Summary:

- Hailing from scenic Zurich Switzerland, Jim Rogers outlines his investing plan for 2015.WTIC appears to be oversold – expect an important bottom this year.The investing legend plans to increase his stockpile of gold at under $1,000 an ounce.

Money, Sound and Unsound

Best Price: $31.95

Buy New $51.85

(as of 08:00 UTC - Details)

He favors equities shares from China (largest holding).

Money, Sound and Unsound

Best Price: $31.95

Buy New $51.85

(as of 08:00 UTC - Details)

He favors equities shares from China (largest holding).

Fed officials may feel compelled to make an incremental rate hike or two, to save face given the level of rate hike rhetoric.

Nonetheless, such efforts will be in vain, the inevitable day of economic reckoning is imminent.

- According to Peter Eliades of Stockmarket Cycles, a particular angle of ascent or slope has lead to a market zenith for nearly 14 consecutive years.

- He presents the precise slope angle and a simple means to calculate the trendline (slope = 68.3 / 238 days = 0.28584) for virtually any forecasting chart.

- Since 2002, the market has failed to close over 1.1% beyond the trendline and then subsequently declined sharply.

- On Monday, May 4th, the model registered a key stock market top, with the proviso that no construct is perfect.

- A market peak of great importance seems imminent.

Against the State: An ...

Best Price: $5.02

Buy New $5.52

(as of 11:35 UTC - Details)

Against the State: An ...

Best Price: $5.02

Buy New $5.52

(as of 11:35 UTC - Details)

- His work suggests that the potential return in US equities is significantly lower than the potential risk – echoing the sentiments of previous guests, such as Dr. Burton Malkiel.

- Our guest suggests Hussman Funds, a free website with market commentary.

- The Silver Investor David Morgan views dollar strength as a direct result of capital flight from the EU.

- Still, the US dollar is a flawed currency, losing over 95% of its value due to Fed machinations.

- The 30 year love affair with US bonds is coming to an end – the coming debt market implosion will direct trillions of dollars into a competing safe haven, gold and silver, tiny markets relative to bonds.

- David Morgan says every portfolio requires at least 10% PMs exposure.

- Few investors have even this recommended amount. The bottom may be in place.

- A final capitulation may not come to pass in the PMs before the onset of the nascent bull market, despite the monthly downtrend.

7775 1.8 CF Large Elec...

Buy New $132.10

(as of 01:20 UTC - Details)

7775 1.8 CF Large Elec...

Buy New $132.10

(as of 01:20 UTC - Details)

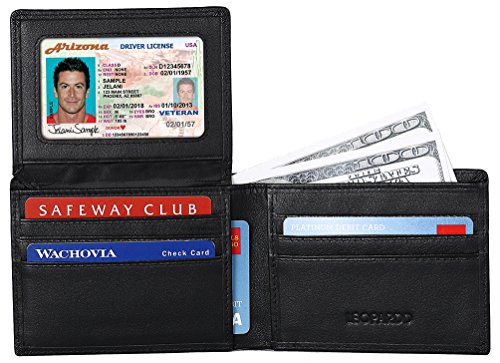

Leopardd Men’s B...

Buy New $21.99

(as of 02:30 UTC - Details)

Leopardd Men’s B...

Buy New $21.99

(as of 02:30 UTC - Details)

Southwest Specialty Pr...

Check Amazon for Pricing.

Southwest Specialty Pr...

Check Amazon for Pricing.