Did BP, Halliburton and Transocean Ltd conspire to let the Deepwater Horizon oil rig explode? Sound preposterous? You may not think so after watching ex-Governor Jesse Ventura interview a bevy of individuals, including investigative journalists Sherri Kane and Len Horowitz (their radio program website: The Insight Hour) in his latest episode, Season 2, No. 7 of Conspiracy Theory with Jesse Ventura.

Then there is Halliburton’s highly coincidental purchase of Boots and Coots/IWC, one of the prime oil disaster intervention companies in the world, for 240 million dollars on April 9, 2010, a purchase suspicious enough to warrant an investigation, to quote from Wikipedia:

Boots and Coots, of course, has been heavily employed in the entire Gulf oil disaster control and cleanup efforts, raking in how much profit I am not sure, but rest assured that it is plentiful.

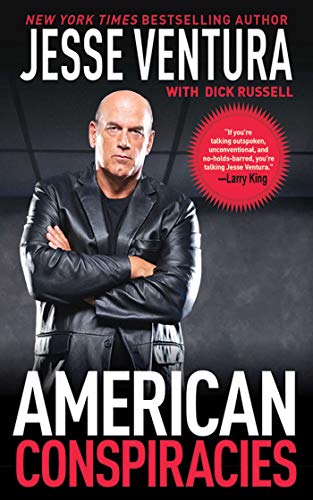

American Conspiracies:...

Best Price: $1.39

Buy New $3.45

(as of 08:50 UTC - Details)

American Conspiracies:...

Best Price: $1.39

Buy New $3.45

(as of 08:50 UTC - Details)

This triumvirate of possibly “preemptive financial strikes” may indeed be coincidence at best or, more darkly, even a disaster capitalist premonition of impending doom at the Macondo Prospect oil rig, brightened by the predatory instinct to capitalize on it. The blackest explanation, however, is that the blowout of the well head was intentional, part of a wider, Big Money/Government Elitist criminal conspiracy to depopulate parts of the Gulf Coast and turn them into a giant industrial field.

December 13, 2010