Jerome Powell puts you in mind of the boy who killed both of his parents and then threw himself on the mercy of the court on the grounds that he was an orphan!

That’s what JayPo essentially did in his presser yesterday while trying to explain that the most hideous equity market bubble in history is actually not that at all:

“If you look at P/Es they’re historically high, but in a world where the risk-free rate is going to be low for a sustained period, the equity premium, which is really the reward you get for taking equity risk, would be what you’d look at,” Powell said.

“Admittedly P/Es are high but that’s maybe not as relevant in a world where we think the 10-year Treasury is going to be lower than it’s been historically from a return perspective,” Powell said.

SheIn Women’s Se...

Buy New $32.99

(as of 08:14 UTC - Details)

Right. The Fed has essentially murdered the bond yield. So relatively speaking, grossly inflated stocks are a bargain compared to dead-in-the-water bonds.

SheIn Women’s Se...

Buy New $32.99

(as of 08:14 UTC - Details)

Right. The Fed has essentially murdered the bond yield. So relatively speaking, grossly inflated stocks are a bargain compared to dead-in-the-water bonds.

Bloomberg even has a chart to prove all this based on the so-called “Fed model”:

The S&P 500’s earnings yield – profit relative to share price – is 2.5 percentage points higher than the yield on 10-year Treasury notes. The comparison, loosely labeled the Fed model, sits well above what the spread was before the burst of the internet bubble, when bonds yielded more than equities by that measure.

Then again, the “earnings yield” is not exactly cash you can take to the bank, unlike a bond coupon as meager as it might be at present. The former is just a computational hope that today’s vastly inflated stock prices relative to earnings stay inflated indefinitely, world without end.

Stocks still looks appealing when compared to bond yields

More fundamentally, where is it written in the annals of sound finance that the purpose of owing bonds is to lose money forever and ever?

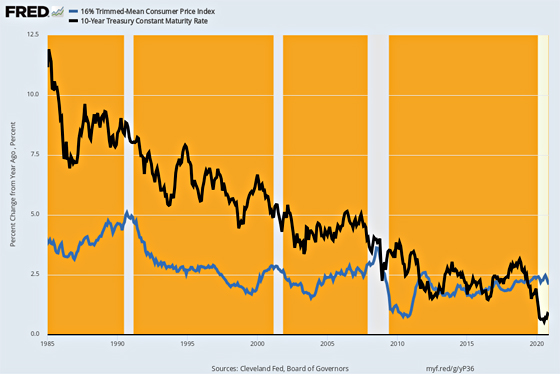

For want of doubt, here’s the 10-year bond yield that has been suffocated by the Fed’s massive bond buying spree. Relative to inflation, which the Fed relentlessly strives to promote at 2.00% per annum, there is no real yield left at all.

KANGKANG Baby Girl Fir...

Buy New $24.99

(as of 08:14 UTC - Details)

KANGKANG Baby Girl Fir...

Buy New $24.99

(as of 08:14 UTC - Details)

So what Powell is apparently saying is that since bonds are for suckers, please have some 40X PE stocks instead.

As is evident from the chart, prior to the year 2000 there tended to be 200-400 basis points of daylight between the inflation rate as measured by the Y/Y change in the 16% trimmed mean CPI (blue line) and the 10-year UST note yield (black line). But after the dotcom crash, money-printing got serious and, as JM Keynes himself might have said, the real yield got euthanized.

As of the most recent reading (October 2020), in fact, the 10-year UST yield at 0.88% was fully 134 basis points lower than the Y/Y inflation rate at 2.22%. At the rate, of course, the purchasing power of your principal would essentially vanish after a few decades.

In truth, even a blithering idiot should be able to see that the current bond yield is a false and dangerous benchmark for the valuation of equities. The fact that JayPo has taken to citing it with alacrity is just another sign that today’s money-printing central bankers have become completely unhinged.

Euthanasia of the Real Bond Yield: 10-Year UST vs. Inflation, 1994-2020

Indeed, the sheer gall of justifying sky-high stock prices based on absurdly low bond yields is underscored by the chart below.

Thanks to more than $30 trillion of central bank balance sheet expansion since the year 2000, the global bond market is completely broken, as attested to by the now all-time record of $18 trillion of global bonds trading at negative nominal yields.

For crying out loud, bonds should never trade at negative nominal yields; it amounts to financial masochism – paying someone to lock-up your own money for an extended period. The only theoretical exception might be in a financial environment of deep and long-lasting deflation.

But in the world as we have known it, where’s the deflation?

Indeed, ever since Nixon crossed the monetary Rubicon in August 1971 and ripped the dollar from its last anchor to real money (gold), the general price level has risen by 540%. Yet these cats at the Fed do not even notice that the global bond market is completely kaput and is priced for an alternate deflationary universe that is the opposite of the real world tracked below.

Even in the most recent period, yields on US treasury paper are stupidly low compared to the current 2.22% Y/Y inflation rate. Not a single point on the treasury yield curve is close to being near or above the inflation rate. Thus, at the end of last week:

InsNova Winter A-Line ...

Buy New $25.99

(as of 08:14 UTC - Details)

InsNova Winter A-Line ...

Buy New $25.99

(as of 08:14 UTC - Details)

- Three-month Treasury bill rates ended at 0.0625%.

- Two-year government yields declined three bps to 0.12%:

- Five-year T-note yields fell five BPS to 0.37%:

- Ten-year Treasury yields dropped seven BPS to 0.90%;

- Long bond yields sank 11 BPS to 1.63%;

- Benchmark Fannie Mae MBS yields fell six BPS to 1.35%.

Yet it is the above lineup of ridiculously underwater real yields that JayPo avers are proof that there is no stock market bubble. About the only consolation for that kind of tommyrot is that central bankers around the world have apparently embraced the same notion: Namely, that the purpose of the bond market is to separate you from your wealth over time.

In Europe, in fact, even the fiscal basket case nations sport below inflation yields, and decidedly so. As if to underscore the absurdity of Europe’s ECB-suffocated bond market, the yield on the 10-year Spanish bond at the end of last week was, well, 0.00% – even as German, French and Portuguese nominal yields traded at negative levels:

- Greek 10-year yields declined three BPS to 0.60%;

- Ten-year Portuguese yields sank eight BPS to negative 0.04%;

- Italian 10-year yields fell seven BPS to 0.59%;

- Spain’s 10-year yields dropped eight BPS to 0.00%;

- German bund yields sank nine BPS to negative 0.64%;

- French yields fell seven BPS to negative 0.38%;

- U.K. 10-year gilt yields sank 18 BPS to 0.17%;

Rise in general price level since August 1971:

But rather than notice that he had accomplished JM Keynes’ fondest wish and had indeed euthanized the bond-owning rentiers, JayPo was on a total different track yesterday: He actually saw fit to bray for moooaar inflation.

“It is not going to be easy to have inflation move up, and it’s going to take some time.”

The above is simply ritual incantation. There has never, ever been in recent times any danger of sustained deflation, as if that were a problem, which 40 years of robust deflationary prosperity between 1870 and 1910 long ago disproved in spades.

ANATA Flower Girls Wed...

Buy New $24.99

(as of 08:14 UTC - Details)

ANATA Flower Girls Wed...

Buy New $24.99

(as of 08:14 UTC - Details)

So the only intelligible reason for more inflation than the 2.10% compound increase in the 16% trimmed mean CPI over the last 20-years is that the Fed considers inflation to be a proxy for real GDP growth. That’s the hoary Phillips Curve notion, as also discredited 40-50 years ago, but what’s the point anyway?

Why not simply keep your eye on real GDP and be done with it?

In fact, why not forget about inflation targeting altogether, when you can’t measure it accurately or influence it directly, anyway; and, instead, keep your eye on the financial variables you can influence from the Eccles Building meeting room?

That is, the absurdly negative real bond yields, which are a direct result of massive monetization, and the preposterous stock market PE multiples, which are being driven by nothing more profound than TINA (FMBM): There Is No Alternative (to a Fed-Murdered Bond Market).

As to the those nosebleed PEs, we are not talking just about the sheer insanity of Tesla at 1300X LTM earnings or Amazon at 95X. The latest estimates hot off the presses from the Wall Street sell-side for the broad market represented by the S&P 500 and its $30 trillion of market cap are $93.29 per share for the year ending December 2020; and a gain of, well, +54% to $143.98 per share for the year ending in December 2021.

Rounding to the nearest whole integer, those guesstimates (which are never, ever low) amount to 40X and 26X, respectively. So if JayPo wants to ruminate about the dangers ahead, perhaps he should forget about a few irrelevant decimal points on the inflation rate and focus on the massive stock market bubble starring him right in the face.

Even more to the point, if these fools in the Eccles Building could just shed their inflation targeting myopia for a brief while, they might also note some of the manifold ill-effects that have resulted from their maniacal money-printing handiwork.

For instance, notwithstanding more than 50 million new unemployment claims and the lockdown-driven calamity across the ranks of millions of small businesses, the 0.001% who sit atop the giant private equity funds are having a year to die for.

That is, thanks to the Fed’s crushing of rates on investment grade government and corporate debt, yield parched money managers have made a bee-line for that tad of something slightly more than nothing offered by junk bonds. So far this year (thru November) junk bond issuance has reached nearly $400 billion, up by more than 50% from the like period of 2019.

But a big share of the proceeds have gone into record amounts of leveraged recaps. Private equity shops have taking the opportunity to further encumber their already debt-laden portfolio companies with even more debt for the purpose of paying themselves a rich harvest of cash dividends.

The amount of issued debt tied to such payouts grew to more than $29 billion this year, up more than 25% from 2019, according to S&P Global Market Intelligence. By comparison, during the last recession, in 2008-09, such activity nearly dried up.

MANER Women’s Se...

Buy New $37.99

(as of 08:14 UTC - Details)

MANER Women’s Se...

Buy New $37.99

(as of 08:14 UTC - Details)

Nor is that the half of it. If you look at total US dollar corporate debt, 2020 is turning out to be an all-time barn burner. According to the latest estimates –

- Investment grade issuance will be up by 53% to an all-time record of $2.02 trillion;

- High yield issuance will rise by nearly 30% to $556 billion.

Yet there is no doubt as to where the overwhelming share of proceeds have ended up. To wit, they have been cycled right back to Wall Street to fund financial engineering projects including stock buybacks and M&A deals.

As to the former, the chart below says it all. Since 2009, nearly $15 trillion of new money has been cycled into the stock market, but virtually 100% of that has come from corporations themselves, which either borrowed new money or drew down cash assets to repurchase their own stocks.

And yet the geniuses in the Eccles Building repeated again yesterday that they will continue to commit $120 billion per month of what amounts to financial fraud until the so-called full employment economy – which is actually being stymied by Fed-fostered financial engineering – is finally attained.

Rarely have even brain-addled house-cats so foolishly chased their own tails.

Then there is the matter of runaway financialization. As a case in point, household net worth as measured by the Fed’s flow-of-funds accounts jumped to a record $123.5 trillion in Q3. At 584% of GDP it now towers over previous cycle peaks 493% during Q1 2007, 447% during Q1 2000 and well less than 350% of GDP prior to 1987.

Yet has JayPo ever deigned to inquire as to why the value of financial assets have become so drastically decoupled from main street GDP? Or whether Fed-fostered ultra-low bond yields and nosebleed stock valuations have anything to do with it – to say nothing as to whether such unprecedented disconnects are stable and sustainable.

Cilucu Flower Girls Dr...

Buy New $9.99

(as of 08:14 UTC - Details)

Cilucu Flower Girls Dr...

Buy New $9.99

(as of 08:14 UTC - Details)

He has not. Nor has he apparently ever wondered about the recent Deloitte study, revealing that during its 15 years of existence, the U.S. shale industry managed to write off a staggering $450 billion in invested capital while generating $300 billion in net negative cash flow. Further, the sector has recorded more than 190 bankruptcies since 2010, the highest by any sector in the United States.

That is to say, might it be that radical financial repression is the mother’s milk of malinvestment? And that one reason the trend rate of economic growth keeps falling despite the Fed’s endless bouts of “stimulus” is that capital is being drastically and systematically mispriced, mis-allocated and wasted?

In that vein there is the fact that back in the 1990s – when real bond yields were still economically rational – there were no such thing as exchange trade funds (ETFs). That’s because in an honest free market they wouldn’t even exist.

If genuine investors and stock pickers wanted balanced exposure to an industry versus a single company, the fact is they could compose their own composites at virtually no expense given today’s low cost research, data analysis and trading tools. As it is, the only real purpose of ETFs is to facilitate speculation by home-gamers and robo-traders.

Not surprisingly, therefore, exchange traded funds attracted record inflows of $121 billion in November, a jump of 14.5% on the previous record month. That huge monthly haul brought net global inflows in the first 11 months of this year to $659 billion, 15.4% more than the $571 billion gathered over the same period in 2019.

Indeed, the chart below is the smoking gun. In broad strokes, traditional stock picking mutual funds at least resemble “investors”, while ETFs are almost entirely the domain of traders and speculators. Yet when capital markets become dominated by speculation per the flow of funds depicted below, the actual efficiency and growth capacity of the main street economy is progressively eroded and impaired.

Needless to say, given the mayhem and malinvestment the central banks have unleashed on Wall Street, it is not surprising that the financially uneducated politicians of Washington might have become unhinged as well.

But as the Congress inches toward another $900 billion Everything Bailout on top of the $3.5 trillion it has already heaved at the nation’s coast-to-coast soup lines, there has been a development in recent days that tell you all you need to know.

It seems that fire-breathing right-wing Senator Josh Hawley of Missouri has teamed up with honest-to-goodness socialist Bernie Sanders to muscle through another round of helicopter checks to 85% of US households. At the rumored $600 per person, that will add another $150 billion to the $300 billion distributed in the April go-round.

But here’s the thing. That comes on top of what will be a total of $850 billion of PPP checks to millions of small businesses for the alleged purpose of job retention, and a total of $500 billion for Federal unemployment benefits on top of the $600 billion being pumped out by the regular state UI programs.

So just in those three programs we are likely to end up with about $2.4 trillion of aid for victims of the government ordered Covid-Lockdowns and economic disruptions.

Then again, between February and November, we calculate that total lost wage and salary income of the entire 160 million US work force came in at about $300 billion.

That’s right. Since the Fed is monetizing all the new debt issuance, the politicians in the fiscal departments of the free lunch brigade have seen fit to dispense 8X more compensation payments than actual losses.

As we said, unhinged……and then some!

PEAK TRUMP, IMPENDING CRISES, ESSENTIAL INFO & ACTION

Reprinted with permission from David Stockman’s Contra Corner.