2018 is starting right on cue. Inflationary pressures have been latent for quite some time but have recently shown the world what is to come in the next few years.

How could anyone believe the propaganda that there is no inflation. It has of course suited the market manipulators. But the fake wizardry of the central bankers is now about to be revealed. Since the early 1980s the interest rate cycle were in a strong down trend. When the financial crisis started in 2007, central banks panicked and rates were rapidly lowered around the globe.

US short term rates went from 5% in 2007 to zero in 2008 and stayed at that level until late 2015. In many countries rates were lowered to negative like in Japan, the Euro area, Switzerland, Sweden etc. Low or negative interest rates defy all economic principles and distort the equilibrium of a normal market economy. They discourage savings and without savings there can be no sound investments. Instead, investments have been made with printed or borrowed money. Due to the low cost of money many high risk projects have been undertaken.

Low or negative interest rates also lead to irresponsible deficit spending by governments. This is why global debt has gone from $120 trillion in 2006 to $240 trillion today.

Explosion in money supply will lead to inflation explosion

Normally this explosion of money would have created very high inflation or hyperinflation. But since virtually none of the fabricated money went to the normal economy, published inflation has been non-existent. Anyone buying food, or paying bills of course knows that official inflation is a fiction of governments’ imagination. And although the official figures show no inflation, there has been an explosion in asset prices. Stocks, bonds and property have all soared. US stock markets for example are up 4 times since 2009.

These assets bubbles do not benefit normal people. They take away valuable investment into the real economy to the benefit of the top 1-5%. This is a very dangerous trend that eventually will lead to social unrest or revolution.

But we have now reached a stage when the explosion in money supply will have a major influence on the real economy. The inevitable consequences of the totally irresponsible mismanagement of the economy that I have been forecasting for quite some time are now starting to take effect.

WATCH COMMODITY PRICES, INTEREST RATES AND THE DOLLAR

The most critical areas to watch are commodity inflation, interest rates and the dollar. These three markets are now giving clear signs of the coming inflation and subsequent hyperinflation.

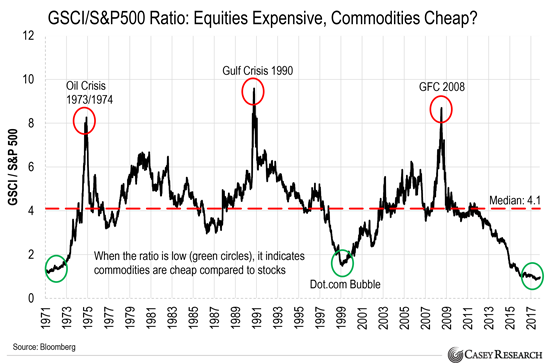

If we start with inflation, official statistics are useless as I mentioned above since these figures are totally manipulated. A very good indicator of inflation are commodities. Below is a chart of the GS commodity index versus the S&P since 1971. That ratio is at an all time low and below the 1971 and 1999 lows. This cycle is now turning and the ratio is likely to go well above the 1974, 1990 and 2008 highs. Thus the minimum target is 10 which is a 10-fold increase from here. This means that stocks will fall at least 90% against commodities. Since the precious metals will be the main beneficiaries of the commodity boom, stocks are likely to fall at least 95% agains gold and silver.

COMMODITIES VS STOCKS

Looking at a short term chart of commodities, the CRB index bottomed in Feb 2016 and is up 30% since then. Since June 2017 the CRB is up 20% and since mid Dec 2017 it is up 8%. This is a clear indication that inflation is now going up fast.

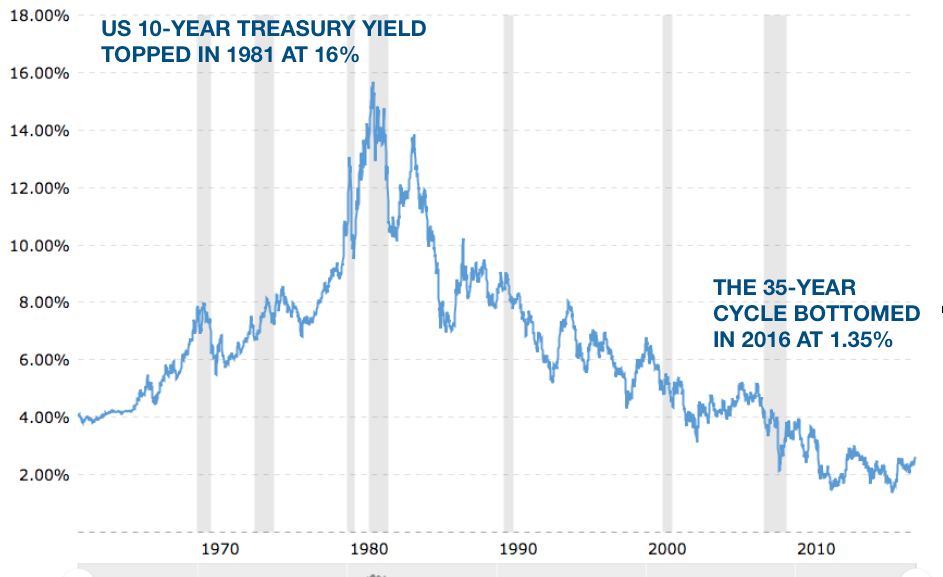

INTEREST RATE CYCLE IS UP

The 35-year long interest rate cycle bottomed in 1945 and topped in 1981. Below is a chart of US 10-year Treasury yield which peaked at 16% in Oct 1981. The 35-year cycle bottomed in July 2016 at 1.35%.

The 10 year treasury yield is now accelerating fast and has gone from 2% last summer to 2.65% today. Rates will now rise rapidly as inflation rises and in the next few years we are likely to see the 10 year rate above the 1981 high of 16%.