The report from RealtyTrac last week proves beyond the shadow of a doubt the supposed housing market recovery is a complete and utter fraud. The corporate mainstream media did their usual spin job on the report by focusing on the fact foreclosure starts in 2013 were the lowest since 2007. Focusing on this meaningless fact (because the Too Big To Trust Wall Street Criminal Banks have delayed foreclosure starts as part of their conspiracy to keep prices rising) is supposed to convince the willfully ignorant masses the housing market is back to normal. It’s always the best time to buy!!!

The talking heads reading their teleprompter propaganda machines failed to mention that distressed sales (short sales & foreclosure sales) rose to a three year high of 16.2% of all U.S. residential sales, up from 14.5% in 2012. The economy has been supposedly advancing for over four years and sales of distressed homes are at 16.2% and rising. The bubble headed bimbos on CNBC don’t find it worthwhile to mention that prior to 2007 the normal percentage of distressed home sales was less than 3%. Yeah, we’re back to normal alright. We are five years into a supposed economic recovery and distressed home sales account for 1 out of 6 all home sales and is still 500% higher than normal.

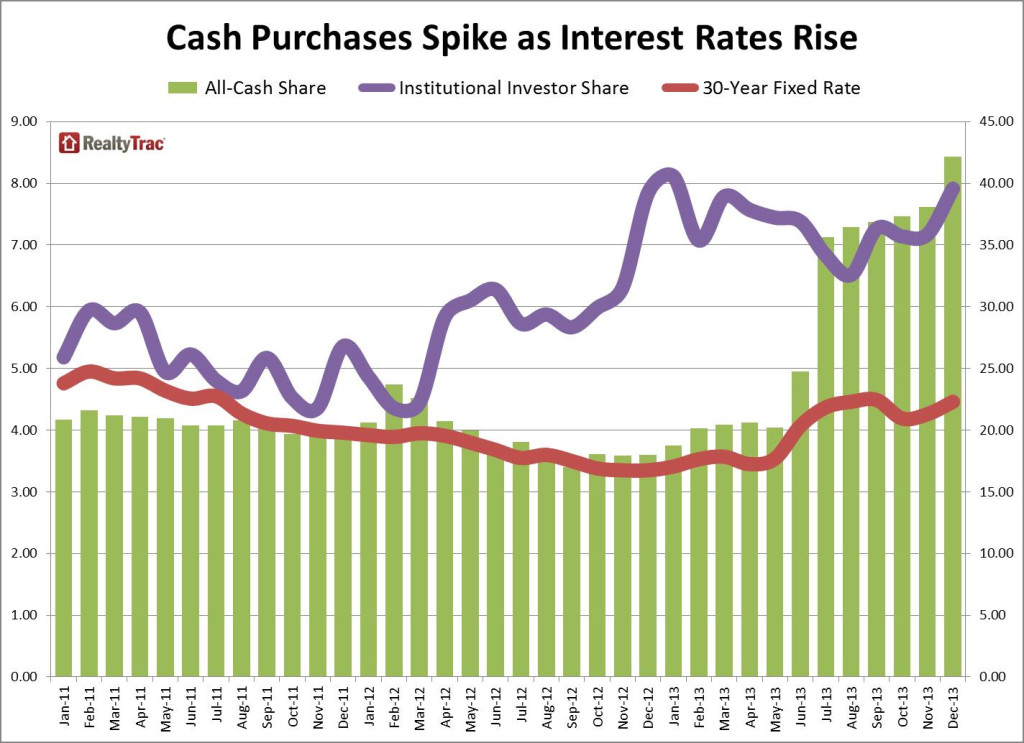

The distressed sales aren’t even close to the biggest distortion of this housing market. The RealtyTrac report reveals that all-cash purchases accounted for 42% of all U.S. residential sales in December, up from 38% in November, and up from 18% in December 2012. Does that sound like a trend of normalization? There were five states where all-cash transactions accounted for more than 50% of sales in December – Florida (62.5%), Wisconsin (59.8%), Alabama (55.7%), South Carolina (51.3%), and Georgia (51.3%). In the pre-crisis days before 2008, all-cash sales NEVER accounted for more than 10% of all home sales. NEVER. This is all being driven by hot Wall Street money, aided and abetted by Bernanke, Yellen and the rest of the Fed fiat heroine dealers.

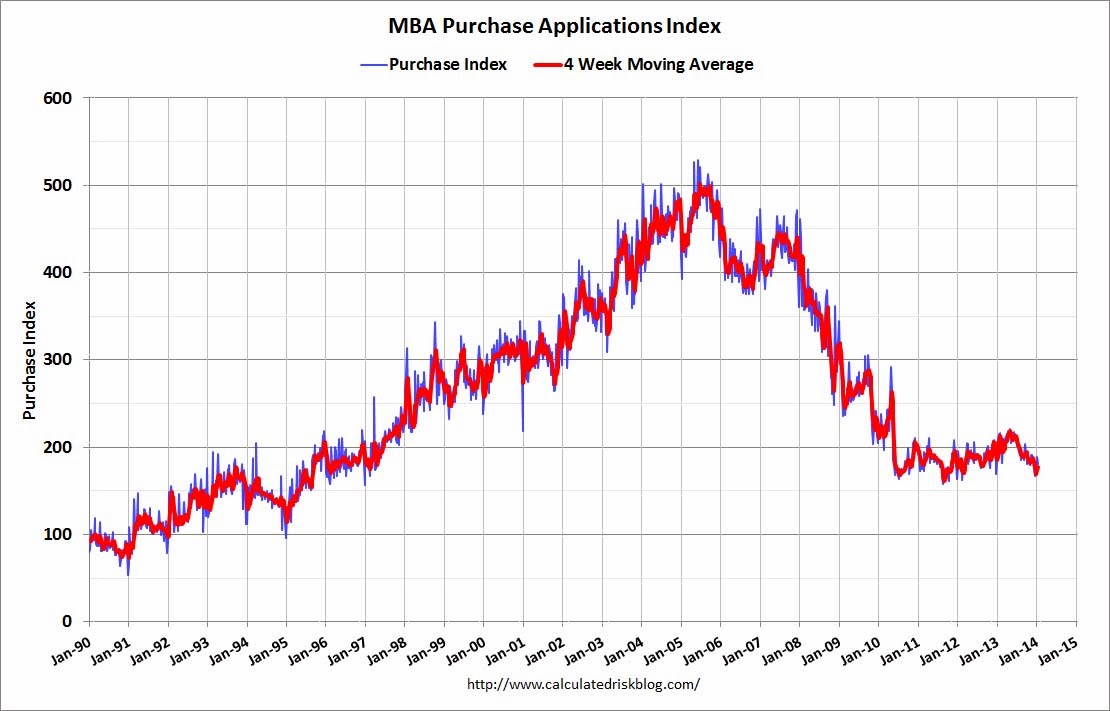

The fact that Wall Street is running this housing show is borne out by mortgage applications languishing at 1997 levels, down 65% from the 2005 highs. Real people in the real world need a mortgage to buy a house. If mortgage applications are near 16 year lows, how could home prices be ascending as if there is a frenzy of demand? Besides enriching the financial class, the contrived elevation of home prices and the QE induced mortgage rate increase has driven housing affordability into the ground. First time home buyers account for a record low percentage of 27%. In a normal non-manipulated market, first time home buyers account for 40% of home purchases.

Price increases that rival the peak insanity of 2005 have been manufactured by Wall Street shysters and the Federal Reserve commissars. Doctor Housing Bubble sums up the absurdity of this housing market quite well.

The all-cash segment of buyers has typically been a tiny portion of the overall sales pool. The fact that so many sales are occurring off the typical radar suggests that the Fed’s easy money eco-system has created a ravenous hunger with investors to buy up real estate. Why? The rentier class is chasing yields in every nook and cranny of the economy. This helps to explain why we have such a twisted system where home ownership is declining yet prices are soaring. What do we expect when nearly half of sales are going to investors? The all-cash locusts flood is still ravaging the housing market.

The Case-Shiller Index has shown price surges over the last two years that exceed the Fed induced bubble years of 2001 through 2006. Does that make sense, when new homes sales are at levels seen during recessions over the last 50 years, and down 70% from the 2005 highs? Even with this Fed/Wall Street induced levitation, existing home sales are at 1999 levels and down 30% from the 2005 highs. So how and why have national home prices skyrocketed by 14% in 2013 after a 9% rise in 2012? Why are the former bubble markets of Las Vegas, Los Angeles, San Diego, San Francisco and Phoenix seeing 17% to 27% one year price increases? How could the bankrupt paradise of Detroit see a 17.3% increase in prices in one year? In a normal free market where individuals buy houses from other individuals, this does not happen. Over the long term, home prices rise at the rate of inflation. According to the government drones at the BLS, inflation has risen by 3.6% over the last two years. Looks like we have a slight disconnect.