of the top 1% or less who have invested in stocks, bonds and property. In these asset classes we have seen massive inflation fuelled by cheap money and unlimited credit. But those figures don’t show up in the official inflation numbers or the velocity ratio.

Another reason why velocity and inflation are not going up is that the world is now over borrowed and ordinary people have so much debt that they can’t take on any more. We have reached debt saturation and the printed money is not creating growth. And why should it?

EVER MORE DEBT TO GENERATE GDP GROWTH

If printed money would create wealth, we could all stop working and just print more. As the graph shows, since 1971 total US debt has gone up 47x from $1.5 trillion to $70t whilst GDP has gone up only 19x.

Thus in the last 48 years it has taken $2.50 to create $1 of GDP. And since 2006, it is around $5 debt for $1 of GDP. This means that the US is running on empty. The country can’t even grow by printing money. How can the US then grow now when QE stops and QT (tightening) starts combined with higher rates? The simple answer is that it can’t. The US economy will come to an abrupt halt very soon and go into a massive reversal in the coming years.