Dallas Fed President Richard Fisher has been a thoughtful dissenter all along on the lunacy of QE and the Fed’s massive bond buying spree. But now he has left nothing to the imagination, admitting that Bernanke’s objective all along was to aggressively levitate the price of financial assets and thereby confer massive windfall gains on the wealthy who own most of them. And all this was done in pursuit of some whacked-out, latter-day Keynesian version of “trickle down” economics, which, according to Bubbles Ben, was for the good of the average American—even if they didn’t appreciate it, comprehend it, demand it, or vote for it.

And that’s the heart of the problem. The average American does not need a monetary politburo comprised of 19 more or less self-selected dictators to decide what’s best for them economically. Once upon a time we had a far better decision mechanism called the free market and a wonderful financial market governor called the price of money and debt, aka market-based interest rates. Under that regime, savers got an honest reward for deferring current consumption and spending; borrowers faced the true economic cost of debt to finance their projects; speculators faced the risk of sudden, sharp changes in the cost of carry when markets got frothy; and investors discovered in the market a valid “cap rate” against which to figure the return on their investments.

At the end of the day, markets cleared. When society’s pool of economic savings out of current income, as opposed to fiat credit created by the central bank, was insufficient to meet demand for borrowed funds, interest rates [amazon asin=B00F6IGN52&template=*lrc ad (right)]rose to induce more savings. At the same time, when investment booms and demand for borrowed funds by speculators got too frisky, interest rates peaked—and even soared into high double digits in the Wall Street call money market, which was the epicenter of capitalist speculation—and thereby rationed available savings and rolled back excess demands for borrowed funds.

Stated differently, the free market of millions of savers, borrowers, investors, intermediaries and speculators was balanced out and stabilized by the mechanism of prices. It thereby had a built-in correction against booms and bubbles—and one that showed no mercy to those who got in over their ski’s when periodic liquidations of financial excesses were rung out of the markets.

The essence of honest free markets for debt, money, equity and everything else that is traded is that there are no bailouts, no moral hazards, no central bank “puts” and safety nets under the stock market, and therefore no unearned windfalls to gamblers and speculators. By contrast, the Greenspan-Bernanke-Yellen style of Keynesian central banking is all about dishonest markets where all prices in the money, debt and related securities markets are rigged, pegged, manipulated and medicated by 12 fallible people—nowadays mostly academic PhDs— who rotate thru the FOMC.

But these monetary central planners operate from a core doctrine that is now obsolete, and which was always a dangerous trick on society based on “stimulating” credit-based expansion of GDP today by means of a one-time leveraging-up of household, business and government balance sheets. Needless to say, this Keynesian debt conjurors trick worked for a long-time because when the old-time financial orthodoxy of President Eisenhower and Fed Chairman William McChesney Martin succumbed to the so-called New Economics in the mid-1960′s, American balance sheets were still relatively clean after the great debt liquidations of the 1930s and, as I have [amazon asin=1591846706&template=*lrc ad (right)]demonstrated in “The Great Deformation”, during World War II, as well.

So from approximately 1970 thru the present a great orgy of consuming the borrowing capacity of America’s balance sheets ran riot, and presently Greenspan proclaimed himself the Maestro and Bernanke the Savior. But the numbers put the lie to that. During the century before 1970, the ratio of total credit market debt—household, business, financial and government—- to national income was steady at about 1.5X. And with the exception of the early 1930s crash of the denominator (national income or GDP), the nation’s ‘leverage ratio” oscillated in a narrow band around that central tendency during periods of booms and bust, war and peace, and mostly during the times of growing prosperity in between. Call it the golden constant and it worked.

As late as 1981, the GDP was $3 trillion and credit market debt about $5 trillion–still reflecting the golden constant of national leverage. Then we had what can only be described as a rolling national LBO under which every sector of the economy totally used up its borrowing capacity and in the process finally ran up against the hard stop of “peak debt”.

Specifically, the “bubble blind” PhD’s who ran the Fed could not see that by 2007 the US economy was consuming $7 of new credit for each dollar of added GDP. In fact, scour the fabled transcripts of the FOMC meetings and there is hardly an acknowledgement that credit market debt that year expanded by $4.5 trillion and that money GDP grew by the niggardly sum of $700 billion. Did this ship of fools not understand the laws of compound arithmetic? Or that at 2007’s rate of up-take, credit market debt outstanding would grow from $50 trillion to the absurd level of $500 trillion within only a few decades![amazon asin=B00H9KKKAY&template=*lrc ad (right)]

More importantly, did they not understand that the Keynesian game of borrowing extra GDP today at the expense of deflationary debt burdens tomorrow was nearing its limit? Self-evidently, they did not. Washington’s so-called rescue of the US economy after the financial crisis consisted of nothing more than a central bank enabled drawdown of the last available balance sheet—that of Uncle Sam. So here we are today with credit market debt of $59 trillion on $17 trillion of money GDP, meaning that our rolling national LBO has reached its end game. At a national leverage ratio of 3.5X the US economy lumbers under two extra turns of debt relative to the stable, sustainable and healthy 1.5X ratio that prevailed before the Keynesian conjurer’s trick became national policy.

Stated differently, at the golden constant of 1.5 turns of debt on income, credit market debt today would total about $27 trillion. And the massive incremental debt burden of $32 trillion that we actually carry is the reason that unreconstructed Keynesians like Larry Summers spend most days sucking their thumbs trying to figure out why the GDP is not attaining “escape velocity”—which is to say, why the Keynesian debt trick is no longer working.

The reason is self-evident, but utterly opaque to our monetary politburo whose vision is utterly impaired by its Keynesian blinders. The fact is, the ”credit expansion channel” of monetary policy transmission is busted and done. The credit user sectors have reached “peak debt” and are just spinning their wheels under the constraint.

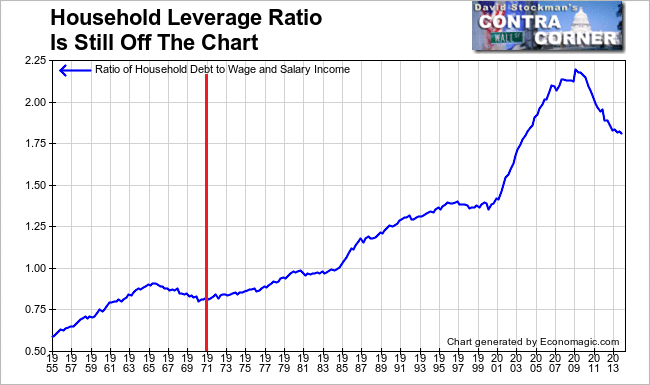

Prior to the 40-year national LBO, household credit amounted to about 80% of wage and salary income, but then was ratcheted up in Fed-induced boom-bust-boom cycles after 1970 until it reached 210% in 2007. Then the debt magic evaporated as the shoppers dropped because they faced the need to curtail rather than expand their leverage ratios.

Today household debt to wage and salary income has dropped to about 180%, which is still far above healthy historical levels, and is sustainable only due to the Fed’s absurd repression of interest rates—particularly for mortgage debt. Interest rates on the latter would easily be 300-400 basis points higher in an honest market without taxpayers subsidies from Fannie Mae and interest rate subsidies that the Fed extracts from the nations’ hapless liquid savers earning their 40 basis points.[amazon asin=1610392779&template=*lrc ad (right)]

Indeed, the only credit expansion happening in the household sector after nearly seven years of frantic money printing at the Fed—-which has taken its balance sheet from $900 billion to $4.2 trillion and still rising—is an explosion of NINJA loans to students and sub-prime loans to buyers of used cars and the down-market offerings of born again GM and Chrysler. Neither of these utterly artificial credit boomlets will last much longer—that’s a certainty.

On the business side, there was about $3 trillion of outstanding credit market debt when Greenspan got his bubble finance scheme up and running. By the time of the Lehman bankruptcy it was up to $11 trillion and spinning its wheels. That is to say, nearly all of the up-take at the pre-crash peak was being used to fund LBOs, leveraged stock buybacks and M&A deals mainly financed with borrowed cash. Stated differently, the business sector had been transformed from a credit user that financed higher growth of productive assets to one that had become merely a transmission belt for financial engineering and the levitation of stock prices on borrowed money.

Today credit market debt outstanding in the business sector exceeds $13.5 trillion, but virtually all of the incremental gain of $2.5 trillion has gone into leveraged financial engineering. The evidence for that is everywhere in plain sight. We have now returned to 2007 bubble conditions— including peak rates of junk bond issuance, massive share buy-backs, rampant leveraged recaps based on so-called covenant lite ”senior” loans being scooped up by agents of toxic debt called CLOs. Even the Wall Street meth labs are back—slicing and dicing rental streams from America’s new hedge fund and private equity landlords who have swarmed into the single family home [amazon asin=1494399806&template=*lrc ad (right)]business in Scottsdale AZ and Las Vegas, among dozens of other Housing Bubble 2.0 markets.

All of that financial engineering does not cause real economic growth or an expansion in the economy’s base of productive assets. The evidence screams out loud. After all of the Fed’s mad money printing, real investment in plant and equipment during Q4 2013 was still $100 billion or 8% lower than it was at the top of the last cycle in late 2007. The Fed is not stimulating economic growth at all. It is just enabling massive rent extractions from the business sector by the fast money gamblers on Wall Street who know how to time the bubbles and rips that result from LBO takeouts and the leveraged share buyback campaigns, and to grab the financial joy which gushes during those strategic minutes before the announcement of pointless M&A deals.

Even the government sector users—federal, state and local— of the credit expansion channel are tapped out objectively. Total credit market debt in the public sector is now nearing 100 percent of GDP, and is sustainable only owing to the Fed’s interest rate repression. And that is the word for it because it is inconceivable that in a world of 2% ”official” inflation and income taxes on top at 40% that there would be many free market takers for Uncle Sam’s two-year notes now yielding the princely sum of 40 basis points.

So on the off-chance that monetary unicorns do not exist after all, and that interest rates will at some point normalize, the interest carry burden on taxpayer debt at 100 percent of GDP will soar. It’s arithmetic! And then the public sector user of the credit channel will be officially done, too. Say like Detroit.[amazon asin=146997178X&template=*lrc ad (right)]

The truth is, the 40-year Keynesian debt trick is over. The credit expansion channel of monetary transmission is exhausted and impotent. The only thing left is the “Wall Street Bubble Channel”, and that is a dangerous, destructive, inequitable and morally offensive curse on a free society. It does nothing more than provide what I have called “ZERO-COGS” or free short-term repo and similar credit for the carry trades—-a game that provides windfalls for the hedge fund invested 1% on the way-up, and devastating crashes for the slow-money and Main Street when these central bank fueled financial bubbles inexorably crash.

Now a member of the Fed has let the cat out of the bag. At least the sheeple have been warned. In this morning’s post, Zero Hedge has summarized all the evidence you need.

“QE Was A Massive Gift Intended To Boost Wealth”, Fed President Admits

By Tyler Durden, Zerohedge.com

With Bernanke gone, the remaining Fed members knowing full well they will be crucified, metaphorically of course (if not literally) when it all inevitably comes crashing down, are finally at liberty with their words… and the truth is bleeding out courtesy of the president of the Dallas Fed, via Bloomberg.

- FISHER SAYS QE WAS A MASSIVE GIFT INTENDED TO BOOST WEALTH

Which incidentally coincides with Bernanke’s heartfelt “admission” that “my natural inclinations, even if it weren’t for the legal mandate, would be to try to help the average person.” As long as helped to boost the wealth of the non-average billionaire., all is forgiven. “The result was there are still many people after the crisis who still feel that it was unfair that some companies got helped and small banks and small business and average families didn’t get direct help,” Bernanke said. “It’s a hard perception to break.” The truth, as again revealed by Fisher, will not help with breaking that perception.

We wonder how President Obama, that crusader for fairness, equality and all time Russell 200,000 highs, will feel about that? In the meantime, just like the Herp, QE is the gift that keeps on giving.. and giving… and giving… to the 0.001%.

US Income Gap Soars To Widest Since “Roaring 20s”

Record US Income Inequality In One Chart

Shopping With Bernanke: Where QE Cash Ends Up Tells Us Who Benefited

Reprinted with permission from David Stockman.