Once upon a time, the Wall Street Journal supported a bevy of reporters who were no one’s fool and who evinced a decent level of economic literacy and respect for the institutions of free markets and sound money.

Obviously, no more. We were reminded again today that these financial journalists of yore have been replaced by scribes who dutifully transmit the statist propaganda that emits from the Eccles Building and from the elected and appointed Federales encamped throughout the Imperial City.

Thus, the WSJ’s in-house Fed shill, Greg Ip, recently saw fit to praise the $10 trillion bacchanalia of fiscal largesse ($6 trillion) and Fed money-pumping ($4 trillion) that has been stood up by Washington since March 2020.

According to the Wall Street Journal’s man on the policy beat –

…..this week we got proof of something that really went right: the economic policy response. The pandemic-induced shutdown was initially the worst to hit the U.S. economy since the Great Depression….And yet poverty, by its broadest measure, went down…..after taking account of government benefits such as stimulus checks, food stamps and tax credits, the share dropped to 9.1% from 10.5% in 2019.

The Federal Reserve gets some credit for rapidly slashing interest rates to near zero and intervening in markets to prevent the economic crisis from becoming a financial crisis. But once the Fed’s interest rate ammunition was exhausted, fiscal policy rose to the challenge. Congress ultimately authorized $5.9 trillion of emergency measures of which $4.6 trillion has been spent….

As important as the magnitude of this relief was the variety. Unsure of the most effective remedy, Congress rolled out several: forgivable loans for small businesses that kept their employees (the paycheck protection program or PPP), stimulus checks to almost everyone, unemployment insurance expanded to gig workers and topped up with an extra $300 to $600 a week, low-cost loans from the Fed and Treasury to medium and large businesses, aid to state and local governments.

Much of this was experimental, and the lessons learned may lessen the toll of future recessions. By depositing cash directly into household bank accounts, Treasury has learned how, with congressional approval, to deliver stimulus almost as quickly as the Fed. PPP has yielded new tools to preserve employer-employee bonds in the face of shocks, reducing wasted economic potential.

Nonetheless, the economy today is in a far healthier place than was imaginable in the spring of 2020. That’s worth celebrating.

What an unrelieved load of horse pucky!

It’s hard to know where to start, but the notion that the massive eruption of stimmie spending generated a “healthy” economy is flat-out preposterous.

That’s because if you get your first principles correct, you focus on production, not spending. The former is the supply-side wellspring from which sustainable incomes, savings, investment and rising wealth and living standards arise. As per Say’s Law, spending is enabled by production, it does not cause it.

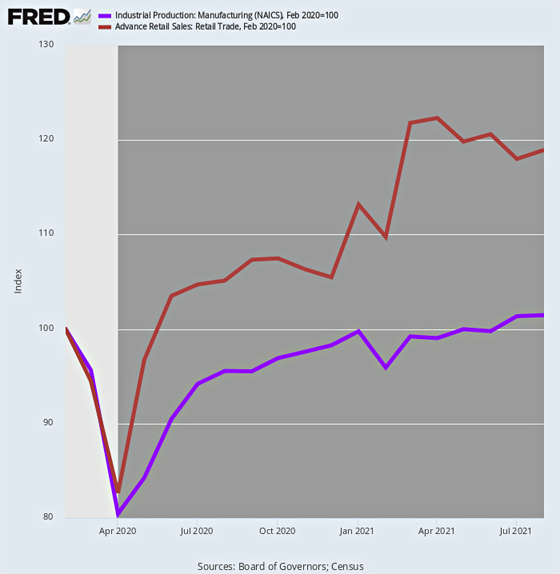

So the chart below on the latest relevant August numbers tells you all you need to know. To wit, during the last 18 months US households bought merchandise goods like there was no tomorrow – with monthly retail sales (red line) rising from $460 billion in February 2020 to $547 billion during August 2021. That’s a record 19% gain during a period when unemployment had soared and output had crumbled.

By contrast, manufacturing output (purple line) in August – the putative source of this cornucopia of retail goods sales – was up by just 1.5% from the February 2020 level. That is, where it counts on the supply-side there is nothing worth celebrating at all.

Manufacturing Production Versus Retail Sales, February 2020-August 2021

Of course, the goods which leapt off retail shelves and on-line order pages have to come from somewhere, and as it happened that “somewhere” was comprised of soaring imports and a radical drawdown of retail inventories.

The problem is that neither of these sources were a product of natural economic health or sustainable macro-economic balance. The surge in imports was just another debt fueled gift to the Red Ponzi and its global supply chain, while the scramble to replace depleted inventories is a major cause of the supply chain disruptions and inflationary bottlenecks which are now hammering the main street economy.

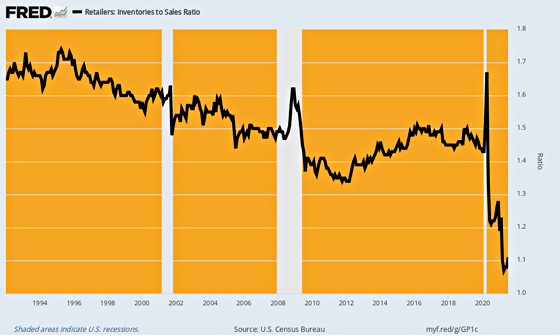

And we do mean depleted inventories. At the pre-Covid peak in February 2020 inventories were already on the light side at $655 billion, representing 1.43X sales. However, retail inventories plunged to a low of $579 billion by June 2020 and have barely recovered since then.

Currently retail inventories are still down by 8% from the February 2020 level and at $603 billion compute to just 1.11X retail sales, which have soared by the aforementioned 19% in the interim.

Needless to say, there is nothing remotely resembling the plunging black line in the chart below in all of modern economic history. In effect, the retail supply pipeline is the economic equivalent of a beached whale gasping for air. The resulting inflationary dislocations have just begun to be manifested.

Retail Inventory to Sales Rate, 1992-2021

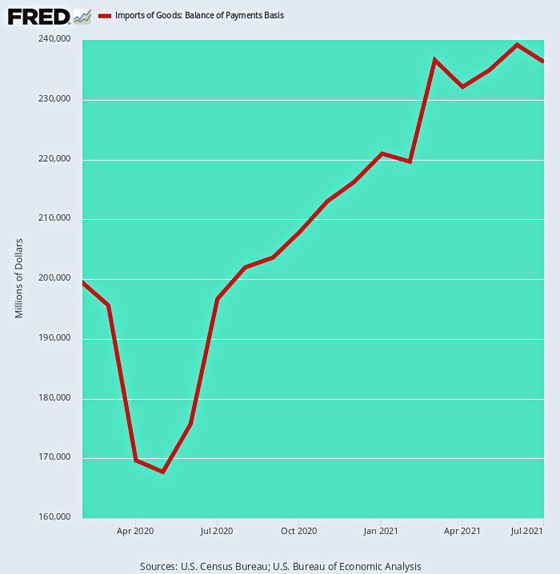

Likewise, there was nothing healthy, awesome or even redeemable about the balance of retail supply, which came from imports. Whereas domestic manufacturing output is only 1.5% ahead of February 2020 levels, monthly imports of goods are higher by $37 billion or 18.6%.

And, no, this isn’t just Adam Smith’s unseen hand of free trade at work or the manifestation of a burgeoning global market in two-way trade. Since February 2020, for instance, US exports have gained only $13 billion on a monthly basis or just 35% of the rise in import volumes.

The Wall Street Journal’s scribe gushes with enthusiasm about the alleged “smarts” embodied in Washington’s $10 trillion Covid rescue bacchanalia, but what pray tell is so smart about burdening future generations with insuperable debts in order to pull in manufactures from the rest of the world to support a level of retail spending which far exceeds the trend rate underway before February 2020?

That’s right. The actual retail spending growth rate was 3.66% per annum during the 4-year period between February 2016 and the Donald’s Greatest Economy Ever in February 2020. Had that trend not been interrupted by the Covid, the Lockdowns and Washington’s flood of stimmies, retail sales would have posted this AM at $485 billion for August 2021, and would have cumulated to $8.09 trillion for the 18 months since February 2020.

As it happened, August retail sales were $547 billion or 13% higher, and cumulated to $9.00 trillion during the 18-month period. That is to say, the geniuses in Washington enabled a $900 billion increase in retail spending over and above the pre-existing trend owing to the torrent of stimmies financed by borrowing and the printing press. And on the margin, the goods came from China and other foreign suppliers.

US Monthly Imports of Goods, February 2020-July 2021

Yet, for what earthly reason did Washington pump a tidal wave of stimmies toward the Red Ponzi? What we had was a supply-side contraction ordered by the Covid Virus Patrol. What that meant was that households were put on a involuntary spending sabbatical for the duration of the lockdowns when it came to the social congregation side – restaurants, bars, movies, sporting events, hair and nail salons etc. – of consumption budgets.

Accordingly, they didn’t need stimmie checks to finance services sector spending which the government prohibited, especially the vast majority of households which retained their paychecks throughout. In fact, what actually happened was that the sum of stimmie checks plus regular wages was directed to a vast outpouring of pull forward demand for goods delivered by Amazon and other on-line venues.

Even in the case of workers who were laid off, the overwhelming share received wage replacement through regular state UI programs at 40-70% of prior pay. They could have gotten by with these transfers plus savings from their involuntary services consumption sabbatical. Compared to the $3.0 trillion spent on the stimmies, UI and the SBA forgivable loan program alone, a few hundred billion of emergency UI benefits for contract and part-time workers not covered by regular state programs would have eliminated any humanitarian adversity.

So why did Washington go full retard with stimmies, bailouts and vast pork barrels of free stuff, and why is this insanity now celebrated by the Wall Street Journal’s Fed reporter?

Simple. As Richard Nixon would have said, they are all Keynesians now. That is to say, present day economics culture has made a fetish of GDP and the alleged need for the quarterly figure to keep on rising come rain or shine and by hook or crook.

The fact is, when people cook at home, pour their own stiff drink, click-on to Netflix, trim their own hair and polish their own nails the effect is to de-monetize economic activity. The same activities happen – albeit with less professional elan in many cases – except do-it-yourself household work doesn’t get a paycheck and therefore doesn’t get toted-up in the GDP.

Therefore, what was actually lost during the lockdowns was not so much economic output as consumer choice and the added quality which usually comes from professional chefs and barbers.

Yet here’s the thing. This loss of consumer choice and service quality was ordered by the public health gendarmes. It was the wrong answer to the Covid and never stood much of a chance of being other than a transient interlude of government madness. So it was the very opposite of an existential crisis. The swoon in the GDP numbers, in fact, was destined to reverse the minute the public health police took their foot off the neck of social congregation activity.

Of course, the aim all along should have been to quickly end the lockdowns and the Fauci fear campaigns and permit main street economic life to revert to the status quo ante. The $6 trillion of Covid relief was absolutely unwarranted. Rather than representing a triumph of Washington policy, it ushered in an outbreak of fiscal insanity that will leave its scars on the public finances and private economic discipline for decades to come.

Worse still, it unleashed central bank money-printing madness like never before – especially the notion that massive monetization of the public debt is completely copacetic. As Mr. Ip noted,

The Federal Reserve gets some credit for rapidly slashing interest rates to near zero and intervening in markets to prevent the economic crisis from becoming a financial crisis.

Oh, puleeze! An economic contraction–whether ordered by the state or the result of natural forces – is supposed to cause financial asset prices to fall, if it is permanent. And if it is artificial or temporary, the adults in the trading pits should be capable of pricing out its long-run implications, if any, without any help from the Fed at all.

But what we now have per the quote above is a recurring phony narrative that says any deep correction in vastly inflated stock prices is a “crisis”

We beg to differ. For the June 2021 LTM period, S&P 500 earnings came in at $158.74 per share. So, what if the Fed had allowed price discovery to take its course – causing the market to stall out at the 2,600 S&P 500 bottom reached in March 2020?

Well, it would mean that today’s market would be valued at 16.4X earnings or just slightly above it long-term average. As it is, today’s closing price of 4,473 represented an absurd 28.2X LTM earnings, and meant that index’s market cap of $38.2 trillion would have been $16 trillion lower at $22 trillion.

There you have it. Not a “crisis” prevented, but simply an unspeakable $16 trillion windfall to speculators juiced-up on the Fed’s hideous $120 billion per month of liquidity injections.

To be sure, these gifts to the 1% and 10% who own most of the stocks are bad enough. But the message to rank and file Americans and their elected politicians was even worse.

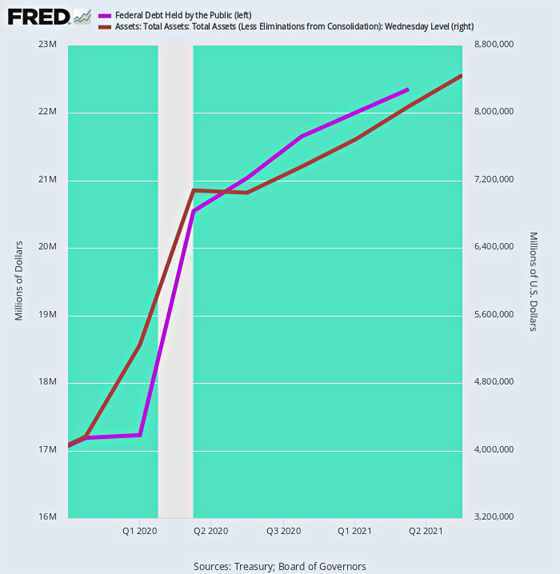

Since February 2020, the Fed has monetized 83% of Washington’s orgy of borrowing. The publicly held debt has grown by $5.2 trillion, while the Fed’s balance sheet has erupted from $4.2 trillion to $8.5 trillion or by $4.3 trillion during the same period.

The only word for that is banana republic finance. And contrary to the Wall Street Journal, that’s nothing to celebrate on this planet or any other.

Fed Balance Sheet Versus Publicly-Held Federal Debt, Q4 2019 to Q2 2021

PEAK TRUMP, IMPENDING CRISES, ESSENTIAL INFO & ACTION

Reprinted with permission from David Stockman’s Contra Corner.