With every passing week that money markets rates remain pinned to the zero bound by the Fed, the magnitude of the financial catastrophe hurtling toward main street America intensifies. That’s because 80 months—– and counting—–of zero interest rates are fueling the most stupendous gambling frenzy that Wall Street has ever witnessed or even imagined. Sooner or later, therefore, this mother of all financial bubbles will splatter, bringing untold harm to millions of households which have been lured back into the casino.

The truth is, zero cost in the money market is irrelevant to main street. As we have repeatedly demonstrated the household sector is stranded at “peak debt” and, consequently, there is no interest rate low enough to elicit a spree of pre-crisis style consumer borrowing and spending. Based on the clueless jawing that occurred this weekend at Jackson Hole, the following simple chart that I laid out last week bears repeating:

On the eve of the financial crisis in Q1 2008, total household debt outstanding—including mortgages, credit cards, auto loans, student loans and the rest——– was $13.957 trillion. That compare to $13.568 trillion outstanding at the end of Q1 2015.

That’s right. After 80 months of ZIRP and an unprecedented incentive to borrow and spend, households have actually liquidated nearly $400 billion or 3% of their pre-crisis debt.

Likewise, zero money market rates are irrelevant to legitimate business finance. That’s because no sane executive would finance the life blood of his enterprise—–the working stock of raw, intermediate and finished goods——in the overnight money market; and, self-evidently, free overnight money is beside the point when it comes to funding long-term, illiquid but productive assets such as plant, equipment and software.

The Great Deformation:...

Best Price: $2.00

Buy New $9.95

(as of 09:55 UTC - Details)

The Great Deformation:...

Best Price: $2.00

Buy New $9.95

(as of 09:55 UTC - Details)

In fact, the only impact that free money market funding has on corporate America is round-about and perverse. To wit, it flushes money managers into a desperate quest for yield and provides stock speculators with endless opportunities to load up their trucks with zero cost carry trades, thereby driving the stock averages to lunatic heights.

As a result of this double-whammy, the C-suites of corporate America have been turned into glorified gambling parlors. The stock option obsessed executives domiciled there are endlessly and overpoweringly presented with the opportunity to sell cheap corporate credit to yield-hungry fund mangers and use the proceeds to buyback their own over-priced stock or to acquire at a hefty premium the equally over-priced stock of their competitors, suppliers and customers, or any other company that Wall Street bankers happen to be peddling.

Again, as I demonstrated last week, after 80-months of the absurd proposition that money has no natural and inherent economic cost the pettifoggers who held forth at Jackson Hole betrayed no clue whatsoever that they are aware of the obvious:

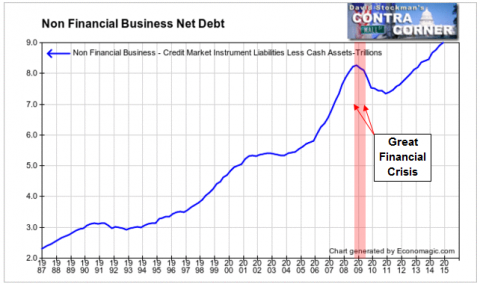

On the margin, all of the gains in business debt since 2008 has been flushed right back into Wall Street in the form of stock buybacks and debt-financed takeovers.

The evidence that zero interest rates have not promoted business borrowing for productive investment is also plain to see. During the most recent year (2014), US business spent $431 billion on plant, equipment and software after depreciation. That was 7% less than net business investment in 2007.

And these are nominal dollars! So all other things being equal, net business debt could have fallen over the past 7 years. The actual gain in net debt outstanding shown above self-evidently went into financial engineering—-that is, back into the Wall Street casino.

Here’s the thing. You don’t need fancy econometric regression analysis or DSGE models to see that ZIRP is an macroeconomic dud. Simple empirical data trends show that it hasn’t goosed household borrowing and consumption spending, nor has it stimulated business investment.

So this is how it boils down. The only thing zero money market interest rates are good for is to subsidize financial market speculation. ZIRP means that the speculator’s cost of goods (COGS) is essentially zero whenever yielding or appreciating assets are funded in the repo market or its equivalent in the options pits and Wall Street confected OTC trades.

The Triumph of Politic...

Best Price: $2.56

Buy New $15.99

(as of 05:55 UTC - Details)

The Triumph of Politic...

Best Price: $2.56

Buy New $15.99

(as of 05:55 UTC - Details)

Accordingly, after 80 months of showering Wall Street with what is a wholly unnatural and perverse financial windfall—-that is, zero cost in the money market—–the Fed has ignited a rip-roaring inflation. But the inflation is in the financial market, not the supermarket.

Needless to say, there was not even a faint trace of recognition of this fundamental reality in Stanley Fischer’s much heralded Jackson Hole speech on inflation. As usual, it was an empty bag of quasi-academic wind about utterly irrelevant short-term twitches in various inadequate measures of consumer inflation published by the Washington statistical mills. Indeed, Fischer went so far as to acknowledge that one of the more plausible consumer prices indices—–the Dallas Fed’s “trimmed mean” measure of the PCE deflator—–was up 1.6% in the past year.

Here’s the thing. No one except the modern equivalent of medieval theologians counting angels on the head of a pin could think that the difference between this reading and the Fed’s arbitrary 2.0% inflation target is of significance to any economic actor in the real world. That fleeting and miniscule difference would never in a thousand years impact the wage and price behavior of firms competing in the world market for tradable goods where cheap labor and mercantilist FX and subsidy policies drive the competition for customers.

Nor would it alter the behavior of the overwhelming share of purely domestic service firms that inherently face an elastic supply curve owing to low entry barriers. There is an unlimited supply of nail salons and yoga studios because folks need work and the Fed’s financial repression policies have fueled a fantastic over-expansion of strip mall real estate.

Likewise, firms with deep brand equity everywhere and always try to raise prices to capture the heavy marketing and other investments which go into creating their brands’ value and consumer franchises. But only clueless academic modelers like Fischer would ever think that 40 basis points of shortfall in the short-run consumer inflation trend would impact the pricing strategy of brand name service firms——-such as Amazon and Wal-Mart, for example.

In short, Fischer’s entire meandering discourse on this and that inflation index and his speculations about immeasurable “inflation expectations” was irrelevant drivel. It could have been delivered by any student who had passed Economics 101 at Podunk College.

And besides that, the man has the gall to cite the “Survey Of Economic Projections” (SEP) as one key indicator showing that inflation expectations have remained “anchored”. For crying out loud, the SEP is the quarterly stab in the dark about the inflation outlook concocted by the 19 members of the Federal Reserve itself!

In fact, the only real value of Fischer’s pretentious bloviation was that it was a reminder that the financial system of the world is in thrall to a tiny, insuperably arrogant posse of Keynesian academics who have invented from whole cloth a monetary theory of plenary control. They have effectively ended free market capitalism in the financial system and beyond and made democratic fiscal governance essentially irrelevant.

Here’s why. It all starts with the Fed’s specious mantra that the “Humphrey-Hawkins” dual mandate makes them do it.

No it doesn’t! Nowhere does it instruct the Fed to keep its fat foot on the neck of liquid savers and depositors for 80 months running.

SJWs Always Lie: Takin...

Buy New $5.99

(as of 01:45 UTC - Details)

SJWs Always Lie: Takin...

Buy New $5.99

(as of 01:45 UTC - Details)

In fact, Humphrey-Hawkins is a content-free expression of Congressional sentiment crafted under the far different economic conditions of the mid-1970’s. It essentially says price stability and fulsome employment are devoutly to be desired national objectives ranking right up there with motherhood and apple pie.

Indeed, the Humphrey-Hawkins Act, which I voted against in 1977, is no more meaningful than the plethora of “captive nations” resolutions, which I voted for that same year——-and just as archaic, too.

In today’s globalized economy, the Fed’s ballyhooed 2% inflation target is no more warranted by the statute’s rubbery language on “price stability” than is 3%, 1% or 0%. And the Fed’s preference for the PCE deflator index of consumer inflation, as measured over a never explained or defined period of time, is no more mandated by the Act than is use of the Cleveland trimmed median or the indices of the MIT Billion Prices Project, as measured monthly, quarterly, yearly or for any other arbitrarily defined period.

In short, the Fed’s 2% target as practiced in the Eccles Building and gummed about by Fischer last Saturday is nothing more than the arbitrary concoction of one demonstrably erroneous and obsolete school of economics. Over the past two decades these Keynesian statist throwbacks to the 1930s have infiltrated the boards and staffs of most of the world’s central banks——and have used their unlimited resources to hire most of the worlds so-called “monetary economists” to write self-justifying studies and perform “research” that is more in the nature of what used to be called “agit prop”.

At the same time, how could the legions of financiers, fund managers, economists, strategists and traders who inhabit Wall Street possibly object——-even if they have no use whatsoever for the Keynesian religion of Fischer and his sidekicks?

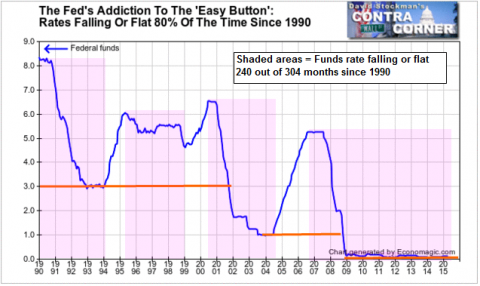

The answer is in the chart below. Under the guise of its silly and arbitrary Humphrey-Hawkins targets the academic fools and crony capitalist opportunists who inhabit the Fed have been delivering a relentless drip of monetary heroin to the casino gamblers 80% of the time over the last 25 years.

The Fed’s Addiction To The ‘Easy Button’: Rates Falling Or Flat 80% Of The Time Since 1990 – Click to enlarge

So with academia on its payroll and Wall Street on its gift list, there is no one left to state the obvious. Namely, that by fueling the most fantastic inflation of financial assets in world history the Fed and its convoy of global central banks have sown its opposite in the real main street economy.

To wit, there is now a massive deflationary tidal wave cresting on the planet, and it was manufactured entirely by the central banks. In the DM world, consumers and governments are stranded at “peak debt” and can no longer live beyond their means by leveraging their balance sheets to the breaking point, as they did in the 30 years leading to the financial crisis.

Likewise, the EM world has buried itself in “peak investment”. This condition is owing to the massive repression of capital costs instituted over the last three decades by their mercantilist central banks in the process of buying dollars and euros to peg their exchange rates, thereby flooding their economies with cheap domestic credits.

As a consequence, the world economy is drowning in malinvestment and excess capacity for virtually every commodity from oil to iron ore and for every stage of downstream industrial production from refineries to blast furnaces, pipe and tube mills, ship-building facilities, car plants and container ships, ports and warehouses.

Moreover, two decades of lunatic money printing have also drastically roiled the global capital and currency markets. During the last 20 years of financial inflation, the Keynesian central bankers have forced DM world money managers to scour the globe looking for yield regardless of risk——a toxic form of malinvestment which is now violently reversing.

That is, credit-saturated EM economies are now imploding, causing their exchange rates to crash, as in Brazil; or is forcing their governments to dump massive amounts of dollar assets——accumulated over the long decades of monetary inflation—–in desperate efforts to prop-up their currencies, as is now happening in China.

Yet the clueless academic who has spent a lifetime contributing to this disaster—–first at MIT where he superintended Bernanke’s misbegotten thesis claiming that the Fed’s failure to massively crank up the printing presses during 1930-1932 was the cause of the Great Depression, through his work as a certified monetary apparatchik at the IMF, the Israeli central bank and now the Fed——effectively confessed in his Jackson Hole speech that he can’t see the forest for the trees.

Well, goodness, gracious. Yes, tumbling commodity prices and the on-going scramble to cover the massive global “dollar short” is roiling the sundry US consumer prices indices. But that is simply the feedback loop of central bank monetary repression and systematic falsification of financial asset prices.

Yet central banker obliviousness to these self-created interferences with and repudiation of their Keynesian bathtub models of macroeconomics knows no bounds. So they continue to equivocate, bloviate and insist that they will keep subsidizing the casino——presumably until it finally blows sky high so that they can resume tilting at “contagion”, which is to say, the violent re-pricing of asset bubbles that they caused in the first place.

Here is Fischer’s concluding paragraph. It leaves no doubt that he is oblivious to the financial firestorm brewing everywhere in the world, and that he is one of the most dangerous academic fools every to gain immense power over the fate of millions of ordinary citizens:

The Fed has, appropriately, responded to the weak economy and low inflation in recent years by taking a highly accommodative policy stance. By committing to foster the movement of inflation toward our 2 percent objective, we are enhancing the credibility of monetary policy and supporting the continued stability of inflation expectations. To do what monetary policy can do towards meeting our goals of maximum employment and price stability, and to ensure that these goals will continue to be met as we move ahead, we will most likely need to proceed cautiously in normalizing the stance of monetary policy………

When the next financial bubble crashes it can only be hoped that this time the people will grab their torches and pitchforks. Stanley Fischer ought to be among the first tarred and feathered for the calamity that he has so arrogantly helped enable.

Reprinted with permission from David Stockman’s Contra Corner.