Nearly everywhere on the planet, the giant financial bubbles created by the central banks during the last two decades are fracturing. The latest examples are the crashing bank stocks in Italy and elsewhere in Europe and the sudden trading suspensions by three UK commercial property funds.

If this is beginning to sound like August 2007 that’s because it is. And the denials from the casino operators are coming in just as thick and fast.

Back then, the perma-bulls were out in full force peddling what can be called the “one-off” bromide. That is, evidence of a brewing storm was spun as just a few isolated mistakes that had no bearing on the broad market trends because the “goldilocks” economy was purportedly rock solid.

Thus, the unexpected collapse of Countrywide Financial was blamed on the empire building excesses of the Orange Man (Angelo Mozillo) and the collapse of the Bear Stearns mortgage funds was purportedly owing to a lapse in supervision.

So it boiled down to an injunction of “nothing to see here”. Just move along and keep buying.

Physical Gold & Silver in your IRA. Get the Facts.

In fact, after reaching a peak of 1550 on July 18, 2007, the S&P 500 stumbled by about 9% during the August crisis, but the dip-buyers kept coming back in force on the one-off assurances of the sell-side “experts”. By October 9 the index was back up to the pre-crisis peak at 1565 and then drifted lower in sideways fashion until September 2008.

The bromides were false, of course. Upon the Lehman event, the fractures exploded, and the hammer dropped on the stock market in violent fashion.

During the next 160 days, the S&P 500 plunged by a further 50%. Altogether, more than $10 trillion of market cap was ionized.

The supreme irony of the present moment is that the perma-bulls insist that there is no lesson to be learned from the Great Financial Crisis. That’s because the single greatest risk asset liquidation of modern times, it turns out, was also, purportedly, a one-off event.

It can’t happen again, we are assured. After all, the major causes have been rectified and 100-year floods don’t recur, anyway.

In that vein, it is insisted that U.S. banks have all been fixed and now have “fortress” balance sheets. Likewise, the housing market has staged a healthy recovery but remains lukewarm and stable without any signs of bubble excesses. And stock market PE multiples are purportedly within historic range and fully warranted by current ultra-low interest rates.

This is complete daytraders’ nonsense, of course. During the past year, for example, the core CPI has increased by 2.20% while the 10-year treasury this morning penetrated its all-time low of 1.38%. The real yield is effectively negative 1%, and that’s ignoring taxes on interest payments.

The claim that you can capitalize the stock market at an unusually high PE multiple owing to ultra-low interest rates, therefore, implies that deep negative real rates are a permanent condition and that governments will be able to destroy savers until the end of time.

The truth of the matter is that interest rates have nowhere to go in the longer-run except up, meaning that the current cap rates are just plain absurd. Indeed, after last’s week’s “bre-lief” rally the S&P 500 was trading at24.3X LTM reported earnings

Moreover, the $87 per share reported for the period ending in March was actually down by 18% from the $106 per share peak recorded in September 2014. So in the face of falling earnings and inexorably rising interest rates, the casino punters are being urged to close their eyes and buy the dip one more time.

And that’s not the half of it. This time is actually different, but not in a good way. Last time around the post-August 2007 dead-cat bounce was against $85 per share of S&P LTM earnings, meaning that on the eve of the 2008 crash the trailing multiple was only 18.4X.

That’s right. After the near-death experience of 2008-2009 and a recovery so halting and tepid as to literally scream out the main street economy is impaired and broken, the casino gamblers have dramatically upped the valuation ante yet again.

There is a reason for such reckless obduracy, however, that goes well beyond the propensity of Wall Street punters and robo-traders to stay at the tables until they see blood on the floor. Namely, their failure to understand that the current central banking regime of Bubble Finance inherently and inexorably generates financial boom and bust cycles that must, and always do, end in spectacular crashes.

Bubble Finance is based on the systematic falsification of financial prices. That’s the essence of ZIRP and NIRP.

It’s also the inherent result of massive QE bond-buying with fiat credits from the central bank. And it’s the purpose of the wealth effects doctrine and stock market puts. The latter are designed to inflate stock prices and net worths, thereby encouraging households to borrow (against rising collateral values) and spend on the expectation of permanently higher real wealth.

The trouble is, financial prices cannot be falsified indefinitely. At length, they become the subject of a pure confidence game and the risk of shocks and black swans that even the central banks are unable to offset. Then the day of reckoning arrives in traumatic and violent aspect.

And that brings us to the father of Bubble Finance, former Fed Chairman Alan Greenspan. In a word, he systematically misused the power of the Fed to short-circuit every single attempt at old-fashion financial market corrections and bubble liquidations during his entire 19-year tenure in the Eccles Building.

That includes his inaugural panic in October 1987 when he flooded the market with liquidity after Black Monday. Worse still, he also sent the monetary gendarmes of the New York Fed out to demand that Wall Street houses trade with parties they knew to be insolvent and to prop up stock prices and other financial valuations that were wholly unwarranted by the fundamentals.

Greenspan went on to make a career of countermanding market forces and destroying the process of honest price discovery in the capital and money markets. Certainty, that’s what he did when he slashed interest rates in 1989-1990, and when he crushed the justified revolt of the bond vigilantes in 1994 with a renewed burst of money printing.

Ditto, when he bailed out Long-Term capital and goosed the stock market in the fall of 1998—-a maneuver that generated the speculator dot com bubble and subsequent collapse.

And then he applied the coup de grace to what remained of honest price discovery on Wall Street. During the 30 months after December 2000, he slashed interest rates from 6.25% to 1.0% in a relentless flood of liquidity. The latter, in turn, ignited the most insane housing market bubble the world had ever seen.

During the second quarter of 2003, for example, as rates were brought down to a previously unheard of 1.0%, the financial system generated mortgage financings at upwards of a $5 trillion annual rate. Even a few years earlier, a $1 trillion rate of mortgage financing had been on the high side.

Needless to say, housing prices and housing finance costs were systematically and radically distorted. The crash of 2008-2009 was but the inexorable outcome of Greenspan’s policy of financial asset price falsification—–a policy that his successor, Bubbles Ben, doubled down upon when the brown stuff hit the fan.

So as we sit on the cusp of the next Bubble Finance crash, now comes Alan Greenspan to explain once again that he knows nothing about financial bubbles at all. According to the unrepentant ex-Maestro, it’s all due to the irrationalities of “human nature”.

Why central banks have nothing to do with it at all!

“The 2000 bubble collapsed. We barely could see a change in economic activity. On October 19, 1987, the Dow Jones went down 23% in one day. You will not find the slightest indication of that collapse of that bubble in the GDP number – or in industrial production or anything else. So I think that you have to basically decide what is causing what. I think the major issue in the financial models has got to be to capture the bubble effect. Bubbles are essentially part of of the fact that human nature is not wholly rational. And you can see it in the data very clearly.”

No, you can’t. As Doug Noland observed in his most recent post:

At their core, Bubbles are about Credit excess and market distortions. Major Bubbles almost certainly have a major government component. They are indeed toxic, seductively so. Had the Greenspan Fed not backstopped the markets and flooded the system with liquidity post the ’87 Crash, Credit would have tightened and bursting Bubble effects would have been readily apparent throughout the data. Instead, late-eighties (“decade of greed”) excess ensured spectacular Bubbles in junk debt, M&A and coastal real estate. It’s been serial Bubbles ever since.

Noland is completely correct. During the early part of the Bubble Finance era, the main street economy was goosed time and again by cheap credit, which induced household and business spending from the proceeds of steadily higher leverage.

At length, the American economy essentially performed an LBO upon itself. The historic leverage ratio of 1.5X total credit market debt to national income soared to 3.5X on the eve of the financial crisis. That meant that the US economy was lugging around $52 trillion of debt in December 2007——or $30 trillion more than would have been outstanding under the historic golden mean of 1.5X.

Needless to say, the one-time leveraging of the US economy’s collective balance sheet did indeed generate incremental GDP, albeit debt-fueled spending growth that was unsustainable and ultimately stolen from the future.

Greenspan’s claim, therefore, that earlier bubble collapses did not cause GDP to falter gives sophistry an altogether new definition. In fact, it just rolled one bubble into the next, making the eventual payback all the more traumatic and destructive.

Yet at the time, Greenspan even applauded the exploding and unstable leveraging of household balance sheets. He actually bragged about how he had induced higher consumption expenditures and GDP by encouraging American families to refinance their castles and then spend the MEW (mortgage equity withdrawal) on a new car or trip to Disneyland.

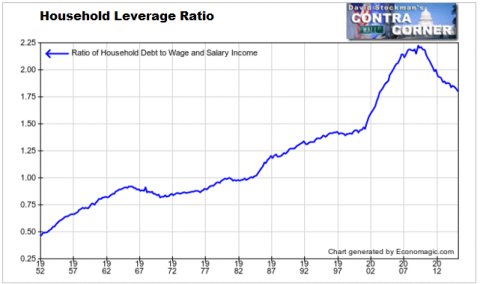

Here is what happened to the household leverage ratio during Greenspan’s destructive MEW campaign. Does he really think that the nearly parabolic rise of the leverage ratio during his tenure to nearly double the stable historic average was due to the irrationalities of human nature?

In fact, the limpid recovery of household consumption spending even by the Fed’s Keynesian measuring sticks is not about human nature at all. It is the consequence of central bank policies that first drove the household sector to an unsustainable balance sheet condition of Peak Debt, and has now left it high and dry under a crushing debt burden of $14.5 trillion.

In short, by its very nature Bubble Finance impregnates the system with FEDs (financial explosive devices). And worse still, what Greenspan started in the US has been exported to the rest of the world.

In part, that was owing to the emulation of Bubble Finance policies by all of the world’s central banks. And it was compounded by the often defensive rationalizations for money printing that has been forced upon them by the massive flow of excess dollar liabilities into the global financial system.

That we are now entering August 2007 redux is evident in the rapidly growing crisis in the Italian banking system. What happens near the end of a bubble cycle is that the high flyers that never merited their bloated valuations in the first place are finally abandoned by the punters, as happened with Countrywide and Bear Stearns in late 2007.

In the case of Italy’s third largest bank, Banca Monte Dei Paschi Siena, the jig is now up. It is completely insolvent and has been for years. Yet as recently as two years ago it was trading at 225X its current virtually worthless stock price.

But the collapse shown below was not the market at work; it was merely the speculative gas fueled by Mario Draghi’s printing press finally rushing out of the bubble.

Nor is this an isolated example. As we pointed out last week, the Italian banking system as a whole is the massively bloated and insolvent off-spring of Bubble Finance. Since the turn of the century, its footings have nearly tripled and now stand at an incredible EUR 4 trillion.

That happens to represent 2X Italy’s languishing GDP, and a full turn more than the approximate 1X ratio in the year 2000. Yet the only thing more off the charts than this kind of bank asset explosion is the degree to which bad assets were enabled to be accumulated in the banking system without corrective crisis years ago.

In fact, there are now about $3 trillion of loans in the Italian banking system and upwards of 13% are non-performing. In relative terms, that is nearly 3X the bad debt ratio which prevailed in the US banking system at the peak of the subprime crisis.

Needless to say, these EUR 400 billion of NPLs are growing rapidly but are not even close to being fully reserved. In fact, Monte Paschi, Unicredit, and three other big Italian banks have EUR 119 billion of NPLs that are unprovisioned. That compares to total book equity of just EUR 125 billion in Italy’s entire banking system at the end of Q1.

Italian banks are essentially insolvent. That shares have been clobbered since the Brexit event, and are down by 50% to 70% since the beginning of the year is simply the belated recognition by speculators that neither the Italian government nor the ECB is in a position to do whatever it takes to sustain the Bubble Finance scam.

The former has come smack up against the EU bail-in rules, while even the latter’s printing press will not be allowed by the Germans to extend QE to the EUR 187 billion of Italian bank bonds that are headed for a massive haircut.

Indeed, as recently as two years ago the traded equity and debt of the Italian banking system was valued at upwards of $400 billion. In fact, it is essentially worthless.

The battle of the Italian government to rescue this catastrophe from a complete meltdown will undoubtedly create the next crisis of governance and survival for the imploding EU. But even before that eventuality fully materializes, the larger point has already been proven.

To wit, like Countrywide and its 2007 compatriots, the implosion of the Italian banking system is not a one-off occurrence. Instead, it is the part and parcel consequence of Bubble Finance.

And there are a lot more Italian Banking Jobs still to come.

Reprinted with permission from David Stockman’s Contra Corner.