This is getting way too stupid. The Keynesian Chorus has launched a full blast trilling campaign, emitting an increasingly shrill cackle of warnings against a Fed rate hike. Yes, 80 months of pumping free money into the canyons of Wall Street is not enough.

Why?

Well, this is hard to type with a straight face, but according to the cackling gaggle of Keynesian Chicken Littles, the Fed has already tightened too much!

Paul Kasriel, the former chief economist at Northern Trust who now writes “The Econtrarian” blog, argues that “in recent months Fed monetary policy has become downright restrictive.”

Would that Kasriel could be dismissed as merely a Wall Street shill, but its seems that he’s taking his cues directly from John Maynard Keynes’ very vicar on earth. That would be Larry Summers, who yesterday blogged an identical bit of tommyrot:

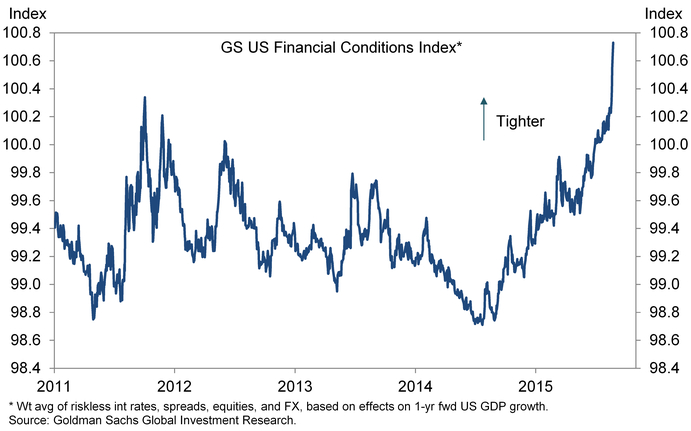

The Great Deformation:... Best Price: $2.00 Buy New $9.95 (as of 09:55 UTC - Details) I believe the case against a rate increase has become somewhat more compelling even than it looked two weeks ago…..First, markets have already done the work of tightening. The U.S. stock market is worth $700 billion less than it was 2 weeks ago and credit spreads have widened noticeably. Financial conditions as measured by Goldman Sachs or the Chicago Fed index have tightened in the last 2 weeks by the impact equivalent of more than a 25 BP tightening. So even if resisting inflation required a 25 BP tightening as of two weeks ago, this is no longer the case.

You can’t make this stuff up! And you don’t have to mince any words, either. This whole mantra that free money is actually tight money is the product of a tiny circle of academic scribblers and Wall Street hirelings who have invented what amounts to an alternate vocabulary of economic newspeak.

Exhibit number one is the Goldman Sachs Financial Conditions Index. As shown below, it purportedly has surged sharply toward “tightening” during the last 15 months.

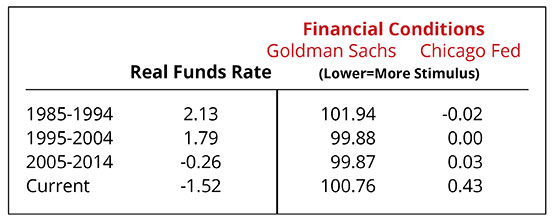

In fact, using this index Professor Summers twists economic logic into a corkscrew. By his lights, today’s deeply negative real interest rates at -1.52% are actually far tighter than 30 years ago when real interest rates were +2.13%!

I am not exaggerating. That’s exactly what the man said:

The figure below makes a crucial point. It shows that even though the federal funds rate is very low (negative one and a half percent after adjusting for inflation, financial conditions are helping the economy less than in previous years when interest rates were much higher.

Here’s the thing, however. Would you actually buy a used car from Goldman Sachs?

It turns out that this purportedly scientific measuring rod is just a goal-seeked data concoction put together by none other than the B-Dud. Back when Bill Dudley was Goldman’s chief economist, he needed a convenient metric to signal whether or not Greenspan was pleasuring the Wall Street gamblers with “moar” money at any given point in time.

So he came up with a four-factor indicator based on interest rates, credit spreads, equity market prices and the value of the US dollar.

The Triumph of Politic...

Best Price: $2.56

Buy New $15.99

(as of 05:55 UTC - Details)

The Triumph of Politic...

Best Price: $2.56

Buy New $15.99

(as of 05:55 UTC - Details)

That is to say, the Goldman index consists of financial variables that are so powerfully influenced by Fed policy that they comprise the next closest thing to an auto loop. And a perverse one at that.

To wit, when the Fed is heavily pumping monetary juice into Wall Street and the gamblers are in a full throttle “risk on” stampede, what happens to the components of this purportedly scientific index?

Why the dollar weakens, as it is sold short into the offshore and EM carry trades; credit spreads between risk-free treasuries and junk bonds tighten,since its risk-on time and money managers are desperate for yield; equity prices rise because the casino is rocking; and interest rates are pegged atzero because the FOMC has essentially expropriated/nationalized the money market.

But when the resulting financial bubble finally reaches its apogee, as it did in the spring of 2000 and during the fall of 2008, the gamblers eventually succumb to a spat of “risk-off”, causing three of the four indicators to beat a panicked retreat.

Accordingly, credit spreads blow-out, as junk and other risky credits are dumped; the dollar soars, as off-shore markets scramble to cover the immense dollar short; and equity markets fall, as leveraged trading in the casino is unwound.

So wouldn’t you know it. The inevitable collapse of the Fed’s bubble cycle causes the Goldman Sachs Financial Conditions Index to go vertical in the direction of “tightening”!

In a word, the Goldman gamblers have constructed a junk economics index that tells the Fed not to tighten because the arrival a modicum of sanity in the casino is evidence that it has already tightened.

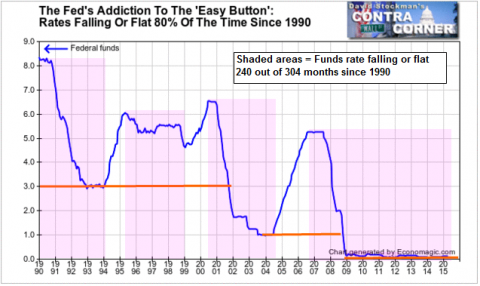

It is not surprising, therefore, that the Fed almost always has its hand on the Easy Button. Indeed, during the last 25 years, it has been cutting or holding money market rates constant at (mostly) ultra low levels 80% of the time.

All of this perpetual easing, of course, is done in the name of filling the Keynesian economic bathtub with that invisible economic ether called “aggregate demand”. But under conditions of peak debt in the household sector and the dynamics of bubble finance in the C-suite, drastic interest rate repression, such as embodied in 80 straight months of ZIRP, does not fuel an outbreak of borrowing and spending in either sector.

In fact, upwards of 90% of households are tapped out and can’t borrow more regardless of the interest rate.

Likewise, the C-suite of corporate American has become so addicted to harvesting stock option gains that virtually any and all incremental borrowings have gone into stock buybacks and other financial engineering maneuvers. That is, into inflating the secondary markets for existing financial assets, not funding an increased call on real plant, equipment, software and other productive assets.

That the Fed’s massive emission of central bank credit never leaves the canyons of Wall Street under a regime of bubble finance is readily evident in the real economic facts. That is, the plain trends in nominal borrowing and spending show a complete absence of credit-fueled stimulus or any elevation of “aggregate demand”.

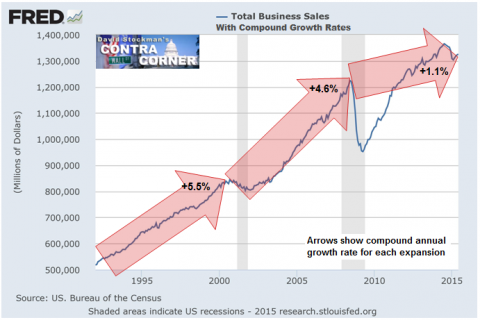

Thus, even as the Fed has resorted to progressively more extreme money printing sprees with each bubble cycle, the actual growth of the business system has slowed. Since the mid-2008 peak, for example, business sales have expanded at only a 1.1% annualized rate—-a small fraction of the 4-6% annual gains which occurred during the two prior cycle.

The crucial point about the above chart which covers net production in the entirety of the US business economy——-mining, energy, manufacturing, wholesale and retail trade—–is that it is expressed in actual nominal dollars which ring at the cash register.

By contrast, all of the Keynesian jawing about real interest rates, real GDP growth, real consumer borrowing and spending etc. assumes that “inflation” can be measured accurately by the primitive techniques of the Washington statistical mills; and that the whole system of national income and product accounts which is predicated on these “deflators” actually reflects reality.

No it doesn’t. The Keynesian alternate vocabulary of economic newspeak often creates the appearance of growth and gains in the macro-aggregates by the presumptions of theory, not the tabulation of empirics at the cash register.

For example, the GDP accounts provide for steady “real growth” of upwards of $3 trillion of “imputations” that do not even exist, such as spending on rents by owners who live in their own houses; or by increasing the reported numbers for software and other technology spending by up to 10X on the grounds that improved quality and function should be registered in deeply negative “deflators”.

At the end of the day, however, main street households and businesses do not spend “real” or deflated dollars as computed by the Washington statistical mills; they spend the nominal dollars they have earned or saved, taking into account their own subjective views on the rate at which its purchasing power is being eroded by the rising cost of living.

In this regard, “real interest” rates are an unadulterated fiction. Households borrow based on the monthly cost of carry and the capacity of their incomes to support the contractual debt service required by the marketplace. Professor Summers’ hooey that real interest rates are negative but too tight never crosses the mind of any real world borrowers.

What does cross their mind, by contrast, is debt service carry-capacity and the penalty spreads they might face based on their credit histories. In that regard, here is the collective verdict of America’s 115 million households as reflected in their nominal dollars of mortgage, credit card, auto, student and other consumer debt.

To wit, after exploding by 5X between 1987 and 2008, household debt has gone flat as a pancake since the financial crisis, and, in fact, is nearly $400 billion or 3% lower than it was in early 2008.

That’s right. During that very same period, the Fed’s balance sheet exploded from $800 billion to $4.5 trillion or by more than 5X. Yet all that monetary stimulus had no impact whatsoever on household spending and borrowing. Self-evidently, professor Summers negative real interest rates, which are still too tight by his lights, did not induce tapped-out households to borrow and spend up a Keynesian storm.

The same is true of business. The Fed could not have made the nominal carry cost of interest any cheaper over the last 80 months, regardless of how corporate financial executive might compute the “real” interest rate.

Yet after consuming their depreciation allowances on replacement capital, US business did not spend up a storm on productive capital investment as predicated by ZIRP. In fact, net business investment in Q2 2015 at $562 billion was actually lower than it was in the second quarter of the year 2000.

In short, ZIRP has not caused a credit fueled inflation of either the business or household sectors of the main street economy. Its inflationary impact has been exclusively realized in the canyons of Wall Street where is have fueled the third and greatest financial bubble of this century.

Needless to say, its impending crash is unavoidable because that’s what artificial monetary bubbles always do. Unfortunately, if the Fed heeds the advice of the cackling gaggle of Keynesian Chicken Little’s now importuning it, a new short-lived run at the old May 2015 highs is likely to ensue in the casino, thereby insuring that the ultimate reckoning will be all the more disruptive and destructive.

And that baleful eventuality is all because by the lights of the ruling posse of Keynesian pettifoggers, 80 month of free money is still too tight. That unadulterated nonsense is the scariest part of all.

Reprinted with permission from David Stockman’s Contra Corner.