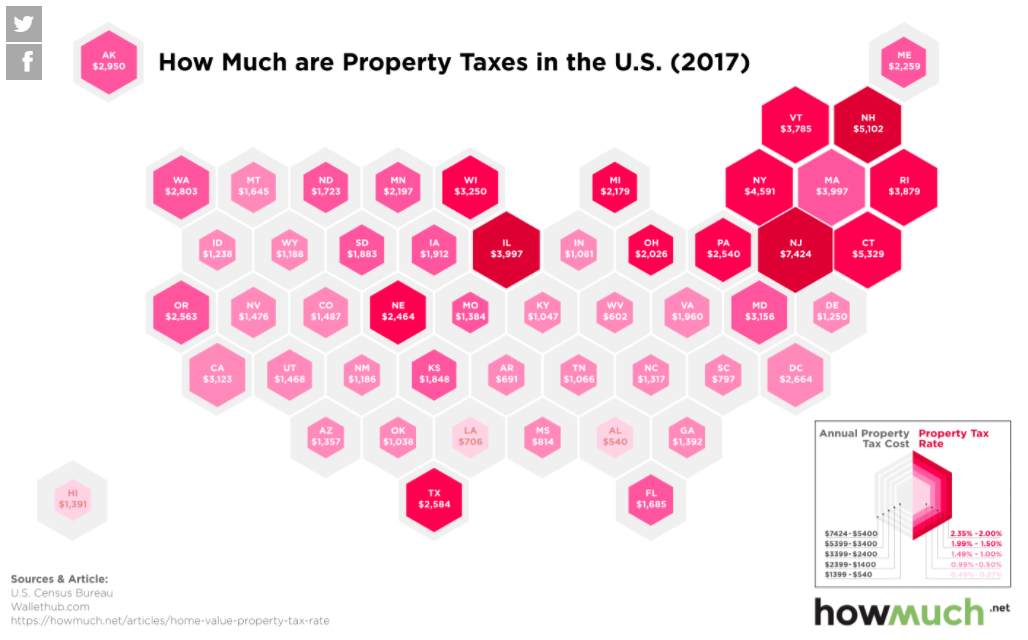

Even if you rent instead of own, property tax still is an important component of your housing cost. Your landlord will take the tax on his house – your home – into account to calculate your rent. So either way, the real-estate tax is a factor in your cost of living well worth considering. How high or low your effective real-estate tax is, varies by state. New Jersey has the highest rate, at 2.35%. Hawaii the lowest, at 0.27%.

Click to enlarge

Originally published by HowMuch.net.