The US stockmarket continues its rise to dizzy heights. The rise has very little to do with economic fundamentals but is more a function of money printing and the weak dollar.

The US in now slowly entering its hyperinflationary phase. Food prices are already up 19% in the first three months of 2014. On an annualised basis that is 76% which is a clear sign that hyperinflation is already starting.

The dollar is likely to start a severe decline this year on its way to the intrinsic value of ZERO. As it falls the vicious spiral of a falling currency and massive money printing is likely to destroy the US economy in a hyperinflationary depression. This will not only happen in the US but also in Japan, the Eurozone and the UK. But the US will be the first country to experience the destruction of its currency.

At the beginning of a hyperinflationary cycle, the stockmarket virtually always makes substantial gains which is just reflecting the sheer weight of printed money. The Weimar Republic and Zimbabwe are two examples of this phenomenon. But after the initial enthusiasm the stockmarket loses its lustre and falls in tandem with the economy.

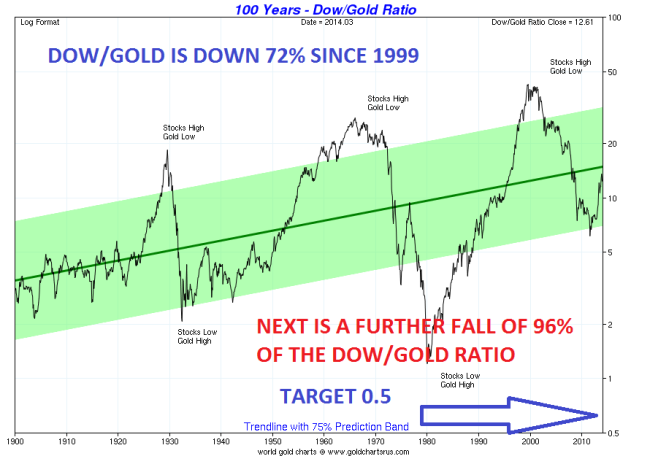

Gold will always reveal the destruction of paper money as the graph of the Dow/Gold ratio below shows. Since 1999 the Dow has fallen 72% in real terms or measured against Gold. The ratio made a bottom in 2011 when Gold was $1,900.

If we turn to Gold, we have been forecasting new highs before 2014 is over and we still believe that is likely. Thus the Dow/Gold ratio could soon turn down and start its journey to below 1 to possibly 0.5. In 1980 the ratio was 1 with gold and the Dow both around 850.If the ratio overshoots, which is likely, and goes to 0.5 that would mean that the Dow would fall another 96% from here against gold.

[amazon asin=B002RHF8TC&template=*lrc ad (left)]

[amazon asin=1586489941&template=*lrc ad (left)]

[amazon asin=1591846706&template=*lrc ad (left)]

[amazon asin=162040236X&template=*lrc ad (left)]