How Much Does It Cost Your Household for War?

by Bill Sardi by Bill Sardi

Someone once told me that politicians use war to hide economic depressions. That war-making artificially relieves unemployment, boosts productivity and helps to invent new technologies. Wars also distract the citizenry away from the failings of their own governments and focus attention on a common external enemy. Wars conceal economic depressions because wartime debt spending can be explained away as the costs of combat. For example, the financial allotment for the war in Iraq is excluded from the government budget altogether and funds are acquired through special emergency appropriations. The Iraq war would add about $100 billion to the annual cost of defense spending. By not reporting this expense, the pie chart used to show how much each segment of government costs, as a percentage of total revenues, is misleading and defense spending appears smaller. It also makes the economy look rosier than it really is.

Here is the pie chart the government uses to inform citizens where their money is going? Hey, just 16 cents on the dollar for protection from Osama bin Laden, Al Qaeda, the Taliban, North Korea, and various other threats. Sounds pretty economical, heh?

Here is the pie chart the government uses to inform citizens where their money is going? Hey, just 16 cents on the dollar for protection from Osama bin Laden, Al Qaeda, the Taliban, North Korea, and various other threats. Sounds pretty economical, heh?

So, take a blind guess what the percentage of the US Federal budget is allotted to war making? Ten percent? A third of the federal budget? Guess again, could it be half of the annual federal outlays? Seems impossible, but it may be so.

To give you a little help in this guessing game, here is the standard pie chart provided by the government displaying the percentage of spending by category.

Robert Higgs, Senior Fellow in Political Economy for the Independent Institute, took a stab at determining the amount of defense spending in 2004. What Higgs showed was the Federal Budget lists expenses for the Department of Defense at about 16% of the federal outlays ($344.4 billion in 2002). But this is not all of the defense spending Higgs uncovered. When defense spending is added for other government departments (Dept. of State, Dept. of Energy, Dept. of Veterans Affairs, Homeland Security, NASA and the interest attributable to past debt-financed defense outlays), the figure rises by 73% (to $596.1 billion), or about 27% of the 2004 federal budget. [San Francisco Chronicle, Jan. 18, 2004]

But the largesse of government is difficult for even a sleuth like Higgs to fully calculate.

The Los Alamos Study Group based in Albuquerque, New Mexico, say they have been dissatisfied with the quoted total for US military spending. So they conducted their own analysis. For fiscal year 2005, the closest of their calculations to Higgs’ 2004 estimates, the Los Alamos Study Group estimates the cost of military spending is more like $793 billion, which would represent 38.4% of the total revenues ($2.064 trillion) for 2005.

The March 2006 newsletter of the Friends Committee on National Legislation calculates defense spending is about 42% of the federal budget ($783 billion out of a 2005 budget of $1,865 billion, not including Social Security and Medicare Trust fund income).

However, the War Resisters League (WRL) may have a more inclusive list of war expenses. The WRL took figures from Fiscal Year 2004 as percentage of federal funds. The big difference in WRL defense figures from other estimates is it designates a larger portion of the interest payments paid for money loaned to fund past wars, more like 80% of the entire federal debt load, compared to other groups that estimate only 50-60% of the debt. The WRL says most (if not all) of the national debt would have been eliminated without debit spending for wars. So all totaled, the WRL estimates 49% of the estimated 2007 federal budget will go towards military spending! But even this figure is understated.

Really, military spending is much greater than the 49% figure because this percentage is calculated on federal outlays, not revenues. The expense budget includes money that was borrowed to fund war. When calculated as a percentage of revenues only, not counting borrowed money, the percentage rises even higher.

There is another way defense spending is minified. Federal funds (from taxes) and Trust Funds (from Social Security and Medicare) are lumped together (so-called Unified budget) so the human needs portion of the budget looks bigger, the war budget relatively smaller.

The Many Ways Military Spending Is Minified

- Defense spending is presented as the Budget for the Defense Department and not for other branches of government involved in military spending (Dept. of State, Dept. of Energy, Dept. of Veterans Affairs, Homeland Security, NASA)

- The cost of current wars (Iraq) is off-budget and funds are acquired through special funding legislation.

- Military budget does not include interest on the debt for prior wars that were fought.

- Military spending is presented as a percentage of Gross Domestic Product so it appears as 3-4% of total spending instead of nearly half of the federal budget.

- Trust funds for Medicare and Social Security are included in the total federal budget to make defense spending look smaller.

- Defense spending is calculated as a percentage of federal outlays, not revenues. Federal outlays include money borrowed to fight wars. When calculated as a percentage of revenues only, not counting borrowed money, the percentage rises even higher.

One of the other ways the federal accounting practices diminish the size of war spending is to compare it against the Gross Domestic Product (GDP), rather than the total revenues in a year. Or restated, defense spending is often calculated as a percentage of total earnings in the entire population rather than a percentage of taxes paid to government. It’s a ruse. So military spending in 2004 was said to be only 3.9% of GDP. This makes it sound like hiring security guards costs less than 4% when it actually costs about half of the federal revenues.

No wonder the federal government has to hide the largesse of its war machine. Bankers love wars funded by debt so they will gain perpetual interest on their money.

The Heritage Foundation estimates per capita military spending in the U.S. is rising at an unprecedented pace (see chart above).

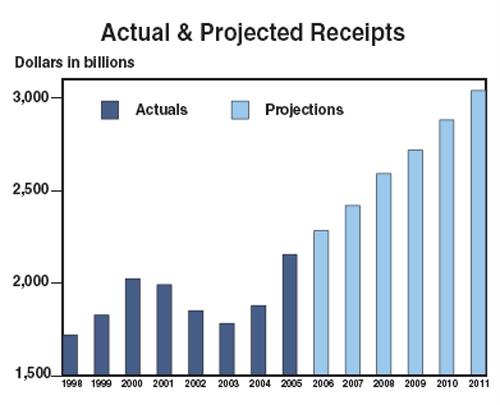

Another concern is that government tends to never return any money to taxpayers should it ever have a surplus. The federal government projects revenue increases over the next few years (though these are often specious) and begins to calculate how much it can add to the defense budget even before the money comes in. For example, in 2005 federal receipts increased by $274 billion, a 14.5 percent increase, and the largest increase in 24 years. It was all gobbled up by the ever-hungry federal behemoth. The chart below estimates future projected federal revenues. Where will all this money go? How much more to fund war?

Source: The White House (in billions)

Source: The White House (in billions)

Oddly, the US continues to develop war technologies designed to fight a non-existent enemy. Russia has dropped its military spending from about $260 billion to just $30 billion annually. [San Jose Mercury News, August 16, 2000] The US has become a nation whose productivity is being measured by war spending.

How do the nation’s voters go about expressing their desire to cut back on military spending? Politicians make it difficult to oppose unbridled defense spending. For example, knowing the current public opinion to restrict illegal immigration, in 2005 the House of Representatives tacked a provision onto President Bush’s emergency $81.3 billion war spending legislation that would make it all but illegal to issue driver’s licenses to undocumented immigrants. They know how to keep the war machine going. [San Francisco Chronicle March 16, 2005]

Something’s Gotta Give: How long can the US continue funding Medicare, Social Security and Wars?

The day is coming when the federal government will not be able to fund all three of its major financial outlays — Medicare, Social Security and war making.

Somewhere in 2008 the federal government will begin an inevitable downward financial spiral. Cutbacks in Medicare spending and extending the age to receive social security benefits will still not stave off the looming catastrophe.

The Heritage Foundation makes us aware that, beginning in 2008, the Social Security cash surplus begins to decline. In 2018 the annual benefit costs exceed cash revenue from taxes. In 2028 the trust fund ceases to grow because even taxes plus interest fall short of benefits. And by 2042 the Social Security trust fund will be exhausted and only 73—81% of benefits could be paid. Payroll taxes would have to be raised to 60% of income to pay for Social Security near mid-century to meet all obligations.

Growing out of debt fallacy

Growing the economy out of this problem would require double-digit economic growth. In the 1990s the economy grew at a rate of about 3.2% per year. Double-digit economic growth would trigger curbs in the money supply from the fed. To balance the nation’s budget in 2040 would require a 60% cut in federal spending (about the cost of defense spending). To understand the false idea of growing the economy to get out of debt, imagine a sole family wage earner going deeper into debt and assuming he can pay it all back based upon anticipated future paycheck increases.

Retiring Baby Boomers will deplete the Medicare trust fund

Furthermore, the cost of Medicare "is about to explode," says the Heritage Foundation. Medicare spending is projected to jump tom $395 in FY 2007 to $504.4 billion in FY 2011. Some modest cuts in Medicare spending will offset a small portion of this growth. But such cuts "do not even begin to tackle the enormity of the task facing Congress and the nation," says the Heritage Foundation. Medicare has unfunded liabilities of $30 trillion!

To fully fund Medicare’s obligation to provide health care for retirees would require a rise in Medicare payroll taxes from 2.9% to 13.4%. The recent passage of Medicare drug benefits only adds to the problem. Health care spending was $1.4 trillion in 2001 but will rise to $3.1 trillion by 2012! This is because the senior citizen population is rising and will double by 2030 to 71 million. Around 2011 the Baby Boomers will begin to turn 65 and by 2030 one in five Americans will be of retirement age.

The sickest 10 percent of Medicare beneficiaries account for 75 percent of outlays, and each costs the system about $37,000. The smokers, overeaters, alcoholics, etc. rack up the biggest bills. Since 75 percent of all Medicare beneficiaries have incomes below $25,000 and spend on average $2,605 in out-of-pocket costs for their medical care, few savings can be squeezed from the elderly.

Will the war machine win out?

At some time in the future Congress has to decide whether it can continue to spend nearly half of the annual federal budget on defense (war making) without making huge cutbacks in Social Security and Medicare. Will the war machine win out over the government’s commitment to fund health care and pension funds? In the next decade or two there will be far more retirees voting in elections. Would you anticipate they will favor funding war over direct benefits to themselves?

Is the federal government ready to reduce military spending? It doesn’t appear so. In 2003 when President Bush asked for an additional $87 billion for military and reconstruction efforts in Iraq and Afghanistan, the Los Angeles Times said Congress had "no appetite for offsetting the increases with cuts in domestic spending." [LA Times, Sept. 17, 2003]

Cut Social Security to free up more war money

In 2002 Patrick Chisholm of The Christian Science Monitor outrageously suggested that reforms in Social Security would free up more dollars for military spending. This is the kind of mentality that exists. Social Security is "crowding out" defense spending, said Chisholm. He said if it weren’t for the government "entitlement" programs (you mean the Medicare and Social Security trust funds that citizens paid into over their lifetime, Mr. Chisholm?), "billions more federal dollars would be freed up for spending on more police and security guards, more FBI agents," etc. Can you imagine this? Chisholm makes Medicare and Social Security sound like doled-out welfare, not repayment to recipients who have paid for these benefits ahead of time.

The federal government gets to renege on its obligation to make Social Security payments because of the growing need for more security guards? Chisholm said that policymakers will be faced with "huge pressure to bail out Social Security and Medicare at the expense of everything else" (everything else being military spending). [Fight terrorism by reforming Social Security, Patrick Chisholm, the Christian Science Monitor, Feb. 26, 2002]

Congress is misdirected

At least some in Congress are not oblivious to the problem. In 2003 Rep. Dennis Kucinich proposed trimming the Pentagon budget by 15%, or $60 billion, but instead of increasing Social Security or Medicare withholding taxes, Kucinich suggested diverting that money to "dwindling domestic priorities" such as education. This became the Ready-to-Teach Act that passed Congress.

It’s obvious, if taxes collected for Medicare and Social Security must increase at some time in the future, taxes allotted to military spending must be cut.

But if military spending is cut, won’t many jobs be lost? Well, the Defense Monitor states, "As far as providing jobs, military spending is a much worse investment than other federally funded programs. For example, $1 billion spent by the Pentagon on weapons, supplies and services generates 25,000 jobs. However, the same $1 billion would create 30,000 mass transit jobs, 36,000 housing jobs, 41,000 education jobs, and 47,000 health care jobs." [Defense Monitor, Center for Defense Information, 1998]